In our series on financial innovation, we discuss key issues relating to financial technology and innovation impacting the global financial services sector in general and the Hamilton Financials Innovation ETF (HFT) in particular. Launched on June 1, 2020, HFT invests in a blue-chip portfolio of 30+ established global financial services firms benefiting from powerful, secular trends amplified by the pandemic such as growth of digital payments, digitization of capital markets, and a multi-year shift to passive/ETF investing (see our insight: “Hamilton Financials Innovation ETF: Invest in Digital Leaders Reshaping the Financial Sector”).

Part I: Can Standalone Digital Banks Disrupt the Incumbents? (January 14, 2021)

Part II: Four Themes Driving Innovation in Global Financials

Importantly, the pandemic has accelerated already powerful changes in how consumers interact with finance and technology, driving a new cycle of innovation in the global economy. We believe an important subset of such innovation is taking place within established financial technology companies that form the core of HFT. In this insight, we review four key themes supporting innovation within the financial sector in 2021 – three established and one emerging.

1. eCommerce drives the rise of integrated payment companies

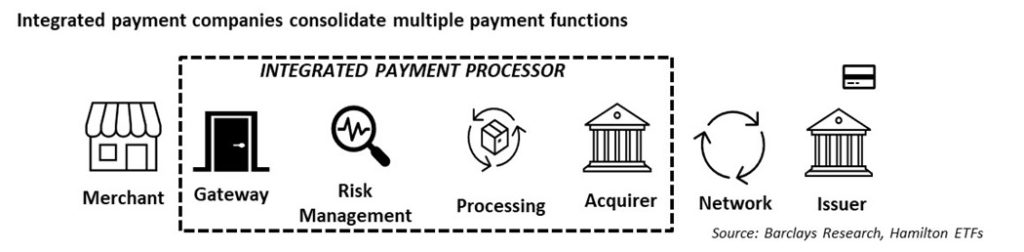

Until a few years ago, the payments ecosystem was fragmented and made up of multiple participants, supporting the card networks including merchant acquirers, processors, and independent sales organizations (ISOs). These firms made the process more secure (gateways, encryption, approvals) and/or faster (processors). In recent years, new integrated competitors have emerged and bundled payment services while offering new product innovations such as cross-border sales capabilities and customer behavior insights.

With the pandemic driving even more transactions to eCommerce/online channels, integrated payments are experiencing high adoption rates from retailers and consumers alike, which is supporting revenue growth (both per transaction and percentage of volume). Going forward, we expect integrated payment companies to capture a bigger share of an already fast-growing payments market and even potentially disintermediate competitors with single product offerings.

This is an important theme in HFT where fast growing/integrated payments businesses represent ~10% of holdings (and payments as a whole account for ~40%).

2. Market data and technology companies capitalize on secular data and analytics demand

We consider market data and technology companies to be those benefiting from the digitization of capital markets including exchanges, index providers and alternate trading venues. Digitization of capital markets has been a persistent and secular theme over the past decade driven by regulatory reforms introduced after the 2008 financial crisis. As a result of these reforms, an increasing volume/share of key asset classes began trading on exchanges and other alternate trading venues (away from OTC markets[1]). Apart from supporting revenue growth, a growing share in traded volumes has also allowed market data and technology companies to capitalize on growing client demand for data and analytics.

The pandemic has brought forward digitization to even more asset classes and strengthened an already robust demand for market data and analytics. HFT portfolio companies have made large and transformational acquisitions to meet this multi-year demand cycle, including: (i) London Stock Exchange’s acquisition of data, trading, and reporting platform Refinitiv, and (ii) Rating agency and index major S&P’s acquisition of IHS Markit. We explore this M&A theme in greater detail later in our innovation series.

In HFT, exposure to firms benefitting from secular demand for market data and technology is ~30% of NAV.

3. ETF universe expands with Active, Non-Transparent (ANT) and Environmental, Social and Governance (ESG)

ETFs are one of the most significant financial innovations over the past two decades. During this period, the ETF sector has grown substantially, consistently taking market share away from mutual funds and active management by offering low-cost products, often passive tied to an established index (which in turn has supported high growth for the index providers). We expect this trend to continue. We also believe two emerging categories of ETFs will add to this growth: active non-transparent (ANT) and Environmental, Social and Governance (ESG) focused products.

Active non-transparent ETFs (ANT) are actively managed ETFs that disclose their holdings on monthly or quarterly basis instead of daily disclosures. Canadian regulators approved active, non-transparent ETFs over 8 years ago and active strategies now represent a highly material ~25% of all ETF AUM in Canada[2]. By contrast, in the U.S., the world’s largest ETF market with more US$5 trillion in AUM[3], the SEC only approved the first ANT ETF in 2019. As in Canada, we expect this product innovation to add to the already robust growth for U.S. ETF providers both from shelf expansion by current passive providers, as well as new entrants with unique offerings. Should active ETFs in the U.S. reach the same market share as in Canada, it would become an over US$1 trillion category.

2020 was a year of substantial growth for ESG, as global AUM of funds with a sustainability objective and/or those using binding ESG criteria for their investment decisions rose to US$1.3 trillion[4] (vs. global asset management industry AUM of $89 trillion[5] and a US$5.3 trillion ETF market[6]). With favourable policy initiatives and growing interest from a broader investor base, we expect increased investor demand for passive/ETF assets in this traditionally actively managed asset class.[7] It could also result in higher flows to thematic ETFs with explicitly ESG-focused supporting growth in ETFs.

In HFT, exposure to ETF managers and related businesses (index providers, market makers) is ~20% of NAV.

4. Open banking creates new markets beyond payments for incumbents

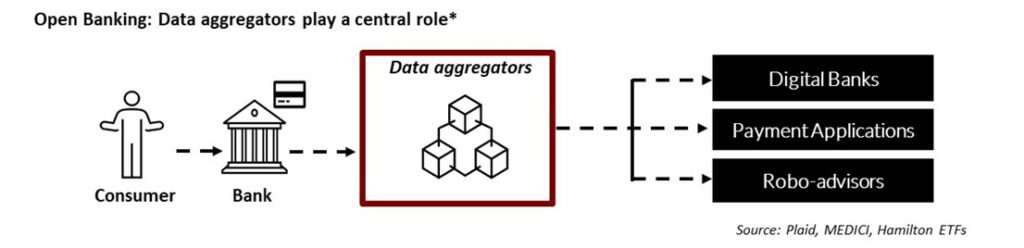

In its simplest form, open banking is a regulatory framework that allows customers to share financial, payments and other transaction data – currently controlled primarily by banks – with third-party financial services providers that meet stringent privacy/security requirements. This sharing of data is intended to provide consumers with access to a wider range of services, greater control over their personal financial information and possibly reduce costs by allowing new competitors to access this data (usually at a bank). While we expect open banking to drive further innovation across the financial services sector (discussed later in our innovation series), the largest beneficiaries at present are the payments companies.

Across the globe, open banking regulations are in varying stages of adoption with the E.U., U.K. and Australia having previously introduced rules[8]. While it is not yet approved in either Canada or the U.S. open banking continues to gain momentum as firms establish one-on-one partnerships with banks. Data aggregators play a key role in the open banking ecosystem by connecting the various parties. Thus, data aggregators are enabling the rise of and supporting growth for new digital competitors in banking, wealth management, payments, and others in the U.S. and Europe (see figure below)[9].

We expect the number and depth of these arrangements to rise significantly as open banking is approved across a greater number of jurisdictions, including Canada.

As mentioned, the biggest beneficiary currently of open banking is the payments sector, a key investment category in HFT. For certain payment companies, open banking has the potential to introduce new revenue opportunities in an increasingly digital financial services sector as adoption continues to expand into lending, insurance, wealth management, investments, and new forms of payments. For example, open banking functionality has been instrumental in expanding the usage of Venmo, a financial app owned by PayPal beyond mere peer-to-peer payments to a broader digital wallet[10]. Realizing the value of this potentially sizeable (and disruptive) technology, large payment incumbents have made significant capital allocations to open banking in recent years, first collaborating and later acquiring the largest open banking levered aggregator platforms[11].

HFT’s exposure to payment companies levered to open banking is ~10% of NAV.

HFT invests in category winners as financial innovation accelerates and a swell of capital lifts all boats

A central theme impacting all areas of financial innovation in recent years (and 2020 in particular) has been the flood of capital supporting new entrants seeking to take market share away from incumbent financial intermediaries in banking, insurance, wealth management and other areas. This is an important – and relatively new – development since it signals that the market increasingly believes that technological innovation will allow new entrants to take market share from the incumbents.

While it remains to be seen if technological changes alone can lower formidable entry barriers such as large trust/brand loyalty (stable funding), regulatory/capital requirements, and sheer scale advantages for the large incumbents a rising tide of cheap capital is lifting all boats. These include potential category winners (e.g., payments, market data) with attractive risk-return to riskier business models that could face regulatory (digital currencies) and funding/underwriting (digital banks, insurers) constraints in the coming years.

Against this backdrop of accelerating technological innovation/disruption and easy capital access masking some of the more vulnerable or speculative business models, we believe Hamilton Financials Innovation ETF’s portfolio of established financial technology companies offers investors exposure to emerging and key innovations in the financial sector. At the core of the portfolio are fintech leaders in three main categories – payments, market data and wealth tech – benefiting from powerful secular trends and continued innovation. In our view, HFT offers Canadian investors a high-quality diversified portfolio with an attractive balance between secular growth, innovation/risk, and valuation.

Related Insights

Can Standalone Digital Banks Disrupt the Incumbents? (January 14, 2021)

Hamilton Financials Innovation ETF: Invest in Digital Leaders Reshaping the Financial Sector (November 19, 2020)

Global Financials: The Most Attractive/Important Investment Themes in 2021 (November 16, 2020)

Hamilton ETFs Launches Hamilton Financials Innovation ETF (June 1, 2020)

Global Exchanges, E-Brokers and Fintech: Secular and Structural Growth Drivers Abound (June 15, 2019)

A word on trading liquidity for ETFs …

Hamilton ETFs are highly liquid ETFs that can be purchased and sold easily. ETFs are as liquid as their underlying holdings and the underlying holdings trade millions of shares each day.

How does that work? When ETF investors are buying (or selling) in the market, they may transact with another ETF investor or a market maker for the ETF. At all times, even if daily volume appears low, there is a market maker – typically a large bank-owned investment dealer – willing to fill the other side of the ETF order (at the bid/ask spread).

Notes

[1] Over-the-counter

[2] Source: National Bank Financial

[3] Source: ETFGI (etfgi.com/)

[4] Source: Morningstar Research; as of Q3 20. Includes open-ended funds and exchange traded funds.

[5] Source: Boston Consulting Group; as of Dec 2019

[6] Source: ETFGI (etfgi.com), as of December 2020.

[7] According to Morningstar Research, globally only 12% of sustainable fund AUM is passively managed vs. 24% in the overall funds space.

[8] The UK and the EU in January 2018 and Australia in July 2020 went live with open banking frameworks. Canada’s Department of Finance introduced a consultation paper on open banking in January 2019, entitled “Consumer-directed finance: the future of financial services”).

[9] Aggregators connect consumers, financial institutions, and new entrants (digital banks, digital advisors, payment apps/wallets) using application program interface (API). API is the technology that allows for the flow of data between various applications. APIs can be open/public which in turn allows new entrants to customize to suit their individual product offerings.

[10] According to PayPal, Venmo had an active account base of 52 million users. Apart from peer-to-peer payments, Venmo also offers debit card and credit cards in a tie-up with MasterCard and Visa, respectively.

[11] MasterCard acquired fintech data aggregator Finicity in 2020.