Hamilton Global Financials ETF (HFG), which launched on June 26, 2020, is focused on investing in high quality global financial stocks with strong balance sheets, diversified income streams and exposure to favorable, medium- and long-term cyclical and secular trends. This focus aims to provide Canadian investors with diversified exposure to the most attractive themes within the global financial sector while maintaining a volatility profile not materially different from that of the Canadian banks[1]. In this insight, we discuss the most important and attractive themes in the sector today and how they relate to HFG.

HFG began trading on the TSX following a merger with its predecessor ETF, the Hamilton Global Financials Yield ETF (HFY)[2]. Over its multi-year history, HFY’s diversification helped it withstand challenging market conditions, including the current year during which it generated substantial outperformance versus nearly every major category of the global financial sector with significantly lower volatility[3]. As of its merger date, HFY had also outperformed the Canadian banks year-to-date[4].

We believe HFG’s strategy of global diversification, which supported a consistent track-record of outperformance across macro/market cycles for its predecessor, positions it to benefit from an eventual economic recovery. In addition, HFG offers an attractive yield (currently ~3%).

The most attractive investment themes in the global financial sector

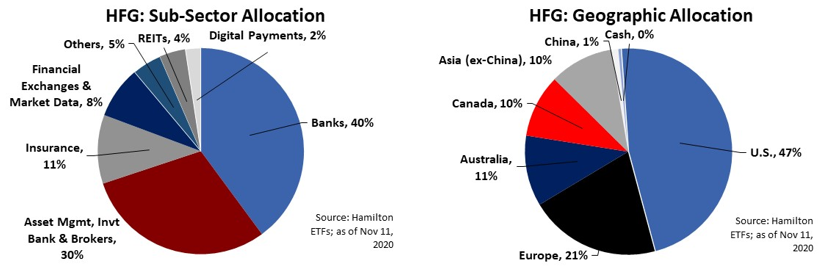

A key benefit of HFG’s global mandate is it allows for significant diversification by country/region, sub-sector, and investment theme. With respect to HFG’s positioning, which includes over 50 positions across 15 countries, the following themes currently drive its investment focus:

V-shaped economic recovery in certain countries/regions: HFG is overweight financials in countries that are coping better than others with the COVID-19 virus, either by policy choice (keeping their economies more open, fiscal flexibility) or initial virus containment. Countries or regions that continue to successfully re-open economies and/or are retaining positive economic momentum are more likely to recover GDP faster than those struggling to re-open or those facing extended lockdowns.

Accelerated shift to a digital economy: The pandemic has accelerated an already powerful digital shift in financial services. This has created secular tailwinds for select financials. Beneficiaries include payments firms, financial exchanges and market data providers, which have seen robust data and technology demand. In addition, alternative/ETF asset managers continue to enjoy an attractive fund-raising environment across asset classes as investors seek to enhance returns either from lower fees or restructure investment strategies to cope with a low interest rate environment.

- For investors looking for a more pureplay vehicle to invest in the ongoing digitization within financial services, we recommend they consider the Hamilton Financials Innovation ETF (ticker: HFT).

Recovery from ongoing credit cycle: The global banking sector entered the current economic slowdown with well-capitalized balance sheets, robust profitability and, over the last six months, has built substantial reserves against ongoing and future credit losses. In certain countries, the recent change in loan loss accounting[5] has significantly pulled forward provisions for credit losses, likely resulting in a shorter credit cycle and an accelerated return to “normalized” earnings. As the global economy recovers, we believe banks in HFG provide investors with exposure to an earnings recovery followed by a resumption of capital return in the form of buybacks and/or (higher) dividends, likely starting next year.

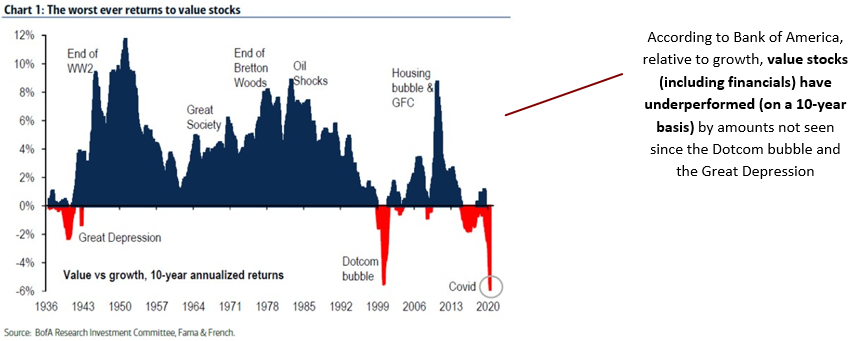

Inexpensive valuations: According to a recent note by Bank of America, value stocks (including financials) are at their all-time lowest returns relative to growth stocks since 1936. The last time value stocks approached this oversold level was just prior to the dotcom bust. Notwithstanding the rebound in value stocks in November – on reduced uncertainty following the U.S. election and positive vaccine news – this relative valuation gap remains wide, with significant room to run.

The 800-pound gorilla: low interest rates (and it’s NOT all bad!)

There is no question the market is grappling with the current low interest rate environment, which is clearly negative for certain sub-sectors, if sustained. However, less appreciated is the fact that not ALL financials are harmed, and in fact some are even benefiting. HFG provides exposure to diverse business models, which means, even within financial services, there are those that stand to benefit from the lower for longer rate environment.

In an absolute sense, the current rate environment is driving demand for alternative managers, certain exchange products (credit, private equity, real estate, ETFs, others), and related businesses like market makers and index providers. HFG’s holdings include a mix of wealth/asset managers, capital market intermediaries and other financials, with its current emphasis on those non-bank financials benefiting from the secular trends discussed above.

From a relative perspective, certain businesses are better positioned to cope with this new rate environment including P&C insurers and banks, both of which have shorter-duration liabilities. Moreover, banks operating in markets characterized by dominant oligopolies (like Canada, Australia, Singapore, select Nordic countries) have greater ability to reprice loans and maintain margins.

The clearest loser in a ‘lower for longer’ rate environment is the life insurance sector because of the sector’s very long-dated liabilities and often fragmented market share across multiple products/geographies. Hence the insurance exposure in HFG is predominantly via P&C and multi-line insurers, where the duration of liabilities and related reinvestment risk is materially lower. Notably, HFG has close to zero exposure to life insurance.

Finally, we expect, once the worst of the pandemic is clearly past, the lower for longer rate environment will accelerate consolidation in the global banking sector, as institutions look to offset revenue pressure, particularly in regions/countries that are either fragmented (U.S. mid-cap) or struggling with low ROEs pre-pandemic (certain parts of Europe).

Cyclical rebound and structural growth drivers shape robust outlook for 2021 and beyond

In our view, HFG offers investors exposure to the most attractive secular and cyclical themes in the global financial sector in an ETF that, relative to the Canadian banks, offers: (i) higher forecast EPS growth, (ii) similar volatility, and crucially (iii) relatively low correlations (i.e., enhanced diversification), and hence we believe complements investors’ core Canadian bank holdings. Importantly, we believe a barbell investment approach – combining secular and cyclical themes – should also provide some dampening of return volatility.

With large and swift global policy support, robust balance sheets in the financial sector and accelerating digital trends, HFG’s actively managed portfolio (of 50+ stocks, 10+ financial sub-sectors and 15+ countries) remains, in our view, primed to succeed in 2021 and beyond.

Related Insights

Hamilton Global Financials ETF (HFG): Merging Two Global ETFs with Material Outperformance (June 26, 2020)

Hamilton ETFs Launches Hamilton Financials Innovation ETF (June 1, 2020)

Financials: Does COVID-19 Represent a Growth Scare, Credit Event or Crisis? (March 25, 2020)

A word on trading liquidity for ETFs …

Hamilton ETFs are highly liquid ETFs that can be purchased and sold easily. ETFs are as liquid as their underlying holdings and the underlying holdings trade millions of shares each day.

How does that work? When ETF investors are buying (or selling) in the market, they may transact with another ETF investor or a market maker for the ETF. At all times, even if daily volume appears low, there is a market maker – typically a large bank-owned investment dealer – willing to fill the other side of the ETF order (at net asset value plus a spread). The market maker then subscribes to create or redeem units in the ETF from the ETF manager (e.g., Hamilton ETFs), who purchases or sells the underlying holdings for the ETF.

Notes

[1] Ideally, HFG will exhibit relatively low correlations to the Canadian banks/financials that will provide investors with higher returns and lower risk (i.e., a higher Sharpe ratio).

[2] And the Hamilton Global Bank ETF (HBG).

[3] Most categories of the global financial sector declined over 40% from peak-to-trough this year, including U.S and European banks, life insurers, among others. Also of note, HFY outperformed its benchmark index, the KBW Nasdaq Financial Sector Dividend Yield Total Return Index (KDXTR-in CAD) by over 20% from its launch on February 6, 2017 to its merger with HFG on June 26, 2020.

[4] As of June 26, 2020, the merger date with HFG, HFY had outperformed the equal weight Canadian bank ETF, ZEB, year-to-date. It had outperformed the S&P/TSX Composite Diversified Bank Index (STDBNKR) by more than 6% between December 31, 2018 and June 26, 2020. This period was characterized by significant market volatility from large macro events including the pandemic.

[5] IFRS 9 in 2018 in Canada/Europe/Australia and FASB’s CECL (Current Expected Credit Losses) in the U.S. in 2020.