Hamilton Energy

YIELD MAXIMIZER™

ETF

Maximize Income from Energy Leaders

HIGHLIGHTS

Last Distribution of $0.168*Last distribution per unit. Distributions are subject to change. For a complete list of historical distributions, please see the Distributions tab below.; monthly distributions

Exposure to the largest energy companies in North America

Active covered call strategy managed by an experienced options team led by Nick Piquard, with 25+ years of experience specializing in options

A GOOD FIT FOR INVESTORS WHO WANT

Attractive monthly income

Tax efficient distributions

Modest long-term growth potential

Reduced volatility from options strategy

INVESTMENT OBJECTIVE

EMAX is designed for attractive monthly income, while providing exposure to an equal-weight portfolio of primarily large-cap North American energy companies. To reduce volatility and augment dividend income, EMAX will employ an active covered call strategy.

EMAX does not use leverage.

Performance

- TICKER EMAX

- NAV $17.03

- 1 DAY CHANGE +$0.07

-

LAST DISTRIBUTION *

Last distribution per unit. Distributions are subject to change. For a complete list of historical distributions, please see the Distributions tab below.

$0.168 - ASSETS $116.0M

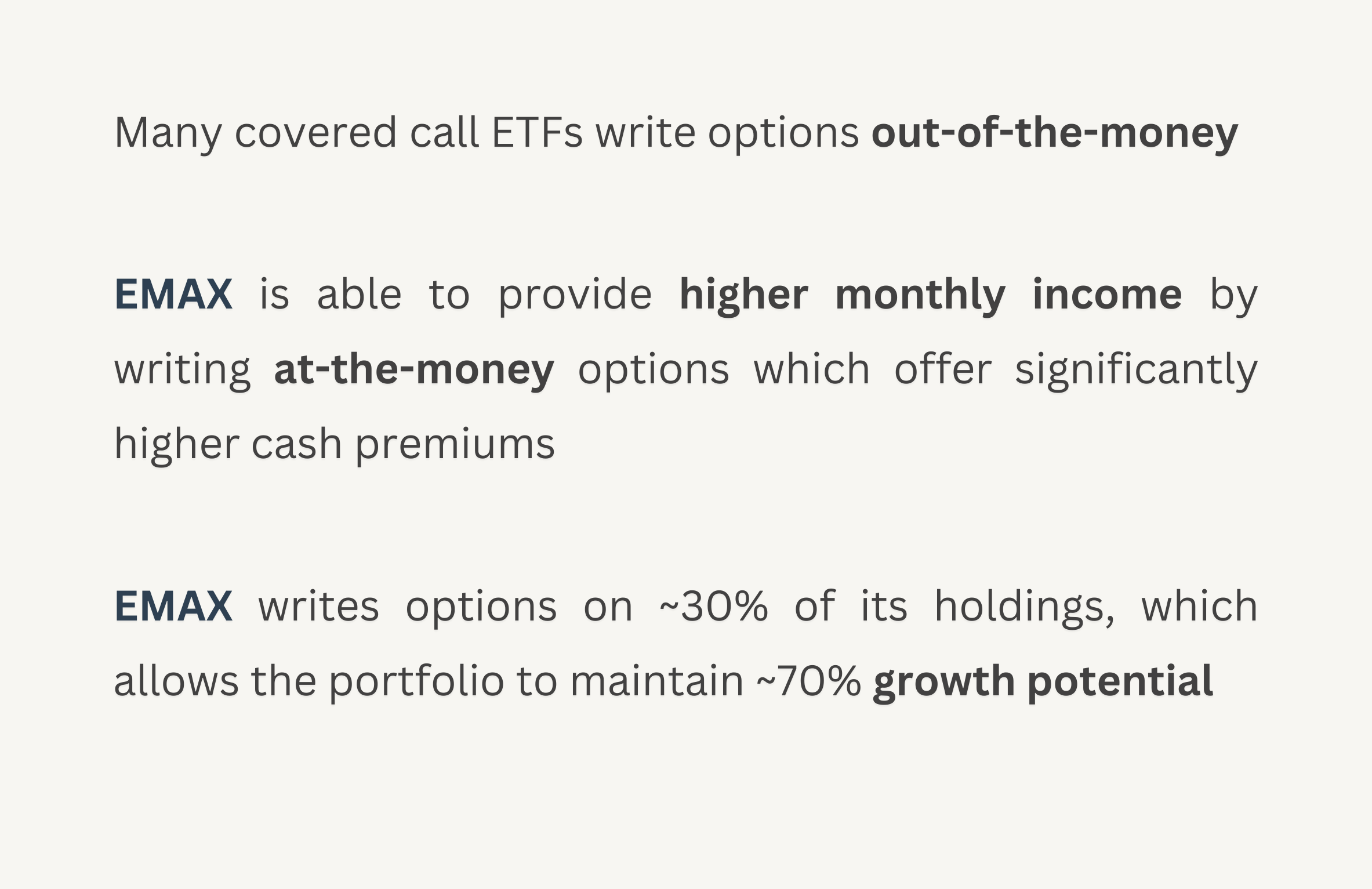

Higher Monthly Income

What Makes EMAX Different?

- Overview

- Distributions

- Documents

█ United States 73.6%

| ticker | name | weight |

| FANG | Diamondback Energy Inc | 7.0% |

| SU | Suncor Energy Inc | 6.9% |

| VLO | Valero Energy Corp | 6.9% |

| SLB | Schlumberger NV | 6.9% |

| XOM | Exxon Mobil Corp | 6.8% |

| PSX | Phillips 66 | 6.8% |

| CVX | Chevron Corp | 6.7% |

| OXY | Occidental Petroleum Corp | 6.7% |

| CVE | Cenovus Energy Inc | 6.6% |

| EOG | EOG Resources Inc | 6.6% |

| MPC | Marathon Petroleum Corp | 6.5% |

| TOU | Tourmaline Oil Corp | 6.5% |

| CNQ | Canadian Natural Resources Ltd | 6.5% |

| COP | ConocoPhillips | 6.5% |

| HES | Hess Corp | 6.4% |

| Ticker | EMAX |

| Exchange | Toronto Stock Exchange (TSX) |

| CUSIP | 407361104 |

| Inception Date | February 6, 2024 |

| Investment Style | Energy, Covered Call |

| Assets | $116.0M CAD* |

| Distributions | Monthly |

| Currency Hedging | None |

| Rebalancing | Semi-annual |

| Management Fee | 0.65% |

| Risk Rating | Medium |

| Auditor | KPMG LLP |

| Legal Entity Identifier | 254900ZDUCOUT62XZK32 |

| Ex-Dividend Date | Paid | Frequency | Amount |

|---|---|---|---|

| 2024-06-28 | 2024-07-08 | Monthly | $0.1680 |

| 2024-05-31 | 2024-06-07 | Monthly | $0.1700 |

| 2024-04-29 | 2024-05-07 | Monthly | $0.1680 |

| 2024-03-27 | 2024-04-05 | Monthly | $0.1610 |

| 2024-02-28 | 2024-03-07 | Monthly | $0.1600 |

You can view public filings for the Hamilton Energy YIELD MAXIMIZER™ ETF on SEDAR+.

Press Releases

View the latest EMAX Press Releases

Fact Sheet

EMAX Fact Sheet (2024-05-31) English Français

ETF Facts

EMAX ETF Facts (2024-01-12) English Français

Prospectus

EMAX Prospectus (2024-01-12) English Français

Latest Portfolio Summary

Q1 2024 Portfolio Summary (2024-03-31) Download