Hamilton Enhanced

Multi-Sector

Covered Call ETF

Delivering You More Income, Every Month

Highlights

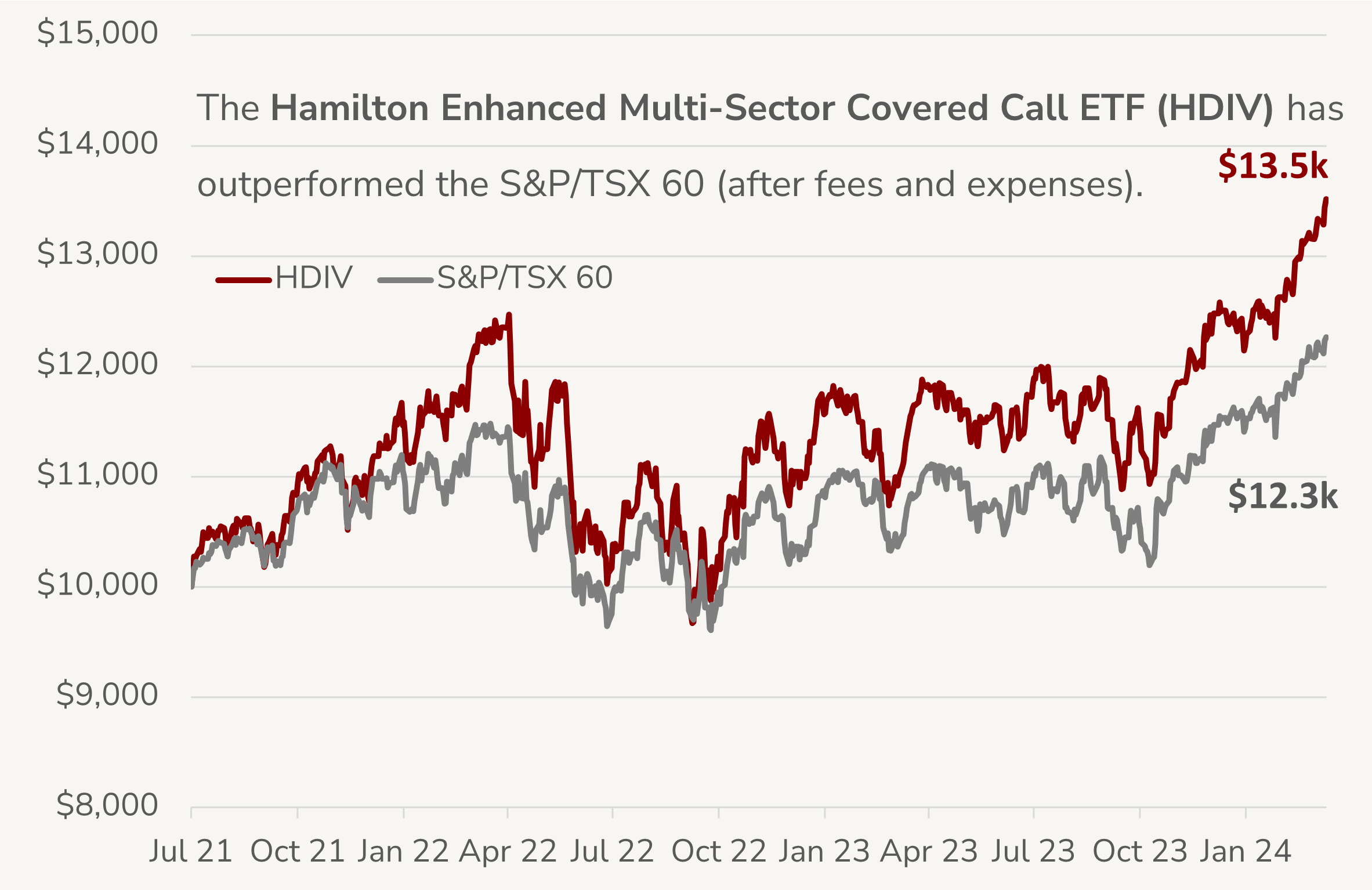

HDIV has outperformed the S&P/TSX 60 by 3.93% annualized since inception*Based on annualized total returns since inception on July 19, 2021. As at March 28, 2024. Source: Bloomberg

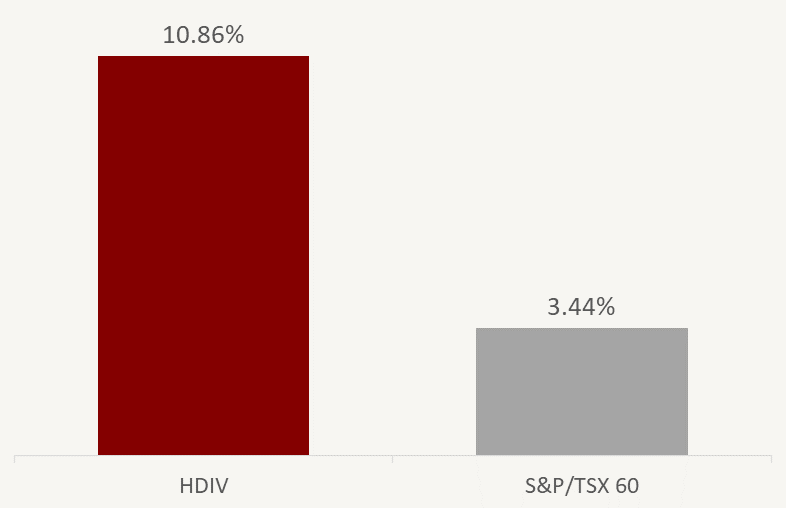

Yield of 10.86%*An estimate of the annualized yield an investor would receive if the most recent distribution remained unchanged for the next 12 months, stated as a percentage of the price per unit on March 28, 2024 with monthly distributions

Portfolio of primarily sector covered call ETFs with a sector mix broadly similar to the S&P/TSX 60

Modest cash leverage of 25% to enhance yield and growth potential

A GOOD FIT FOR INVESTORS WHO WANT

Attractive monthly income

Sector diversification broadly similar to S&P/TSX 60 with higher yield

Increased growth potential vs individual covered call ETFs

Higher yielding alternative vs broad-based index ETFs and individual covered call strategies

FUND OBJECTIVE

The fund seeks to provide attractive monthly income and long-term capital appreciation from a diversified, multi-sector portfolio of primarily covered call ETFs focused on Canada.

Performance

- TICKER HDIV

- NAV $16.33

- 1 DAY CHANGE -$0.02

-

YIELD *

Current annualized yield, as at March 28, 2024

10.86% - ASSETS $394.8M

Total Returns (incl. Dividends)

- ticker 0.00%

- 1 month 5.83%

- 3 months 8.05%

- 6 months 20.36%

- year to date 8.05%

- 1 year 18.87%

- inception* 11.81%

- as of date 202400.00%

Outperformance1

since July 2021

1Value of $10,000 invested in HDIV and the S&P/TSX 60 since inception on July 19, 2021, as at March 28, 2024. Source: Bloomberg, Hamilton ETFs

Higher Yield2

2HDIV and S&P/TSX 60 current annualized yields as at March 28, 2024. Source: Bloomberg, Hamilton ETFs

- Overview

- Distributions

- Documents

█ Utilities 15.0%

█ Health Care 10.6%

█ Technology 15.6%

█ Gold 10.6%

█ Energy 15.6%

| ticker | name | weight |

| HFIN | Hamilton Enhanced Canadian Financials ETF | 21.4% |

| QMAX | Hamilton Technology Yield Maximizer ETF | 19.3% |

| EMAX | Hamilton Energy Yield Maximizer ETF | 19.3% |

| HMAX | Hamilton Canadian Financials Yield Maximizer ETF | 18.7% |

| LMAX | Hamilton Healthcare Yield Maximizer ETF | 13.1% |

| AMAX | Hamilton Gold Producer Yield Maximizer ETF | 13.1% |

| UMAX | Hamilton Utilities Yield Maximizer ETF | 12.4% |

| HUTS | Hamilton Enhanced Utilities ETF | 6.1% |

| Total (including modest ~25% leverage) | 123.4% |

Please note the portfolio weights include modest ~25% leverage via cash borrowing (not derivatives), provided by a Canadian financial institution.

| Ticker | HDIV |

| Exchange | Toronto Stock Exchange (TSX) |

| CUSIP | 407362102 |

| Inception Date | July 19, 2021 |

| Assets | $394.8M CAD* |

| Current Annualized Yield | 10.86%* |

| Distributions | Monthly |

| Management Fee | 0.00% (subject to the fees of the underlying portfolio ETFs) |

| Risk Rating | Medium |

| Auditor | KPMG LLP |

| Legal Entity Identifier | 5493008TSHTG4IQYNN95 |

| Ex-Dividend Date | Paid | Frequency | Amount |

|---|---|---|---|

| 2024-04-29 | 2024-05-07 | Monthly | $0.1650 |

| 2024-03-27 | 2024-04-05 | Monthly | $0.1510 |

| 2024-02-28 | 2024-03-07 | Monthly | $0.1510 |

| 2024-01-30 | 2024-02-09 | Monthly | $0.1410 |

| 2023-12-28 | 2024-01-08 | Monthly | $0.1410 |

| 2023-11-29 | 2023-12-07 | Monthly | $0.1400 |

| 2023-10-30 | 2023-11-07 | Monthly | $0.1400 |

| 2023-09-28 | 2023-10-06 | Monthly | $0.1400 |

| 2023-08-30 | 2023-09-08 | Monthly | $0.1400 |

| 2023-07-28 | 2023-08-08 | Monthly | $0.1400 |

| 2023-06-29 | 2023-07-10 | Monthly | $0.1350 |

| 2023-05-30 | 2023-06-07 | Monthly | $0.1350 |

| 2023-04-27 | 2023-05-05 | Monthly | $0.1350 |

| 2023-03-30 | 2023-04-13 | Monthly | $0.1350 |

| 2023-02-27 | 2023-03-10 | Monthly | $0.1350 |

| 2023-01-30 | 2023-02-10 | Monthly | $0.1350 |

| 2022-12-29 | 2023-01-12 | Monthly | $0.1250 |

| 2022-11-29 | 2022-12-12 | Monthly | $0.1250 |

| 2022-10-28 | 2022-11-10 | Monthly | $0.1250 |

| 2022-09-28 | 2022-10-13 | Monthly | $0.1250 |

| 2022-08-30 | 2022-09-13 | Monthly | $0.1250 |

| 2022-07-28 | 2022-08-11 | Monthly | $0.1250 |

| 2022-06-29 | 2022-07-13 | Monthly | $0.1250 |

| 2022-05-30 | 2022-06-10 | Monthly | $0.1250 |

| 2022-04-28 | 2022-05-11 | Monthly | $0.1250 |

| 2022-03-30 | 2022-04-12 | Monthly | $0.1250 |

| 2022-02-25 | 2022-03-10 | Monthly | $0.1250 |

| 2022-01-28 | 2022-02-10 | Monthly | $0.1175 |

| 2021-12-30 | 2022-01-13 | Special (non-cash) | $0.06438 |

| 2021-12-30 | 2022-01-13 | Monthly | $0.1175 |

| 2021-11-29 | 2021-12-10 | Monthly | $0.1175 |

| 2021-10-28 | 2021-11-10 | Monthly | $0.1175 |

| 2021-09-28 | 2021-10-13 | Monthly | $0.1175 |

You can view public filings for the Hamilton Enhanced Multi-Sector Covered Call ETF on SEDAR+.

Press Releases

View the latest HDIV Press Releases

Fact Sheet

HDIV Fact Sheet (2024-03-28) English Français

ETF Facts

HDIV ETF Facts (2024-02-02) English Français

Prospectus

HDIV Prospectus (2024-02-02) English Français

Financial Statements

Annual Financial Statements (2023-12-31) English Français

Interim Financial Statements (2023-06-30) English Français

Latest Portfolio Summary

Q3 2023 Portfolio Summary (2023-09-30) Download

Independent Review Committee

2023 Annual Report to Securityholders (2024-03-13) Download