Hamilton Canadian Bank

Mean Reversion Index ETF

A Smarter Way to Invest in Canadian Banks

Highlights

Canadian bank ETF with exposure to the “Big Six” banks using a mean reversion strategy

+16.28% annualized return SI*As at March 28, 2024

5.19% yield; monthly distributions*An estimate of the annualized yield an investor would receive if the most recent distribution remained unchanged for the next 12 months, stated as a percentage of the price per unit on March 28, 2024

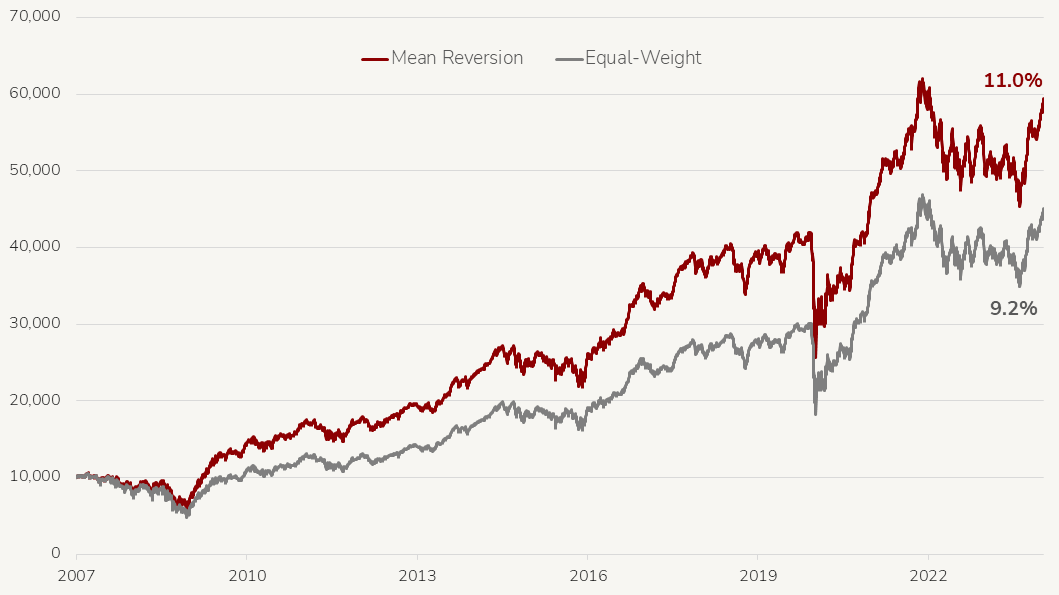

Mean reversion has long-term outperformance vs. equal weight strategies*Annualized returns of Solactive Canadian Bank Mean Reversion Index TR (SOLCBMRT) since inception on March 16, 2007 vs Solactive Equal Weight Canada Banks Index (SOLCBEW) as at March 28, 2024; source: Bloomberg, Solactive AG

FundGrade A+® Rating*For calendar year 2023 in the Financial Services Equity CIFSC Category. FundGrade A+® is used with permission from Fundata Canada Inc., all rights reserved. The annual FundGrade A+® Awards are presented by Fundata Canada Inc. to recognize the “best of the best” among Canadian investment funds. The FundGrade A+® calculation is supplemental to the monthly FundGrade ratings and is calculated at the end of each calendar year. The FundGrade rating system evaluates funds based on their risk-adjusted performance, measured by Sharpe Ratio, Sortino Ratio, and Information Ratio. The score for each ratio is calculated individually, covering all time periods from 2 to 10 years. The scores are then weighted equally in calculating a monthly FundGrade. The top 10% of funds earn an A Grade; the next 20% of funds earn a B Grade; the next 40% of funds earn a C Grade; the next 20% of funds receive a D Grade; and the lowest 10% of funds receive an E Grade. To be eligible, a fund must have received a FundGrade rating every month in the previous year. The FundGrade A+® uses a GPA-style calculation, where each monthly FundGrade from “A” to “E” receives a score from 4 to 0, respectively. A fund’s average score for the year determines its GPA. Any fund with a GPA of 3.5 or greater is awarded a FundGrade A+® Award. For more information, see www.FundGradeAwards.com. Although Fundata makes every effort to ensure the accuracy and reliability of the data contained herein, the accuracy is not guaranteed by Fundata.

What is Mean-Reversion?

Mean reversion is one of the most popular themes in Canadian bank investing, given the individual Canadian banks have tended to perform similarly over time.

HCA attempts to take advantage of these tendencies by rebalancing the portfolio quarterly and investing 80% of the portfolio in the 3 banks which have recently underperformed, and 20% in the 3 banks which have outperformed.

FUND OBJECTIVE

The fund is designed to closely track the returns of the Solactive Canadian Bank Mean Reversion Index TR, which applies a variable-weight, mean reversion trading strategy to Canada’s “Big Six” banks, with quarterly rebalancing.

The Solactive Canadian Bank Mean Reversion Index TR has outperformed an equal weight portfolio of Canada’s banks*Annualized returns of Solactive Canadian Bank Mean Reversion Index TR (SOLCBMRT) since inception on March 16, 2007 vs Solactive Equal Weight Canada Banks Index (SOLCBEW) as at January 31, 2024; source: Bloomberg, Solactive AG

Performance

- TICKER HCA

- NAV $21.39

- 1 DAY CHANGE -$0.06

-

YIELD *

Current annualized yield, as at March 28, 2024

5.19% - ASSETS $71.2M

Total Returns (incl. Dividends)

- ticker 0.00%

- 1 month 5.45%

- 3 months 5.68%

- 6 months 19.99%

- year to date 5.68%

- 1 year 16.20%

- 3 years* 7.94%

- inception* 16.28%

- as of date 202400.00%

Solactive Canadian Bank Mean Reversion Index TR vs Solactive Equal Weight Canada Banks Index

Value of 10,000 of Solactive Canadian Bank Mean Reversion Index TR (SOLCBMRT) vs Solactive Equal Weight Canada Banks Index (SOLCBEW) with annual compounded total returns since inception on March 16, 2007, as at March 28, 2024. Source: Bloomberg, Solactive AG

- Overview

- Distributions

- Documents

| ticker | name | weight |

| BNS | Bank of Nova Scotia | 27.7% |

| NA | National Bank of Canada | 27.6% |

| TD | Toronto-Dominion Bank | 24.8% |

| CM | Canadian Imperial Bank of Commerce | 7.0% |

| BMO | Bank of Montreal | 6.5% |

| RY | Royal Bank of Canada | 6.5% |

| Ticker | HCA |

| Exchange | Toronto Stock Exchange (TSX) |

| CUSIP | 40704K100 |

| Inception Date | June 26, 2020 |

| Investment Style | Index-based, mean reversion strategy |

| Benchmark | Solactive Canadian Bank Mean Reversion Index |

| Assets | $71.2M CAD* |

| Current Annualized Yield | 5.19%* |

| Distributions | Monthly |

| Rebalancing | Quarterly |

| Management Fee | 0.29% |

| Risk Rating | Medium to High |

| Auditor | KPMG LLP |

| Legal Entity Identifier | 549300ZKTX737BJCLT27 |

| Ex-Dividend Date | Paid | Frequency | Amount |

|---|---|---|---|

| 2024-04-29 | 2024-05-07 | Monthly | $0.0960 |

| 2024-03-27 | 2024-04-05 | Monthly | $0.0960 |

| 2024-02-28 | 2024-03-07 | Monthly | $0.0960 |

| 2024-01-30 | 2024-02-09 | Monthly | $0.0960 |

| 2023-12-28 | 2024-01-08 | Special (cash) | $0.1605 |

| 2023-12-28 | 2024-01-08 | Monthly | $0.0960 |

| 2023-11-29 | 2023-12-07 | Monthly | $0.0960 |

| 2023-10-30 | 2023-11-07 | Monthly | $0.0960 |

| 2023-09-28 | 2023-10-06 | Monthly | $0.0960 |

| 2023-08-30 | 2023-09-08 | Monthly | $0.0960 |

| 2023-07-28 | 2023-08-08 | Monthly | $0.0960 |

| 2023-06-29 | 2023-07-10 | Special (cash) | $0.6000 |

| 2023-06-29 | 2023-07-10 | Monthly | $0.0960 |

| 2023-05-30 | 2023-06-07 | Monthly | $0.0960 |

| 2023-04-27 | 2023-05-05 | Monthly | $0.0960 |

| 2023-03-30 | 2023-04-13 | Monthly | $0.0960 |

| 2023-02-27 | 2023-03-10 | Monthly | $0.0960 |

| 2023-01-30 | 2023-02-10 | Monthly | $0.0960 |

| 2022-12-29 | 2023-01-12 | Monthly | $0.0960 |

| 2022-11-29 | 2022-12-12 | Monthly | $0.0960 |

| 2022-10-28 | 2022-11-10 | Monthly | $0.0960 |

| 2022-09-28 | 2022-10-13 | Monthly | $0.0960 |

| 2022-08-30 | 2022-09-13 | Monthly | $0.0960 |

| 2022-07-28 | 2022-08-11 | Monthly | $0.0960 |

| 2022-06-29 | 2022-07-13 | Monthly | $0.0960 |

| 2022-05-30 | 2022-06-10 | Monthly | $0.0925 |

| 2022-04-28 | 2022-05-11 | Monthly | $0.0925 |

| 2022-03-30 | 2022-04-12 | Monthly | $0.0925 |

| 2022-02-25 | 2022-03-10 | Monthly | $0.0925 |

| 2022-01-28 | 2022-02-10 | Monthly | $0.090 |

| 2021-12-30 | 2022-01-13 | Special (non-cash) | $1.80801 |

| 2021-12-30 | 2022-01-13 | Monthly | $0.090 |

| 2021-11-29 | 2021-12-10 | Monthly | $0.085 |

| 2021-10-28 | 2021-11-10 | Monthly | $0.080 |

| 2021-09-28 | 2021-10-13 | Monthly | $0.080 |

| 2021-08-30 | 2021-09-13 | Monthly | $0.080 |

| 2021-07-29 | 2021-08-12 | Monthly | $0.080 |

| 2021-06-29 | 2021-07-13 | Monthly | $0.080 |

| 2021-05-28 | 2021-06-10 | Monthly | $0.080 |

| 2021-04-29 | 2021-05-12 | Special (cash) | $0.100 |

| 2021-04-29 | 2021-05-12 | Monthly | $0.075 |

| 2021-03-30 | 2021-04-13 | Monthly | $0.075 |

| 2021-02-25 | 2021-03-10 | Monthly | $0.072 |

| 2021-01-28 | 2021-02-10 | Monthly | $0.072 |

| 2020-12-30 | 2021-01-13 | Special (cash) | $0.26041 |

| 2020-12-30 | 2021-01-13 | Monthly | $0.072 |

| 2020-11-27 | 2020-12-10 | Monthly | $0.072 |

| 2020-10-29 | 2020-11-12 | Monthly | $0.072 |

| 2020-09-29 | 2020-10-13 | Monthly | $0.070 |

| 2020-08-28 | 2020-09-11 | Monthly | $0.070 |

You can view public filings for the Hamilton Canadian Bank Mean Reversion Index ETF on SEDAR+.

Press Releases

View the latest HCA Press Releases

Fact Sheet

HCA Fact Sheet (2024-03-28) English Français

ETF Facts

HCA ETF Facts (2024-03-27) English Français

Prospectus

HCA Prospectus (2024-03-27) English Français

Financial Statements

Annual Financial Statements (2023-12-31) English Français

Interim Financial Statements (2023-06-30) English Français

Latest Portfolio Summary

Q3 2023 Portfolio Summary (2023-09-30) Download

Independent Review Committee

2023 Annual Report to Securityholders (2024-03-13) Download