Hamilton Enhanced

Canadian Bank ETF

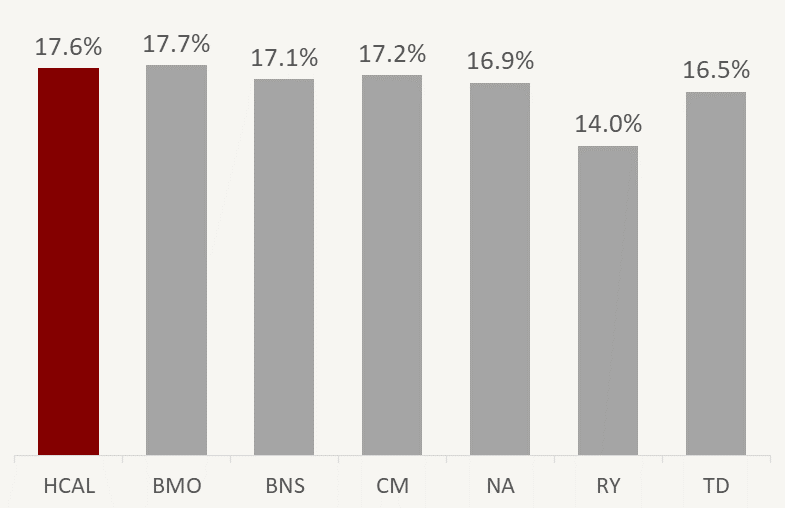

Top Performing Canadian Bank ETF

Highlights

Top performing Canadian bank ETF*Since inception on October 14, 2020, as at March 28, 2024. Based on a universe of seven Canadian bank ETFs that trade on the Toronto Stock Exchange, including unlevered and covered call strategies. Effective April 14, 2023, the investment objective of the Hamilton Enhanced Canadian Bank ETF (HCAL) was changed to equal weight exposure from its prior mean reversion approach. In certain markets, the current approach is expected to outperform the prior.

Yield of 7.03%*An estimate of the annualized yield an investor would receive if the most recent distribution remained unchanged for the next 12 months, stated as a percentage of the price per unit on March 28, 2024, paid monthly

Equal-weight exposure to Canada’s “Big Six” banks with modest 25% cash leverage

HCAL has similar volatility compared to the Big-6 Canadian banks*Volatility is the annualized standard deviation of daily returns since Oct 14, 2020. Big-6 average is the Solactive Equal Weight Canada Banks Index (SOLCBEW). As at March 28, 2024. Source: Bloomberg, Hamilton ETFs

A GOOD FIT FOR INVESTORS WHO WANT

Enhanced growth potential

Higher monthly income

Modest 25% cash leverage

FUND OBJECTIVE

HCAL is designed to track 1.25x the returns of the Solactive Equal Weight Canada Banks Index, investing in Canadian banks — using modest 25% cash leverage. HCAL does not use derivatives.*Effective April 14, 2023, the investment objective of the Hamilton Enhanced Canadian Bank ETF (HCAL) was changed. Please refer to the disclosure documents of HCAL at www.hamiltonetfs.com.

Performance

- TICKER HCAL

- NAV $20.68

- 1 DAY CHANGE -$0.07

-

YIELD *

Current annualized yield, as at March 28, 2024

7.03% - ASSETS $519.3M

Total Returns (incl. Dividends)

- ticker 0.00%

- 1 month 7.23%

- 3 months 6.72%

- 6 months 23.73%

- year to date 6.72%

- 1 year 16.70%

- 3 years* 7.95%

- inception* 17.36%

- as of date 202400.00%

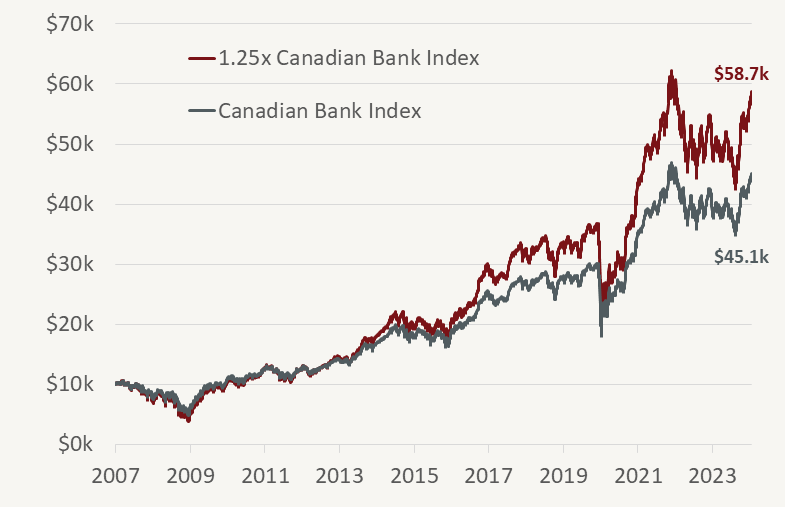

Benefits of Modest Leverage1

Since March 2007

1Growth of $10,000 based on total returns of the Solactive Equal Weight Canada Banks Index (SOLCBEW) vs 1.25x SOLCBEW, since March 16, 2007, as at March 28, 2024. Source: Bloomberg, Solactive AG, Hamilton ETFs

Similar Volatility vs. Big-6 Banks2

2Standard deviation since October 14, 2020, at March 28, 2024. Source: Bloomberg, Hamilton ETFs

- Overview

- Distributions

- Documents

| ticker | name | weight |

| HEB | Hamilton Canadian Bank Equal-Weight Index ETF | 124.5% |

Leverage is via cash borrowing (not derivatives), provided by a Canadian financial institution.

HEB Holdings

Hamilton Canadian Bank Equal-Weight Index ETF invests in Canada's "big six" banks| Name | Weight |

|---|---|

| Bank of Nova Scotia | 17.0% |

| Bank of Montreal | 16.9% |

| National Bank of Canada | 16.7% |

| Canadian Imperial Bank of Commerce | 16.7% |

| Royal Bank of Canada | 16.4% |

| Toronto-Dominion Bank | 16.3% |

| Ticker | HCAL |

| Exchange | Toronto Stock Exchange (TSX) |

| CUSIP | 407363100 |

| Inception Date | October 14, 2020 |

| Investment Style | Index-based, 25% modest leverage |

| Index | Solactive Equal Weight Canada Banks Index |

| Assets | $519.3M CAD* |

| Current Annualized Yield | 7.03%* |

| Distributions | Monthly |

| Management Fee | 0.65% |

| Risk Rating | Medium to High |

| Auditor | KPMG LLP |

| Legal Entity Identifier | 549300JNYPYDVKHHRV07 |

| Ex-Dividend Date | Paid | Frequency | Amount |

|---|---|---|---|

| 2024-04-29 | 2024-05-07 | Monthly | $0.1270 |

| 2024-03-27 | 2024-04-05 | Monthly | $0.1270 |

| 2024-02-28 | 2024-03-07 | Monthly | $0.1270 |

| 2024-01-30 | 2024-02-09 | Monthly | $0.1270 |

| 2023-12-28 | 2024-01-08 | Monthly | $0.1270 |

| 2023-11-29 | 2023-12-07 | Monthly | $0.1270 |

| 2023-10-30 | 2023-11-07 | Monthly | $0.1270 |

| 2023-09-28 | 2023-10-06 | Monthly | $0.1270 |

| 2023-08-30 | 2023-09-08 | Monthly | $0.1270 |

| 2023-07-28 | 2023-08-08 | Monthly | $0.1270 |

| 2023-06-29 | 2023-07-10 | Monthly | $0.1270 |

| 2023-05-30 | 2023-06-07 | Monthly | $0.1270 |

| 2023-04-27 | 2023-05-05 | Monthly | $0.1270 |

| 2023-03-30 | 2023-04-13 | Monthly | $0.1270 |

| 2023-02-27 | 2023-03-10 | Monthly | $0.1270 |

| 2023-01-30 | 2023-02-10 | Monthly | $0.1270 |

| 2022-12-29 | 2023-01-12 | Monthly | $0.1270 |

| 2022-11-29 | 2022-12-12 | Monthly | $0.1270 |

| 2022-10-28 | 2022-11-10 | Monthly | $0.1270 |

| 2022-09-28 | 2022-10-13 | Monthly | $0.1270 |

| 2022-08-30 | 2022-09-13 | Monthly | $0.1270 |

| 2022-07-28 | 2022-08-11 | Monthly | $0.1270 |

| 2022-06-29 | 2022-07-13 | Monthly | $0.1270 |

| 2022-05-30 | 2022-06-10 | Monthly | $0.1225 |

| 2022-04-28 | 2022-05-11 | Monthly | $0.1225 |

| 2022-03-30 | 2022-04-12 | Monthly | $0.1225 |

| 2022-02-25 | 2022-03-10 | Monthly | $0.1225 |

| 2022-01-28 | 2022-02-10 | Monthly | $0.115 |

| 2021-12-30 | 2022-01-13 | Special (non-cash) | $2.29452 |

| 2021-12-30 | 2022-01-13 | Monthly | $0.115 |

| 2021-11-29 | 2021-12-10 | Monthly | $0.1075 |

| 2021-10-28 | 2021-11-10 | Monthly | $0.100 |

| 2021-09-28 | 2021-10-13 | Monthly | $0.100 |

| 2021-08-30 | 2021-09-13 | Monthly | $0.100 |

| 2021-07-29 | 2021-08-12 | Monthly | $0.100 |

| 2021-06-29 | 2021-07-13 | Monthly | $0.100 |

| 2021-05-28 | 2021-06-10 | Monthly | $0.100 |

| 2021-04-29 | 2021-05-12 | Special (cash) | $0.110 |

| 2021-04-29 | 2021-05-12 | Monthly | $0.093 |

| 2021-03-30 | 2021-04-13 | Monthly | $0.093 |

| 2021-02-25 | 2021-03-10 | Monthly | $0.087 |

| 2021-01-28 | 2021-02-10 | Monthly | $0.087 |

| 2020-12-30 | 2021-01-13 | Special (cash) | $0.30745 |

| 2020-12-30 | 2021-01-13 | Monthly | $0.087 |

You can view public filings for the Hamilton Enhanced Canadian Bank ETF on SEDAR+.

Press Releases

View the latest HCAL Press Releases

Fact Sheet

HCAL Fact Sheet (2024-03-28) English Français

ETF Facts

HCAL ETF Facts (2023-06-07) English Français

Prospectus

HCAL Prospectus (2023-06-07) English Français

A special meeting of HCAL unitholders was held on February 15, 2023. For further details, please see the Management Information Circular.

Financial Statements

Annual Financial Statements (2023-12-31) English Français

Interim Financial Statements (2023-06-30) English Français

Latest Portfolio Summary

Q3 2023 Portfolio Summary (2023-09-30) Download

Independent Review Committee

2023 Annual Report to Securityholders (2024-03-13) Download