Hamilton Canadian Bank

Equal-Weight Index ETF

Low-Cost Canadian Bank ETF

HIGHLIGHTS

Low-cost Canadian bank ETF

Last distribution of $0.069 per unit*Last distribution per unit. Distributions are subject to change. For a complete list of historical distributions, please see the Distributions tab below.; monthly distributions

Convenient equal-weight exposure to Canada’s big-6 banks

Dividends from Canadian banks are eligible for the Canadian Dividend Tax Credit

A GOOD FIT FOR INVESTORS WHO WANT

Attractive monthly income

Tax efficient distributions

Low-fee exposure to the big-6 Canadian banks

FUND OBJECTIVE

HEB is designed to track the returns of the Solactive Equal Weight Canada Banks Index, net of fees and expenses. HEB rebalances semi-annually to equal-weight.

Performance

- TICKER HEB

- NAV $16.68

- 1 DAY CHANGE -$0.05

-

LAST DISTRIBUTION *

Last distribution per unit. Distributions are subject to change. For a complete list of historical distributions, please see the Distributions tab below.

$0.069 - ASSETS $664.7M

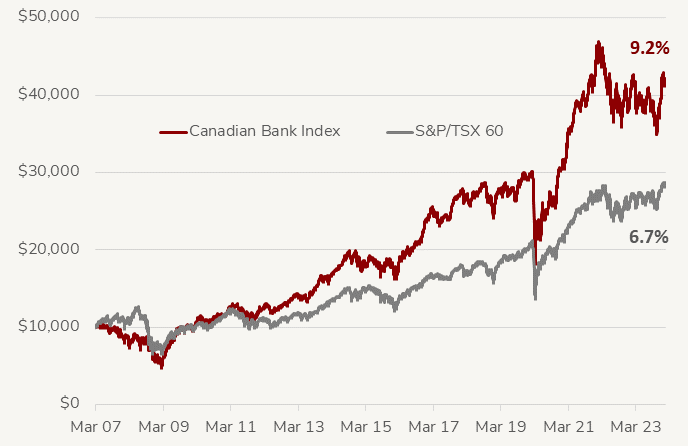

Canadian Bank Index Outperformance1

since March 2007

1Annualized total returns based on Solactive Equal Weight Canada Banks Index (SOLCBEW) vs the S&P/TSX 60, since March 16, 2007, as at March 28, 2024. Source: Bloomberg, Solactive AG, Hamilton ETFs

Low-Cost Canadian Bank ETF

- Overview

- Distributions

- Documents

| ticker | name | weight |

| BNS | Bank of Nova Scotia | 17.0% |

| BMO | Bank of Montreal | 16.9% |

| NA | National Bank of Canada | 16.7% |

| CM | Canadian Imperial Bank of Commerce | 16.7% |

| RY | Royal Bank of Canada | 16.4% |

| TD | Toronto-Dominion Bank | 16.3% |

| Ticker | HEB |

| Exchange | Toronto Stock Exchange (TSX) |

| CUSIP | 40704N104 |

| Inception Date | April 3, 2023 |

| Investment Style | Equal-Weight, Index-based |

| Benchmark | Solactive Equal Weight Canada Banks Index |

| Assets | $664.7M CAD* |

| Distributions | Monthly |

| Rebalancing | Semi-Annually |

| Management Fee | 0.19% |

| Risk Rating | Medium to High |

| Auditor | KPMG LLP |

| Legal Entity Identifier | 549300093ISLOKV5JH04 |

| Ex-Dividend Date | Paid | Frequency | Amount |

|---|---|---|---|

| 2024-04-29 | 2024-05-07 | Monthly | $0.069 |

| 2024-03-27 | 2024-04-05 | Monthly | $0.069 |

| 2024-02-28 | 2024-03-07 | Monthly | $0.069 |

| 2024-01-30 | 2024-02-09 | Monthly | $0.069 |

| 2023-12-28 | 2024-01-08 | Monthly | $0.069 |

| 2023-11-29 | 2023-12-07 | Monthly | $0.069 |

| 2023-10-30 | 2023-11-07 | Monthly | $0.069 |

| 2023-09-28 | 2023-10-06 | Monthly | $0.069 |

| 2023-08-30 | 2023-09-08 | Monthly | $0.069 |

| 2023-07-28 | 2023-08-08 | Monthly | $0.069 |

| 2023-06-29 | 2023-07-10 | Monthly | $0.069 |

| 2023-05-30 | 2023-06-07 | Monthly | $0.069 |

| 2023-04-27 | 2023-05-05 | Monthly | $0.069 |

You can view public filings for the Hamilton Canadian Bank Equal-Weight Index ETF on SEDAR+.

Press Releases

View the latest HEB Press Releases

Fact Sheet

HEB Fact Sheet (2024-03-28) English Français

ETF Facts

HEB ETF Facts (2024-03-27) English Français

Prospectus

HEB Prospectus (2024-03-27) English Français

Financial Statements

Annual Financial Statements (2023-12-31) English Français

Interim Financial Statements (2023-06-30) English Français

Latest Portfolio Summary

Q3 2023 Portfolio Summary (2023-09-30) Download

Independent Review Committee

2023 Annual Report to Securityholders (2024-03-13) Download