Hamilton Canadian

Financials YIELD

MAXIMIZER™ ETF

Higher Income from Canadian Financials

HIGHLIGHTS

13%+ Target Yield*As at January 31, 2024. Distributions are not fixed or guaranteed. Hamilton ETFs may, in its complete discretion, change the frequency or expected amount of these distributions. Target yield is an estimate of the annualized yield an investor would receive if the target distribution remained unchanged for the next 12 months, stated as a percentage of the net asset value per unit on the as at date.; monthly distributions

Diversified exposure to Canada’s 10 largest financials with approximately 70% exposure to the ‘big-5’ banks

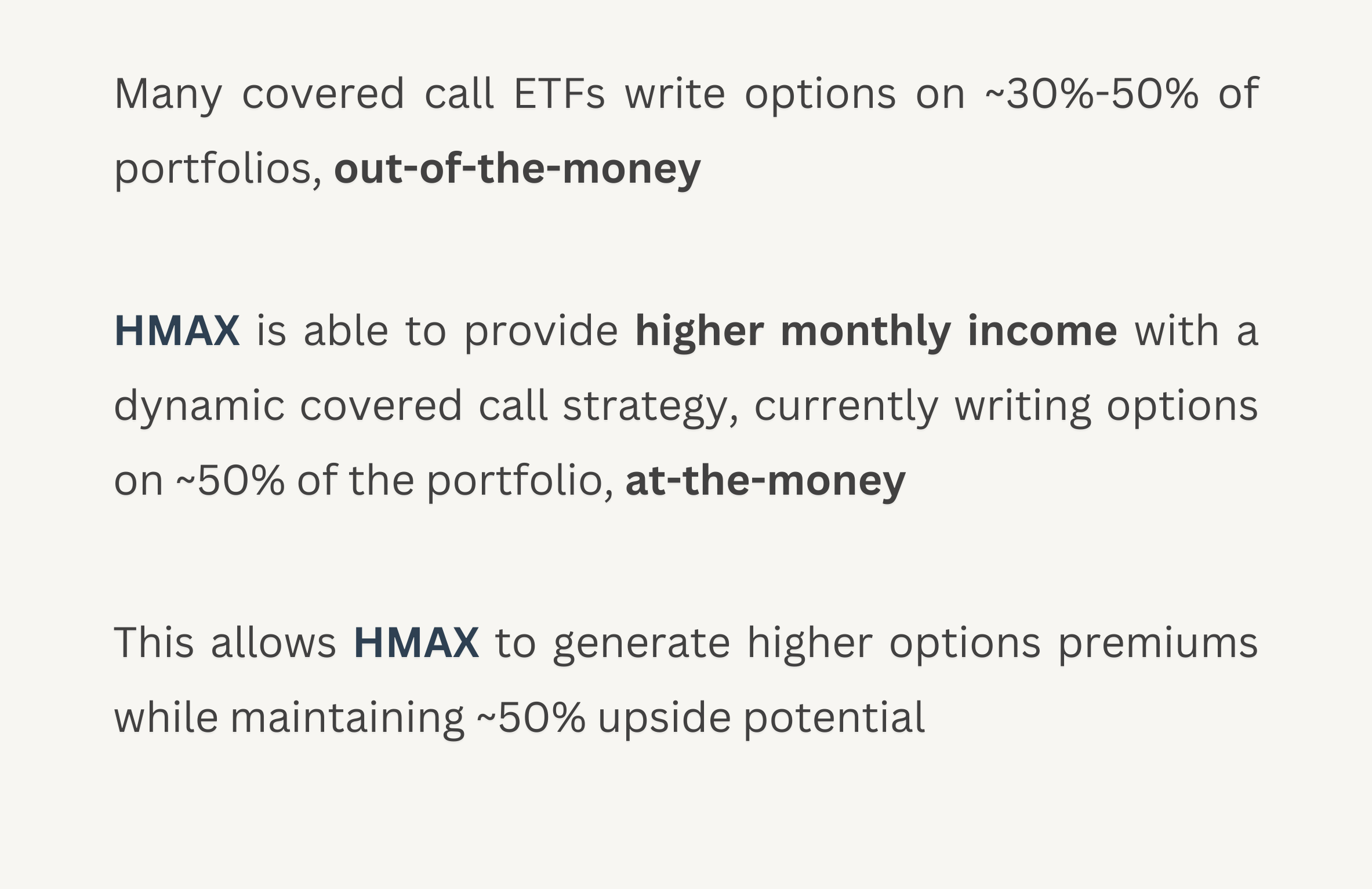

Dynamic covered call strategy to enhance monthly income and reduce volatility

Active covered call strategy managed by an experienced options team led by Nick Piquard, with 25+ years of experience specializing in options

A GOOD FIT FOR INVESTORS WHO WANT

Higher monthly income

Blue-chip Canadian banks/financials exposure

Tax efficient distributions

Reduced volatility from options strategy

FUND OBJECTIVE

HMAX is designed for attractive monthly income, while providing exposure to a market cap-weighted portfolio of Canadian financial services stocks. To reduce volatility and augment dividend income, HMAX will employ an active covered call strategy.

HMAX does not use leverage.

Performance

- TICKER HMAX

- NAV $13.63

- 1 DAY CHANGE -$0.05

-

TARGET YIELD *

As at January 31, 2024. Distributions are not fixed or guaranteed. Hamilton ETFs may, in its complete discretion, change the frequency or expected amount of these distributions. Target yield is an estimate of the annualized yield an investor would receive if the target distribution remained unchanged for the next 12 months, stated as a percentage of the net asset value per unit on the as at date.

13%+ - ASSETS $733.2M

Total Returns (incl. Dividends)

- ticker 0.00%

- 1 month 3.14%

- 3 months 4.33%

- 6 months 12.42%

- year to date 4.33%

- 1 year 10.12%

- inception* 3.77%

- as of date 202400.00%

Attractive Monthly Income

What Makes HMAX Different?

- Overview

- Distributions

- Documents

█ Banks 68.9%

█ Insurance 21.7%

| ticker | name | weight |

| RY | Royal Bank of Canada | 22.7% |

| TD | Toronto-Dominion Bank | 17.2% |

| BMO | Bank of Montreal | 11.3% |

| BN | Brookfield Corp | 11.1% |

| BNS | Bank of Nova Scotia | 10.1% |

| CM | Canadian Imperial Bank of Commerce | 7.6% |

| MFC | Manulife Financial | 7.1% |

| SLF | Sun Life Financial | 5.1% |

| GWO | Great-West Lifeco | 4.8% |

| IFC | Intact Financial | 4.7% |

| Ticker | HMAX |

| Exchange | Toronto Stock Exchange (TSX) |

| CUSIP | 40704M106 |

| Inception Date | January 20, 2023 |

| Investment Style | Covered Call |

| Assets | $733.2M CAD* |

| Target Yield | 13%+* |

| Current Annualized Yield | 14.82%* |

| Distributions | Monthly |

| Rebalancing | Semi-Annual |

| Management Fee | 0.65% |

| Risk Rating | Medium |

| Auditor | KPMG LLP |

| Legal Entity Identifier | 549300MRZG8IKUDNCP20 |

| Ex-Dividend Date | Paid | Frequency | Amount |

|---|---|---|---|

| 2024-04-29 | 2024-05-07 | Monthly | $0.1710 |

| 2024-03-27 | 2024-04-05 | Monthly | $0.1731 |

| 2024-02-28 | 2024-03-07 | Monthly | $0.1730 |

| 2024-01-30 | 2024-02-09 | Monthly | $0.1746 |

| 2023-12-28 | 2024-01-08 | Monthly | $0.1745 |

| 2023-11-29 | 2023-12-07 | Monthly | $0.1745 |

| 2023-10-30 | 2023-11-07 | Monthly | $0.1775 |

| 2023-09-28 | 2023-10-06 | Monthly | $0.1775 |

| 2023-08-30 | 2023-09-08 | Monthly | $0.180 |

| 2023-07-28 | 2023-08-08 | Monthly | $0.180 |

| 2023-06-29 | 2023-07-10 | Monthly | $0.180 |

| 2023-05-30 | 2023-06-07 | Monthly | $0.180 |

| 2023-04-27 | 2023-05-05 | Monthly | $0.180 |

| 2023-03-30 | 2023-04-13 | Monthly | $0.185 |

| 2023-02-27 | 2023-03-10 | Monthly | $0.185 |

You can view public filings for the Hamilton Canadian Financials YIELD MAXIMIZER™ ETF on SEDAR+.

Press Releases

View the latest HMAX Press Releases

Fact Sheet

HMAX Fact Sheet (2024-03-28) English Français

ETF Facts

HMAX ETF Facts (2024-01-12) English Français

Prospectus

HMAX Prospectus (2024-01-12) English Français

Financial Statements

Annual Financial Statements (2023-12-31) English Français

Interim Financial Statements (2023-06-30) English Français

Latest Portfolio Summary

Q3 2023 Portfolio Summary (2023-09-30) Download

Independent Review Committee

2023 Annual Report to Securityholders (2024-03-13) Download