Hamilton Enhanced

Canadian Financials ETF

Get More from Canadian Banks & Insurers

HIGHLIGHTS

Equal-weight portfolio of Canada’s 12 largest financial services companies

Yield of 5.64%*An estimate of the annualized yield an investor would receive if the most recent distribution remained unchanged for the next 12 months, stated as a percentage of the price per unit on March 28, 2024 with monthly distributions

Modest 25% cash leverage to enhance yield and return potential

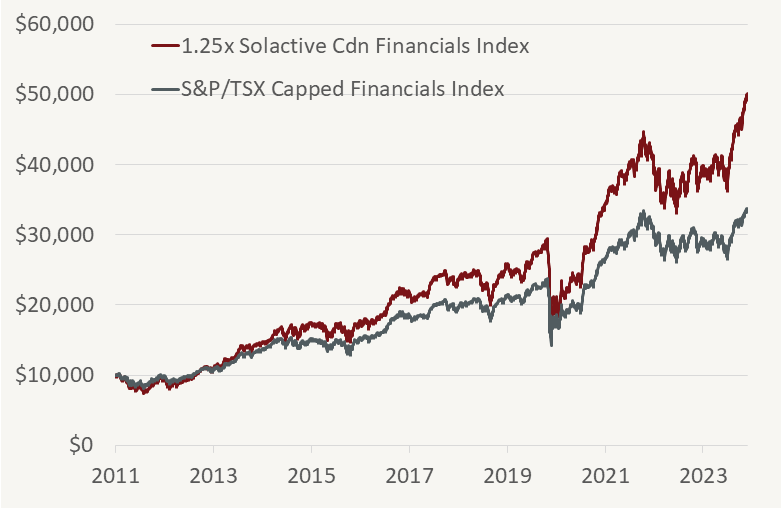

Solactive Canadian Financials Equal-Weight Index TR x 1.25 has outperformed the S&P/TSX Capped Financials Index by 3.41%*Based on annualized returns since inception on April 29, 2011, as at March 28, 2024

A GOOD FIT FOR INVESTORS WHO WANT

Attractive monthly distributions

Enhanced yield and growth potential

Diversified exposure to Canada’s large-cap banks and insurers

FUND OBJECTIVE

HFIN seeks to replicate a 1.25 times multiple of the Solactive Canadian Financials Equal-Weight Index TR (SOLCAFNT), comprised of equal-weightings of the top 12 largest Canadian financial services companies, while adding modest 25% cash leverage to enhance growth potential and yield.

Performance

- TICKER HFIN

- NAV $15.27

- 1 DAY CHANGE -$0.07

-

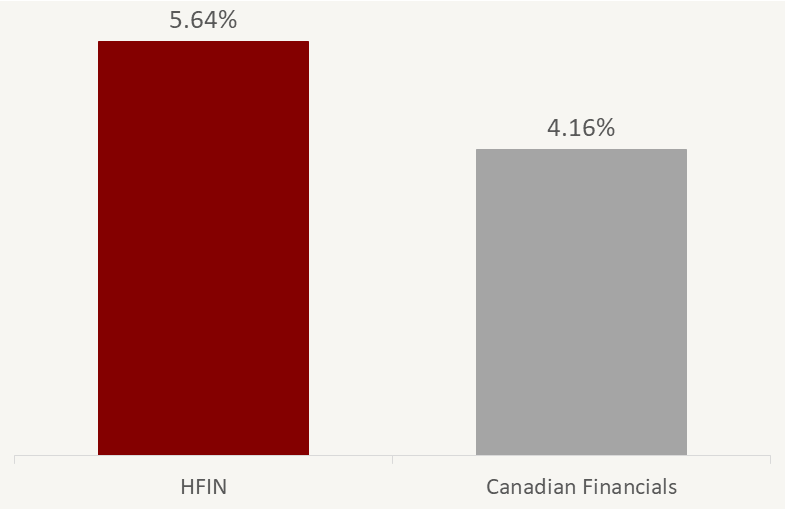

YIELD *

Current annualized yield, as at March 28, 2024

5.64% - ASSETS $121.5M

Total Returns (incl. Dividends)

- ticker 0.00%

- 1 month 4.76%

- 3 months 9.56%

- 6 months 27.35%

- year to date 9.56%

- 1 year 29.14%

- inception* 6.54%

- as of date 202400.00%

Benefits of Modest Leverage1

Since April 2011

1Based on Solactive Canadian Financials Equal-Weight Index TR (SOLCAFNT) x 1.25 and Canadian Financials as represented by the S&P/TSX Capped Financials Index (SPTSFN) from April 29, 2011 to March 28, 2024. Source: Bloomberg, Solactive AG, Hamilton ETFs

Higher Yield2

2Current annualized yield. Canadian Financials as represented by the S&P/TSX Capped Financials Index (SPTSFN), at March 28, 2024. Source: Bloomberg, Hamilton ETFs

- Overview

- Distributions

- Documents

█ Banks 50.3%

█ Insurance 40.5%

| ticker | name | weight |

| CM | Canadian Imperial Bank of Commerce | 11.7% |

| MFC | Manulife Financial | 11.5% |

| BN | Brookfield Corp | 11.4% |

| NA | National Bank of Canada | 11.0% |

| BMO | Bank of Montreal | 10.5% |

| FFH | Fairfax Financial Holdings | 10.4% |

| BNS | Bank of Nova Scotia | 10.3% |

| RY | Royal Bank of Canada | 10.1% |

| SLF | Sun Life Financial | 9.6% |

| GWO | Great-West Lifeco | 9.3% |

| IFC | Intact Financial | 9.2% |

| TD | Toronto-Dominion Bank | 8.7% |

| Total (including modest ~25% leverage) | 123.7% |

Please note the portfolio weights include modest ~25% leverage via cash borrowing (not derivatives), provided by a Canadian financial institution.

| Ticker | HFIN |

| Exchange | Toronto Stock Exchange (TSX) |

| CUSIP | 407364108 |

| Inception Date | January 26, 2022 |

| Investment Style | Index-based, modest 25% leverage |

| Benchmark | Solactive Canadian Financials Equal-Weight Index TR |

| Assets | $121.5M CAD* |

| Current Annualized Yield | 5.64%* |

| Distributions | Monthly |

| Rebalancing | Semi-Annual |

| Management Fee | 0.65% |

| Risk Rating | Medium to High |

| Auditor | KPMG LLP |

| Legal Entity Identifier | 549300COL2AQM2EJU464 |

| Ex-Dividend Date | Paid | Frequency | Amount |

|---|---|---|---|

| 2024-04-29 | 2024-05-07 | Monthly | $0.0750 |

| 2024-03-27 | 2024-04-05 | Monthly | $0.0750 |

| 2024-02-28 | 2024-03-07 | Monthly | $0.0750 |

| 2024-01-30 | 2024-02-09 | Monthly | $0.0750 |

| 2023-12-28 | 2024-01-08 | Monthly | $0.0750 |

| 2023-11-29 | 2023-12-07 | Monthly | $0.0750 |

| 2023-10-30 | 2023-11-07 | Monthly | $0.0750 |

| 2023-09-28 | 2023-10-06 | Monthly | $0.0750 |

| 2023-08-30 | 2023-09-08 | Monthly | $0.0750 |

| 2023-07-28 | 2023-08-08 | Monthly | $0.0750 |

| 2023-06-29 | 2023-07-10 | Monthly | $0.0750 |

| 2023-05-30 | 2023-06-07 | Monthly | $0.0750 |

| 2023-04-27 | 2023-05-05 | Monthly | $0.0750 |

| 2023-03-30 | 2023-04-13 | Monthly | $0.0750 |

| 2023-02-27 | 2023-03-10 | Monthly | $0.0750 |

| 2023-01-30 | 2023-02-10 | Monthly | $0.0750 |

| 2022-12-29 | 2023-01-12 | Monthly | $0.0750 |

| 2022-11-29 | 2022-12-12 | Monthly | $0.0750 |

| 2022-10-28 | 2022-11-10 | Monthly | $0.0750 |

| 2022-09-28 | 2022-10-13 | Monthly | $0.0750 |

| 2022-08-30 | 2022-09-13 | Monthly | $0.0750 |

| 2022-07-28 | 2022-08-11 | Monthly | $0.0750 |

| 2022-06-29 | 2022-07-13 | Monthly | $0.0750 |

| 2022-05-30 | 2022-06-10 | Monthly | $0.0725 |

| 2022-04-28 | 2022-05-11 | Monthly | $0.0725 |

| 2022-03-30 | 2022-04-12 | Monthly | $0.0725 |

You can view public filings for the Hamilton Enhanced Canadian Financials ETF on SEDAR+.

Press Releases

View the latest HFIN Press Releases

Fact Sheet

HFIN Fact Sheet (2024-03-28) English Français

ETF Facts

HFIN ETF Facts (2024-01-12) English Français

Prospectus

HFIN Prospectus (2024-01-12) English Français

Financial Statements

Annual Financial Statements (2023-12-31) English Français

Interim Financial Statements (2023-06-30) English Français

Latest Portfolio Summary

Q3 2023 Portfolio Summary (2023-09-30) Download

Independent Review Committee

2023 Annual Report to Securityholders (2024-03-13) Download