Hamilton U.S. Bond

YIELD MAXIMIZER™

ETF

Higher Income from Trusted U.S. Treasuries

HIGHLIGHTS

Last distribution of $0.13 per unit*Last distribution per unit. Distributions are subject to change. For a complete list of historical distributions, please see the Distributions tab below.; monthly distributions

Exposure to trusted U.S. treasuries

Unlike bonds, covered call premiums are generally taxed as capital gains

Active covered call strategy managed by an experienced options team led by Nick Piquard, with 25+ years of experience specializing in options

Watch Nick answer the most commonly asked questions on HBND.

A GOOD FIT FOR INVESTORS WHO WANT

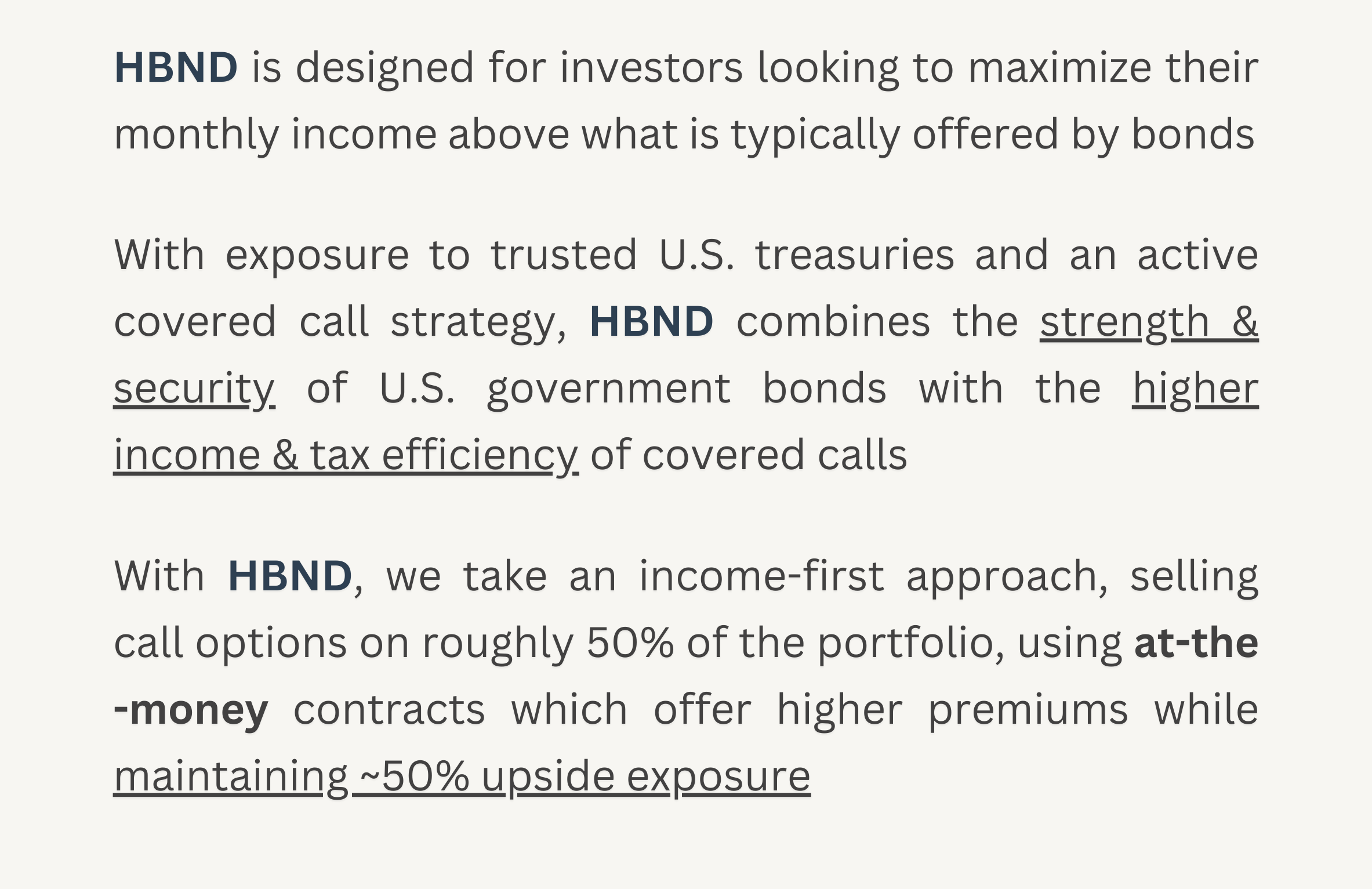

Higher monthly income combined with the strength and security of U.S. government bonds

Tax efficient distributions

CAD-Hedged exposure to long-term U.S. treasuries

Reduced volatility from options strategy

INVESTMENT OBJECTIVE

The investment objective of HBND is to deliver attractive monthly income, while providing exposure primarily to U.S. treasuries through a portfolio of bond exchange traded funds. To supplement distribution income earned on the exchange traded fund holdings, mitigate risk and reduce volatility, HBND will employ a covered call option writing program.

HBND does not use leverage.

Performance

- TICKER HBND

- NAV $14.60

- 1 DAY CHANGE -$0.09

-

LAST DISTRIBUTION *

Last distribution per unit. Distributions are subject to change. For a complete list of historical distributions, please see the Distributions tab below.

$0.13 - ASSETS $97.7M

Attractive Monthly Income

What Makes HBND Different?

- Overview

- Distributions

- Documents

█ Medium-Term 10.0%

█ Short-Term 4.1%

| ticker | name | weight |

| TLT | iShares 20+ Year Treasury Bond ETF | 50.5% |

| VGLT | Vanguard Long-Term Treasury ETF | 30.1% |

| VGIT | Vanguard Intermediate-Term Treasury ETF | 10.0% |

| EDV | Vanguard Extended Duration Treasury ETF | 6.3% |

| SCHO | Schwab Short-Term U.S. Treasury ETF | 4.1% |

| Ticker | HBND |

| Exchange | Toronto Stock Exchange (TSX) |

| CUSIP | 407917103 |

| Inception Date | September 14, 2023 |

| Investment Style | Fixed Income, Covered Call |

| Assets | $97.7M CAD* |

| Distributions | Monthly |

| Maturity | 22.3* |

| Duration | 15.1* |

| Currency Hedging | 100% hedged |

| Management Fee | 0.45% |

| Risk Rating | Low to Medium |

| Auditor | KPMG LLP |

| Legal Entity Identifier | 254900GVE3JWA7DQOB42 |

| Ex-Dividend Date | Paid | Frequency | Amount |

|---|---|---|---|

| 2024-04-29 | 2024-05-07 | Monthly | $0.1300 |

| 2024-03-27 | 2024-04-05 | Monthly | $0.1300 |

| 2024-02-28 | 2024-03-07 | Monthly | $0.1300 |

| 2024-01-30 | 2024-02-09 | Monthly | $0.1310 |

| 2023-12-28 | 2024-01-08 | Monthly | $0.1315 |

| 2023-11-29 | 2023-12-07 | Monthly | $0.1310 |

| 2023-10-30 | 2023-11-07 | Monthly | $0.1300 |

You can view public filings for the Hamilton U.S. Bond YIELD MAXIMIZER™ ETF on SEDAR+.

Press Releases

View the latest HBND Press Releases

Fact Sheet

HBND Fact Sheet (2024-03-28) English Français

ETF Facts

HBND ETF Facts (2023-09-08) English Français

Prospectus

HBND Prospectus (2023-09-08) English Français

Financial Statements

Annual Financial Statements (2023-12-31) English Français

Latest Portfolio Summary

Q3 2023 Portfolio Summary (2023-09-30) Download

Independent Review Committee

2023 Annual Report to Securityholders (2024-03-13) Download