As investors in Hamilton Enhanced Multi-Sector Covered Call ETF (HDIV) and Hamilton Enhanced U.S. Covered Call ETF (HYLD, HYLD.U) know, we aim to create higher income ETF versions of the S&P/TSX 60 and S&P 500, respectively by investing in various covered call strategies. Today’s insight discusses the recent changes to HDIV’s portfolio, and why we believe they will help better achieve HDIV’s investment objective of providing attractive monthly income and the opportunity for long-term capital appreciation.

Adding Hamilton Enhanced Canadian Financials ETF (HFIN), Selling CI U.S & Canada Lifeco Income ETF (FLI)

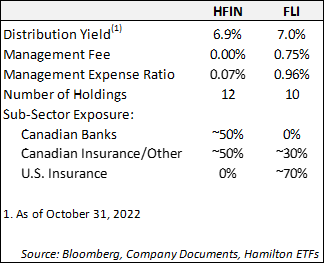

We have decided to add the Hamilton Enhanced Canadian Financials ETF (HFIN) and sell the CI U.S. & Canada Lifeco Income ETF (FLI). HFIN is ~50% Canadian banks, and 50% Canadian insurers/other, while FLI is 100% life insurance: ~70% in the U.S. and ~30% Canada. Therefore, in making this change, we will be removing U.S life insurers, in favour of Canadian banks and other Canadian financials, including P&C insurers, and Brookfield Asset Management.

As the table highlights, HFIN offers the following advantages over FLI, including: (i) comparable yield, (ii) 0.07% MER to HDIV unitholders versus FLI at 0.96%, and (iii) significantly greater alignment of sector mix to the S&P/TSX 60.

Early in the rate cycle, insurance generally, and FLI specifically performed very well relative to the banks. However, over the long-term, the Canadian banks have benefited from material outperformance versus the U.S. life insurers. And given the Canadian banks have fallen over 20%, and now trade at ~ 8.7x forward earnings, we believe this adjustment is timely.

Of note, although HFIN is not a covered call ETF, it offers an enhanced yield through modest 25% leverage, and for long-term investors, potential for higher returns.

For HDIV: Strong Underlying Distributions, Material Reduction in Fees, and Increased Canadian Bank Exposure

We believe going forward, these changes will strengthen the Hamilton Enhanced Multi-Sector Covered Call ETF (HDIV), by increasing its exposure to the Canadian banking sector, enhancing its growth potential to an eventual recovery in the Canadian financial sector, materially reducing its underlying weighted average management fee, and aligning its sector mix closer to the S&P/TSX 60. At the same time, these changes will not impact the distribution or the underlying volatility of HDIV.

The current yield of the Hamilton Enhanced Multi-Sector Covered Call ETF (HDIV) is 9.72%[1], paid monthly. Since HDIV was launched, it has outperformed the S&P/TSX 60 by over 4%[2]. While we are pleased with this (out)performance, and hope it continues, we are focused on providing attractive monthly income and growth potential from a portfolio with a sector mix broadly similar to the S&P/TSX 60.

For investors seeking U.S. exposure, we would recommend the Hamilton Enhanced U.S. Covered Call ETF (HYLD); its current yield of is 14.25%[3], paid monthly.

____

[1] As at October 31, 2022

[2] Since inception on July 19, 2021. As at October 31, 2022. Source: Bloomberg

[3] As at October 31, 2022

Commissions, trailing commissions, management fees and expenses all may be associated with an investment in the ETFs. The relevant prospectus contains important detailed information about each ETF. Please read the relevant prospectus before investing. The ETFs are not guaranteed, their values change frequently and past performance may not be repeated.

Certain statements contained in this insight constitute forward-looking information within the meaning of Canadian securities laws. Forward-looking information may relate to a future outlook and anticipated distributions, events or results and may include statements regarding future financial performance. In some cases, forward-looking information can be identified by terms such as “may”, “will”, “should”, “expect”, “anticipate”, “believe”, “intend” or other similar expressions concerning matters that are not historical facts. Actual results may vary from such forward-looking information. Hamilton ETFs undertakes no obligation to update publicly or otherwise revise any forward-looking statement whether as a result of new information, future events or other such factors which affect this information, except as required by law.