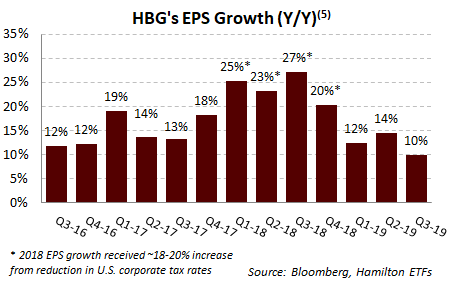

Hamilton Global Bank ETF (ticker: HBG) holdings reported portfolio-weighted EPS growth of 10% Y/Y[1], driven by strong U.S. banks fundamentals (~60% weight) and a diversified portfolio of global banks (~40% weight). This is the 13th consecutive quarter of double-digit portfolio-weighted EPS growth for HBG. The strong growth was led by U.S. mid-caps and bank holdings in India, Norway and select European countries.

Note to Reader: This Insight includes references to certain Hamilton ETFs that were active at the time of writing. On June 29, 2020, the following mergers took place: (i) Hamilton Global Financials Yield ETF and Hamilton Global Bank ETF into the Hamilton Global Financials ETF (HFG), (ii) Hamilton Australian Financials Yield ETF into the Hamilton Australian Bank Equal-Weight Index ETF (HBA); (iii) Hamilton Canadian Bank Variable-Weight ETF into the Hamilton Canadian Bank Mean Reversion Index ETF (HCA), and (iv) Hamilton U.S. Mid-Cap Financials ETF (USD) into the Hamilton U.S. Mid/Small-Cap Financials ETF (HUM).

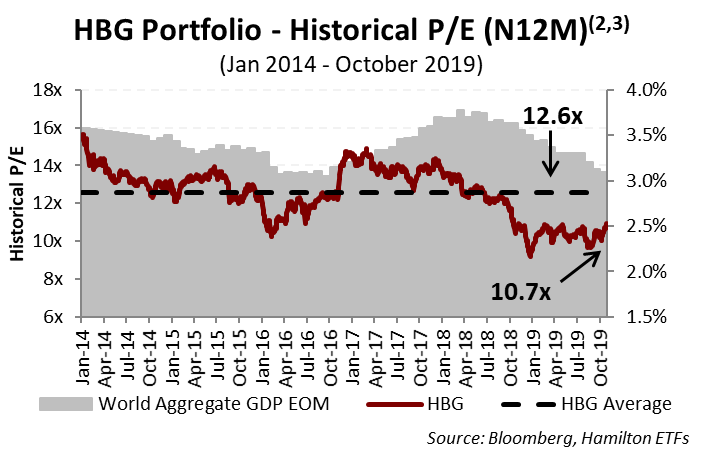

However, despite this strong and consistent EPS growth, concerns around slowing global growth from extended US-China trade negotiations and lower policy interest rates, weighed on share prices and valuations. As a result, the underlying holdings of HBG trade at a substantial discount to their 5-year averages (see below) offering the potential for multiple expansion as global growth fears recede. With global growth forecast to remain over 3.0% this year and next, the rationale for global diversification remains strong.

The robust EPS growth in the quarter has supported HBG’s strong absolute and relative returns since inception. Since its 2016 launch, HBG has generated an annualized return of 8%, despite absorbing three severe macro corrections (Brexit vote, yuan devaluation threat and last year’s recession fears related sell-off). HBG also continues to generate substantial outperformance and is ~19% ahead of the global banks[4].

Strong and Consistent EPS Growth Across Most Regions

The chart below highlights the strong and consistent earnings growth of HBG’s holdings in the ETF’s fourth year. The robust earnings trajectory underscores the portfolio’s excellent fundamental performance driven by stock selection and geographical allocation.

In Q3, HBG’s strong EPS growth was driven by holdings in the U.S., India and Norway. The U.S. portfolio generated EPS growth of 7%, a clear beat to street expectations. Continued allocation to higher growth U.S. states/MSAs as well to banks with operating and balance sheet levers in a low rate environment supported EPS growth in the quarter. We also continue to believe that consolidation in the U.S. mid-cap banking sector is likely to accelerate in the next two years and with over 20 U.S. mid-caps in HBG, we remain optimistic that this trend will be beneficial to unitholders.

Benefits of global diversification were evident across other major markets, most prominently India. Across nearly all major global economies, credit trends remain robust and credit environment is expected to remain benign. In India, credit normalization (and declining provisions) drove bank profits higher yet again. Reported earnings were impacted by DTA write-downs as a result of corporate tax cuts and reforms introduced in India last month[6]. In Europe, the low interest rate environment is supporting credit quality even as bank margins remain under pressure. The region’s economic outlook continued to be impacted by policy and political uncertainty. Bank managements maintained a cautious tone.

The global banking sector is trading at a large valuation discount to its five-year average, offering the potential for multiple expansion as underlying EPS growth remains robust. With the current holdings of HBG trading at ~10.7x P/E, a nearly ~15% discount to their five-year average, we believe the global banks represent strong risk/reward while providing diversification.

A word on trading liquidity for ETFs …

HBG is a highly liquid ETF that can be purchased and sold easily. ETFs are as liquid as their underlying holdings and the underlying holdings in HBG trade millions of shares each day.

How does that work? When ETF investors are buying (or selling) in the market, they may transact with another ETF investor or a market maker for the ETF. At all times, even if daily volume appears low, there is a market maker – typically a large bank-owned investment dealer – willing to fill the other side of the ETF order (at net asset value plus a spread). The market maker then subscribes to create or redeem units in the ETF from the ETF manager (e.g., Hamilton ETFs), who purchases or sells the underlying holdings for the ETF.

Notes

[1] This figure is with ~80% of HBG having reported as on November 4; assumes remaining holdings report EPS equal to consensus. As of the time of writing this note banks in Canada, Japan, Singapore and Portugal had not reported the corresponding calendar quarter. Australian banks report semi-annually.

[2] Portfolio weights as of October 31, 2019

[3] GDP data is a blended forward 12 month forecast of annual estimates. Data prior to September 30, 2014 uses actual GDP growth (versus market forecast).

[4] The KBW Nasdaq Global Bank Net Total Return Index, GBKXN, in Canadian dollars through October 31, 2019.

[5] Portfolio weights as at October 31, 2019

[6] On September 20,2019 India cut base corporate tax rates to 22% from ~35% earlier.