Supported by improving global growth and a more positive monetary policy backdrop, sentiment for the global financials has improved over the last year. In our view, the sector is “under-earning” in a low rate environment, largely in the form of lower margins. With monetary policy slowly beginning to normalize, the potential for margin expansion to support higher EPS growth, and therefore stock prices is becoming increasing likely.

Earlier this year, we launched the Hamilton Capital Global Financials Yield ETF (HFY), which focuses on investing in the equity securities of blue-chip global financials with higher yields. At present, HFY has a yield of 4.64%, which is comparable to both REIT and covered call financials ETFs listed in Canada. It is the aspiration of HFY to provide investors with a yield comparable to these products, while eliminating two key risks: (i) rising rates (for REIT ETFs) or (ii) losses on options in rising markets (covered call ETFs, a product category that works best in periods of stable to declining stock prices).

And this year, these risks have been evident:

(1) The largest REIT ETFs in Canada have underperformed the financials, often materially.

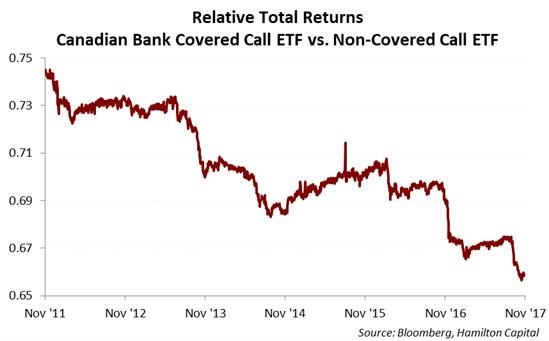

(2) The most recent rally demonstrated the “opportunity cost” of covered call financials ETFs in a period of rising stock prices. Year to date, a covered call equal-weight Canadian Bank ETF has materially underperformed a comparable equal-weight Canadian bank ETF. Despite the covered call ETF having a ~100 bps higher yield than that of the straight ETF, to gain this incremental yield (paid monthly), investors have sacrificed total return of over 200 bps this year, and considerably more over the life of the fund, as the chart below illustrates.

For information about Hamilton Capital Global Financials Yield ETF (HFY), please go to https://hamiltonetfs.com/etf/hfy/. The ETF offers global diversification in a blue-chip portfolio of higher yielding equity securities.

Note: Comments, charts and opinions offered in this commentary are produced by Hamilton Capital and are for information purposes only. They should not be considered as advice to purchase or to sell mentioned securities. Any information offered is believed to be accurate, but is not guaranteed.