Per our comment published today, “HFY and HBG Manager Comment: Reducing Australian Bank Exposure on Rising Regulatory Risk”, we have recently reduced HFY’s Australian exposure following the government’s launch of a Royal Commission into the Australian financial services sector. This change was part of a wider review of the portfolio which also saw HFY’s REIT exposure reduced by over half to ~7%. At the same time, we: (i) increased U.S. banks (up 600 bps to 12% weighting), (ii) raised non-bank European financials (by almost 800 bps to ~25% weighting), and (iii) added a small (5%) exposure to Indian banks.

The reasons for the rebalance?

- the aforementioned Australian Royal Commission into the financial services sector is expected to cause headline risk and unknown regulatory implications in the short-medium term,

- improving economic data implies a higher probability that the long end of the interest rate curve will increase, which could benefit insurers and banks (rising short rates are also likely to benefit banks), but weigh on REITs (more on this below),

- improving fiscal/monetary policy backdrop for both European and U.S. financials implies higher EPS growth, and

- the recent pullback in European financials since recent highs in October (banks down over 4% , financials index down 3%) allowed for a more favourable entry point.

The net impact of this rebalancing was an increase in the portfolio’s underlying EPS/FFO growth profile. Specifically, cumulative portfolio-weighted consensus EPS/FFO growth for the next two years (i.e., 2018 and 2019) rose to ~24% from ~12%. The near doubling in forecast EPS/FFO growth did result in slight reduction of the net yield for the ETF’s underlying holdings (i.e., gross yield, less expenses and withholding taxes), although it remains attractive. The yield of HFY is currently 4.70%.

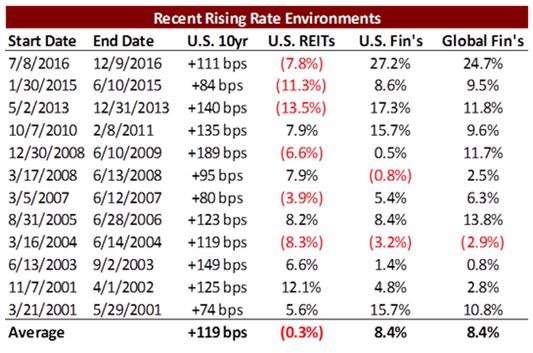

On REITs and interest rates: in our January 16, 2017 HFY Manager Comment entitled, “Are REITs Set to Underperform the Financials?”, we noted that REITs substantially underperformed the financials in the last 12 periods of rising rates since 2001 (i.e., the last 15 years). While it is difficult to predict rates – and we try not to – in our view, the risk/reward is increasingly shifting away from REITs. Should macro risk factors emerge, we will revisit our REIT weighting.

Note: Comments, charts and opinions offered in this commentary are produced by Hamilton Capital and are for information purposes only. They should not be considered as advice to purchase or to sell mentioned securities. Any information offered is believed to be accurate, but is not guaranteed.