Higher Monthly Income from Blue-Chip Canadian Utilities Companies

Building off the success of the Hamilton Enhanced Canadian Bank ETF (HCAL) – the top performing Canadian bank ETF since its inception[1] – we are pleased to announce the launch of the Hamilton Enhanced Utilities ETF, which will begin trading on the TSX under the ticker, “HUTS” on Tuesday, September 6, 2022. HUTS provides exposure to a portfolio of blue-chip, high dividend-paying Canadian utilities, pipelines, and telecommunications companies with modest leverage of 25% to enhance the long-term growth potential and provide higher monthly income. HUTS has an initial target yield of 5.00%, with monthly distributions. With HUTS, investors can gain enhanced exposure to three major segments of the utility services sector that have historically been viewed as defensive industries, providing a stable source of Canadian dividends even during periods of volatility and bear markets.

Why HUTS?

- Higher long term growth potential and higher yield from modest 25% leverage (obtained at institutional borrowing rates)

- Target Yield: 5.00%, with monthly distributions

- Goes beyond traditional utilities exposure by including pipelines and telecoms

- Favourable tax treatment of Canadian sourced dividends

- Defensive Positioning: Historically, the utility services sector has been considered as defensive with consistent and stable dividends throughout market cycles

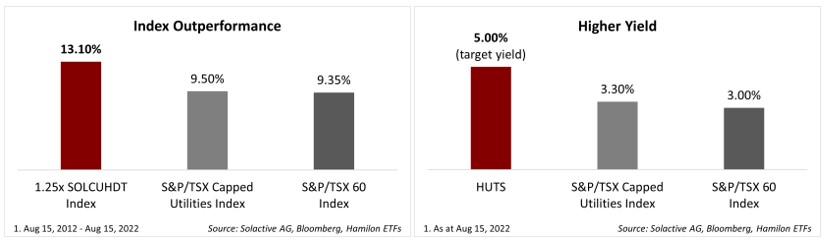

- Index Outperformance: HUTS’ underlying index x1.25 has outperformed the S&P/TSX Capped Utilities Index (TTUTAR) by 360 bps in the last 10 years, with a higher yield (see charts below)

- Higher growth potential vs. utility covered call strategies while maintaining an attractive dividend yield (see chart below)

Index Outperformance & Higher Yield

To meet its investment objective, HUTS will invest 1.25x its net asset value in the Horizons Canadian Utility Services High Dividend Index ETF (ticker: UTIL), which will not charge any management fees to HUTS. UTIL seeks to replicate, net of expenses, the performance of the Solactive Canadian Utility Services High Dividend Index (SOLCUHDT). Historically, 1.25x the underlying index has outperformed the S&P/TSX Capped Utilities Index and the S&P/TSX 60, with a higher yield (see charts below).

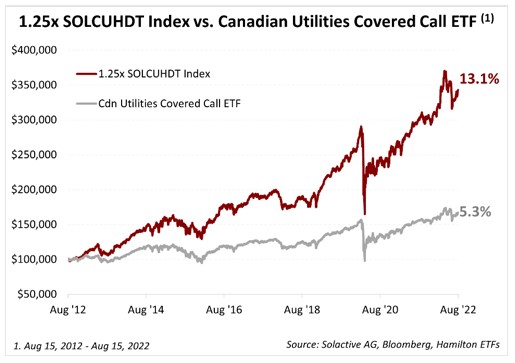

HUTS vs. Covered Call Utilities ETFs

HUTS offers one very important benefit versus covered call utilities strategies: an attractive dividend yield (target yield of 5.00%) without an options strategy capping the upside thus providing higher long term growth potential. The chart below shows the material outperformance of 1.25x the Solactive Canadian Utility Services High Dividend Index (SOLCUHDT) versus a large Canadian Utilities Covered Call ETF[2], since the latter’s launch.

Defensive Sector with Historically Higher Yields

Utility, pipeline, and telecommunications companies have historically paid out much higher amounts of their free cash flows as dividend income to investors, as very little of these companies’ expenditures are focused on research and development or marketing. Instead, their costs are primarily related to the upkeep and expansion of critical infrastructure in areas such as electricity, heating, energy transportation, and basic telecommunication services.

Traditionally, these three sectors have been regarded as defensive, as demand for these services tends to remain relatively constant even in periods of higher market volatility. Unlike other sectors such as Information Technology and Consumer Goods that can have boom and bust cycles, customers need to use the critical infrastructure provided by utility service companies. This inelasticity of revenues can provide some downside protection during negative equity markets relative to other sectors more dependent on discretionary spending.

We believe that HUTS, through its use of modest leverage, is uniquely positioned to provide investors with the potential for higher long-term returns and an attractive dividend yield from a relatively defensive and lower volatility sector with stable and consistent dividends. Investors interested in gaining diversified exposure to the utilities sector, but without modest leverage, should consider the Horizons Canadian Utility Services High Dividend Index ETF, which trades on the TSX under the ticker UTIL.

____

A word on trading liquidity for ETFs …

Hamilton ETFs are highly liquid ETFs that can be purchased and sold easily. ETFs are as liquid as their underlying holdings and the underlying holdings trade millions of shares each day.

How does that work? When ETF investors are buying (or selling) in the market, they may transact with another ETF investor or a market maker for the ETF. At all times, even if daily volume appears low, there is a market maker – typically a large bank-owned investment dealer – willing to fill the other side of the ETF order (at the bid/ask spread). It is recommended that investors use limit orders.

[1] Since inception, as at August 31, 2022. Based on a universe of seven Canadian bank ETFs that trade on the Toronto Stock Exchange.

[2] Annualized returns of 1.25x Solactive Canadian Utility Services High Dividend Index (SOLCUHDT) vs. BMO Covered Call Utilities ETF (ZWU) which includes a 65bps management fee plus taxes and other expenses. From August 15, 2012, to August 15, 2022.