Before we talk about HDIV/HYLD, we wanted to highlight the launch of the Hamilton Canadian Financials Yield Maximizer ETF, or HMAX. This covered call ETF is ~75% Canadian banks and has an initial target yield of 13%+, paid monthly. This materially higher yield will be supported by an options coverage ratio of ~50% (higher than most covered call ETFs) and writing options at-the-money (versus out-of-the money). Therefore, under current parameters, investors would still realize roughly half of the upside from potential capital appreciation from the sector. HMAX is designed for investors who are seeking higher monthly income from a portfolio of primarily Canadian banks. For additional information, go to www.hamiltonetfs.com/etf/HMAX.

Back to HDIV/HYLD.

In July 2021, we launched the Hamilton Enhanced Multi-Sector Covered Call ETF (HDIV). The objective of the fund is to provide attractive monthly income and long-term capital appreciation from a diversified, multi-sector portfolio of primarily covered call ETFs focused on Canada — a higher income version of the S&P/TSX 60 with an overall sector mix that is “broadly similar”. HDIV also has a modest 25% cash leverage overlay to enhance monthly income, and to offset some of the yield/return trade-off inherent in covered call ETFs.

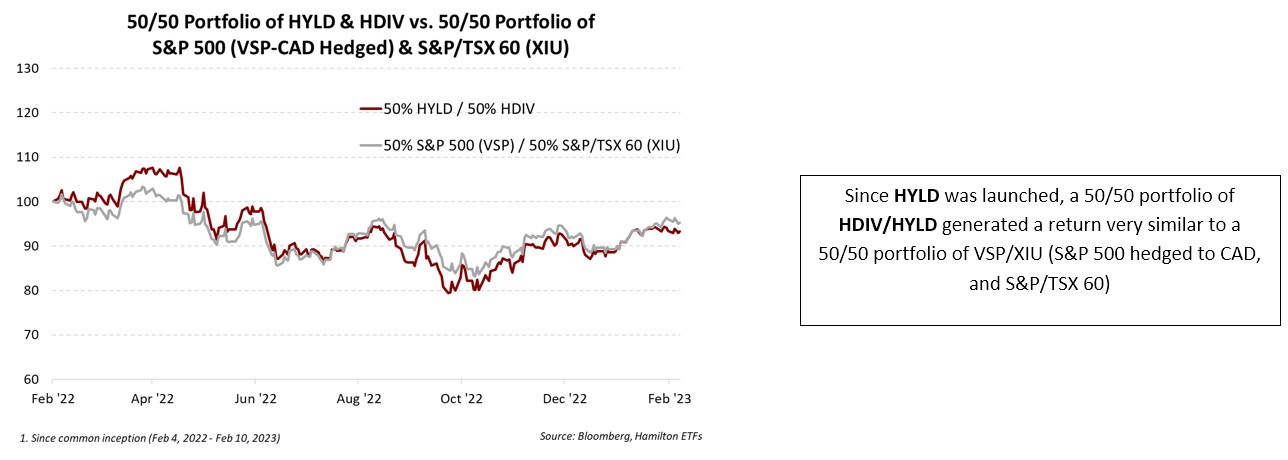

Following in the success of HDIV, we launched the Hamilton Enhanced U.S. Covered Call ETF (HYLD) early last year, which has a similar structure to HDIV but is focused on the U.S. equity markets. Like HDIV, we sought an overall sector mix “broadly similar” to the largest benchmark index – the S&P 500. Given that the sector mixes of the Canadian and U.S. equity markets are highly complementary, we believe HDIV and HYLD can represent core holdings for investors seeking exposure to both markets while generating higher monthly income. The chart below supports this view, showing that a 50/50 portfolio of HDIV and HYLD produced a very similar return to a 50/50 portfolio of VSP/XIU (i.e., the Vanguard S&P 500 Index ETF (CAD-hedged) and iShares S&P/TSX 60 ETF).

We believe this provides significant support for our view that these two ETFs can serve as complementary core holdings for investors seeking higher monthly income from Canadian and U.S. equity markets. Although the sector mixes for each ETF are “broadly similar” – but not exact – to these large benchmark indices, we aim for similar returns and relatively high correlations going forward in modest markets. That said, it is important to note that should the markets rally strongly, it is possible this portfolio could lag these two benchmark indices as the covered call strategies weigh on returns more than the modest leverage adds to returns.

A few other highlights from the last 12 months (since HYLD was launched):

A 50/50 Portfolio of HDIV/HYLD Held Up Well in a Tough Year[1]

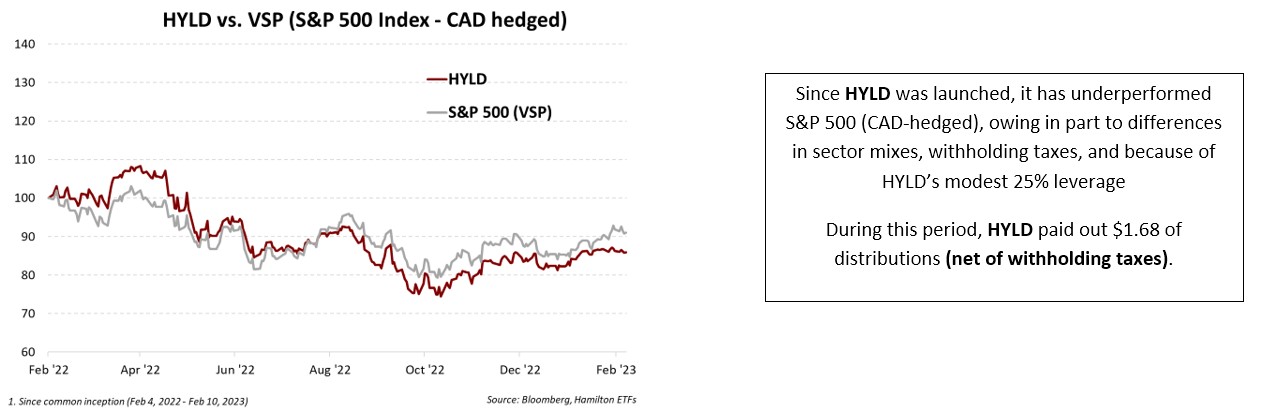

In the last 12 months ending in January 2022, HDIV and HYLD distributed $1.51 and $1.68 per share to its unitholders, respectively. Unfortunately, within 6 weeks of the launch of HYLD, the global markets started selling off and the Canadian dollar experienced a very steep decline falling 10% peak-to-trough, before partially rebounding. In its first year, HYLD declined ~14%, while HDIV rose ~1% over the same period (total returns net of fees and withholding taxes). This caused a 50/50 portfolio of HDIV/HYLD to decline by 6.6% in Canadian dollars during the last 12 months[2].

Over this period, HDIV outperformed the S&P/TSX 60, while HYLD underperformed the S&P 500 (hedged to CAD). Of note, because of its significantly higher yield, HYLD’s relative performance to VSP is more negatively impacted by withholding taxes, which are recoverable for taxable investors. HYLD’s modest leverage was also a contributing variable to its underperformance in a down market.

Reduction in “All-In” Management Fees to ~1.25% (Comparable to “All-in-One” ETFs with “Zero” Management Fees) in Late 2022

In May 2022, unitholders approved changes to HYLD and HDIV to allow us to adjust the portfolios to (i) support distributions (should a constituent reduce its payout), (ii) more closely align the sector mix of the S&P 500 and S&P/TSX 60, and (iii) add flexibility to invest in newer ETFs with lower fees. Also importantly, by moving away from a fixed index-based portfolio, we negotiated “bulk” fee reductions as the two funds became larger.

Following unitholder approval, we have been able to make changes to both HDIV and HYLD to accomplish these objectives. Very importantly, these changes have enabled us to reduce the combined management fees being paid by unitholders. Heading into 2023, we now estimate “all in” management fees of ~1.25% – comparable to other “all-in-one” ETFs which have a headline management fee of “zero” (but include admin fees and the fees of underlying funds). Important to note: these reductions will NOT be fully reflected in the 2022 disclosure as many of the changes took place in the latter half of 2022.

Sustainability of Distributions: Nothing is Guaranteed, but Diversification is a Friend

Given the very high yields of HDIV (9.9%) and HYLD (13.9%)[3], we are often asked about the sustainability of distributions. In general, our distributions are very close – but not exact – to the average portfolio weighted yield of the constituent ETFs multiplied by 1.25x. At present, the indicative yields of HYLD and HDIV are both similar to this “rule of thumb” measurement.

That said, obviously, nothing is guaranteed. If one or more of the constituent ETFs reduced its distribution, downward pressure would be placed on the distributions of HDIV and/or HYLD (just as substituting higher yielding ETFs and or distribution increases from the constituents places upward pressure). When considering the sustainability of distributions, we believe the following factors are important to consider: (i) the underlying ETFs in HDIV/HYLD are highly diversified and invest in hundreds of stocks, supported by multiple options strategies offered by 5-7 providers, (ii) if a constituent ETF reduces its distribution, the impact is limited to its weighting in the fund (current maximum ~17%), and (iii) we have the flexibility to switch to another fund should this occur.

Cost of Financing Increased: Still Large Offset to Long-Term Options Drag (in Rising Markets)

As everyone investing in covered calls is aware, investors trade-off potential share price appreciation in exchange for premium income which supports a higher current yield/distribution. The objective of the modest 25% leverage is to mitigate this yield-return trade-off inherent in the underlying covered call strategies. Over time, if the markets are rising, this modest leverage can support both a higher payout and higher returns. However, as HYLD’s first year demonstrated, it can also impact drawdowns in falling markets.

With respect to sensitivity to changes in interest rates, in general, every 1.0% increase in the Bank of Canada rate reduces the annualized return of HDIV/HYLD by ~25 bps. While rising interest rates were an obvious headwind last year, we would note the modest leverage: (i) still has a material impact on the indicative yield, and (ii) provides long-term compounding return benefits. Furthermore, the Bank of Canada appears to be taking a pause. Going forward, if investors have a long-term time horizon and believe market returns will be positive, the impact of this modest leverage should be to increase total returns, and the indicative yield, albeit with a commensurate increase in volatility.

Aiming for Similar Returns/Correlations to the Canadian/U.S. Benchmark Indices

In the first year since HYLD was launched on February 4, 2022, we were pleased that the returns of a 50/50 portfolio of HDIV/HYLD produced a similar return to a 50/50 portfolio of VSP/XIU – while at the same time offering significantly higher distributions. We reiterate our view that the sector mixes of the Canadian and U.S. equity markets are highly complementary, and therefore, owning HDIV and HYLD together can be a core position for investors seeking higher income versions of the Canadian and U.S. equity indices.

The Hamilton Enhanced Multi-Sector Covered Call ETF (HDIV) is designed for investors seeking a higher yielding ETF focused on the Canadian equity markets. Since its launch, HDIV has outperformed the S&P/TSX 60 index by ~7.0% (and since inception annualized outperformance of ~4.3%)[4]. The current yield of HDIV is 9.9%[5], paid monthly.

The Hamilton Enhanced U.S. Covered Call ETF (HYLD) is designed for investors seeking a higher yielding ETF focused on the U.S. equity markets.

Investors wanting to ensure their monthly distributions are not impacted by fluctuations in the Canadian dollar are likely to prefer HYLD, whereas those preferring direct U.S. exposure including currency are likely to favour HYLD.U. The current yield of the Hamilton Enhanced U.S. Covered Call ETF (HYLD) is 13.9%[6], paid monthly.

____

A word on trading liquidity for ETFs …

Hamilton ETFs are highly liquid ETFs that can be purchased and sold easily. ETFs are as liquid as their underlying holdings and the underlying holdings trade millions of shares each day.

How does that work? When ETF investors are buying (or selling) in the market, they may transact with another ETF investor or a market maker for the ETF. At all times, even if daily volume appears low, there is a market maker – typically a large bank-owned investment dealer – willing to fill the other side of the ETF order (at the bid/ask spread).

Commissions, management fees and expenses all may be associated with an investment in the ETFs. The relevant prospectus contains important detailed information about each ETF. Please read the relevant prospectus before investing. The ETFs are not guaranteed, their values change frequently and past performance may not be repeated.

Certain statements contained in this insight constitute forward-looking information within the meaning of Canadian securities laws. Forward-looking information may relate to a future outlook and anticipated distributions, events or results and may include statements regarding future financial performance. In some cases, forward-looking information can be identified by terms such as “may”, “will”, “should”, “expect”, “anticipate”, “believe”, “intend” or other similar expressions concerning matters that are not historical facts. Actual results may vary from such forward-looking information. Hamilton ETFs undertakes no obligation to update publicly or otherwise revise any forward-looking statement whether as a result of new information, future events or other such factors which affect this information, except as required by law.

[1] Ending February 10, 2023

[2] Ending February 10, 2023. Source: Hamilton ETFs, Bloomberg.

[3] As of February 10, 2023. Source: Hamilton ETFs, Bloomberg

[4] Since HDIV was launched on July 19, 2021, vs. XIU as of February 10, 2023. Source: Hamilton ETFs, Bloomberg

[5] As of February 10, 2023. Source: Hamilton ETFs, Bloomberg

[6] As of February 10, 2023. Source: Hamilton ETFs, Bloomberg