Today, the ECB announced greater than expected easing measures, which the market interpreted as constructive for the eurozone economy and its banking sector (note, eurozone represents ~60% of total Europe GDP). Key components of the announcement include:

- Deposit rate cut of 10 bps to -0.4% (the rate banks use to make overnight deposits with the Eurosystem)

- Increased quantitative easing (QE) to €80 bln per month, from €60 bln (i.e., asset purchases designed to reduce yields and financing costs throughout the economy)

- Expansion of QE to include investment grade euro-denominated corporate bond purchases (previously just public-sector debt, asset-backed securities and covered bonds)

- New series of targeted-longer term refinancing operations (TLTRO II) with a four year maturity (i.e., a facility that allows banks to borrow from the central bank on favourable terms, on the condition they use the funds to make loans)

In the post-announcement press conference, Draghi made it clear that the current view of the ECB is that it does not anticipate more rate cuts and sees current levels for an extended period of time. The measures announced are expected to be positive for the banking sector overall. The expansion of TLTRO is seen to be constructive to lending/margins, while concerns over a deeper cut into negative rates did not materialize.

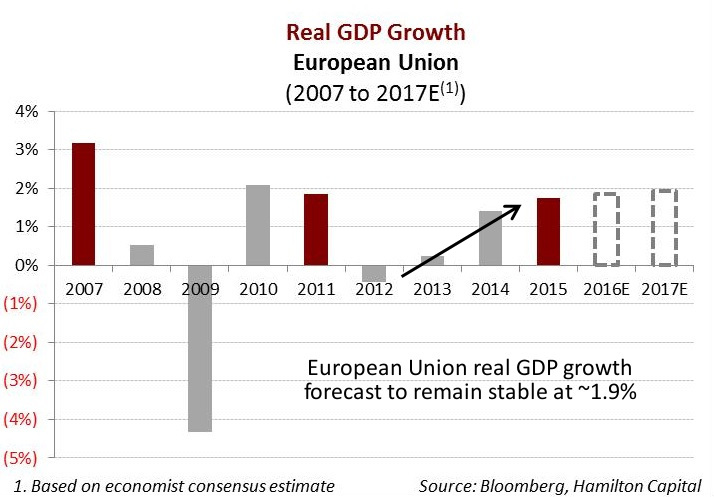

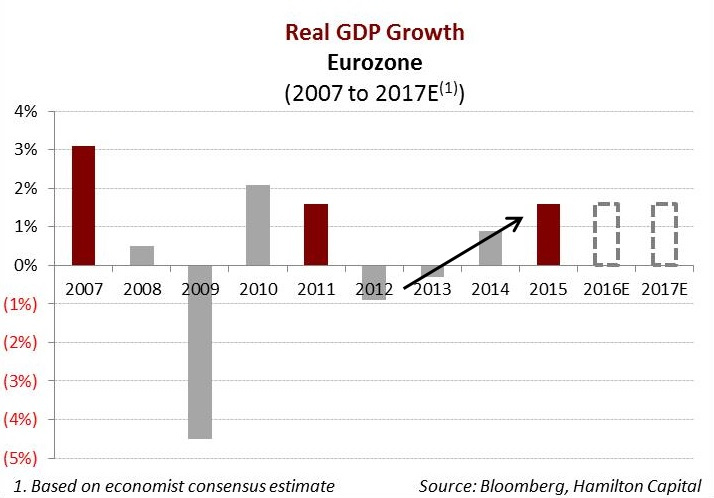

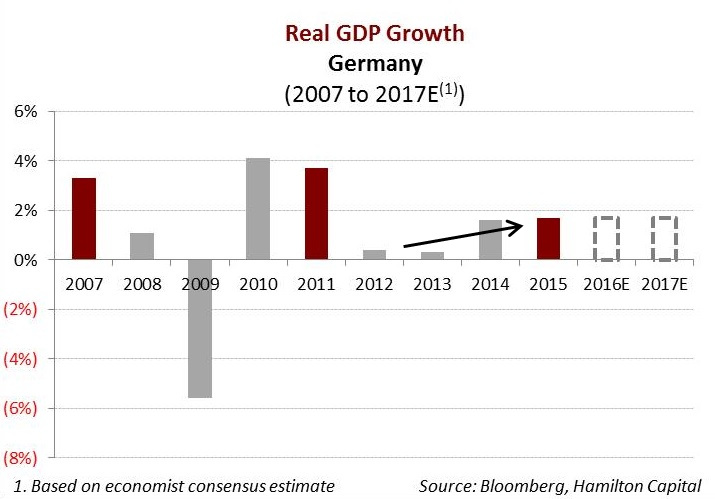

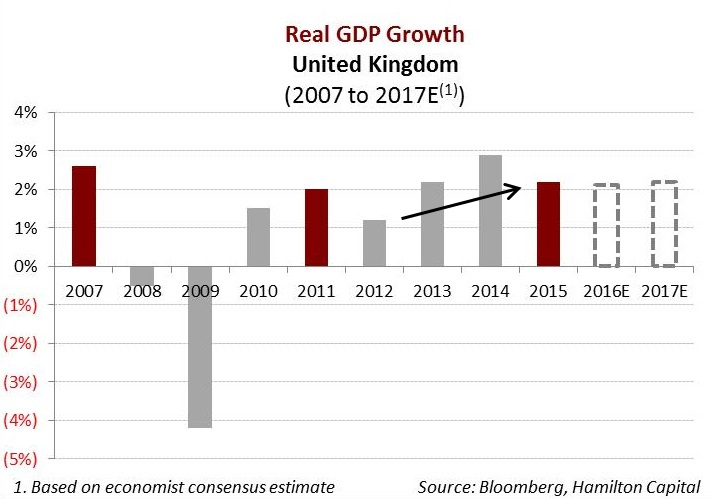

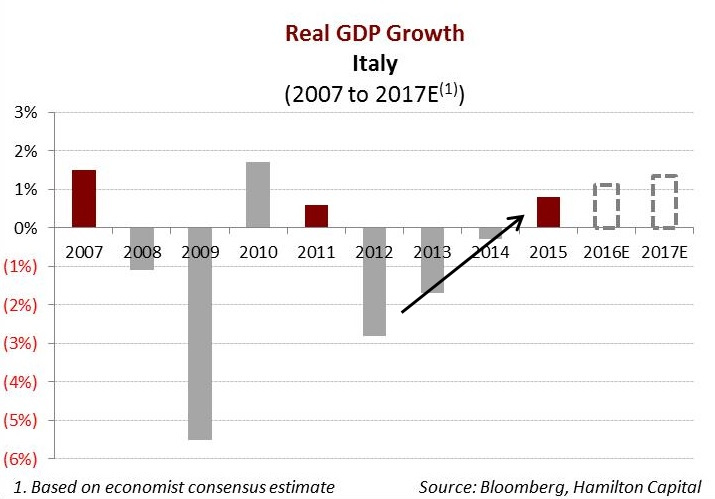

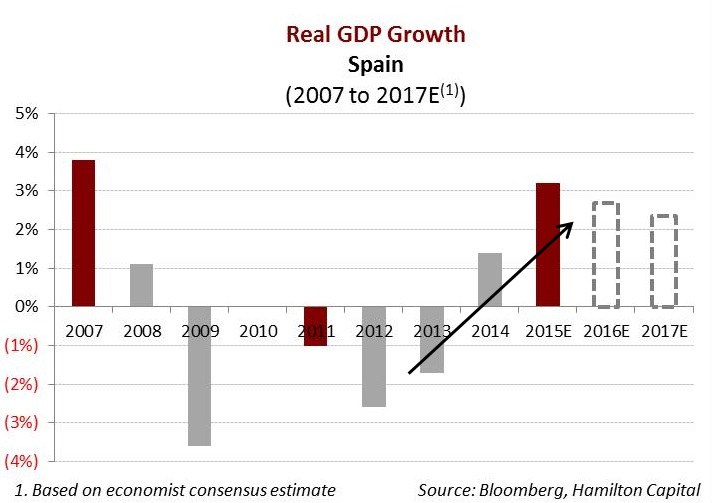

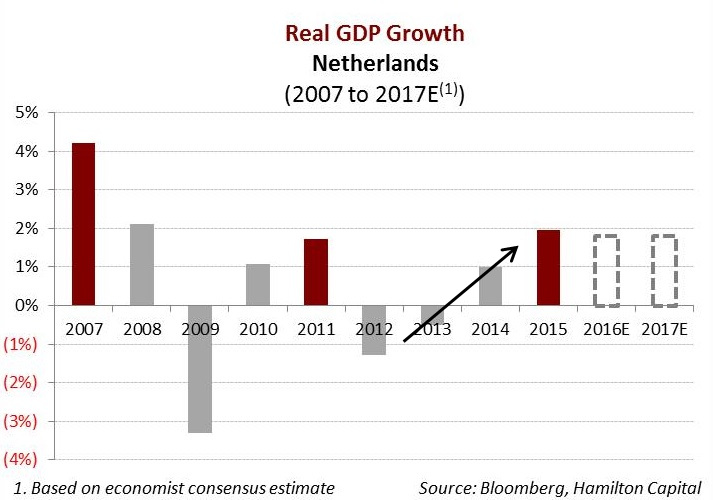

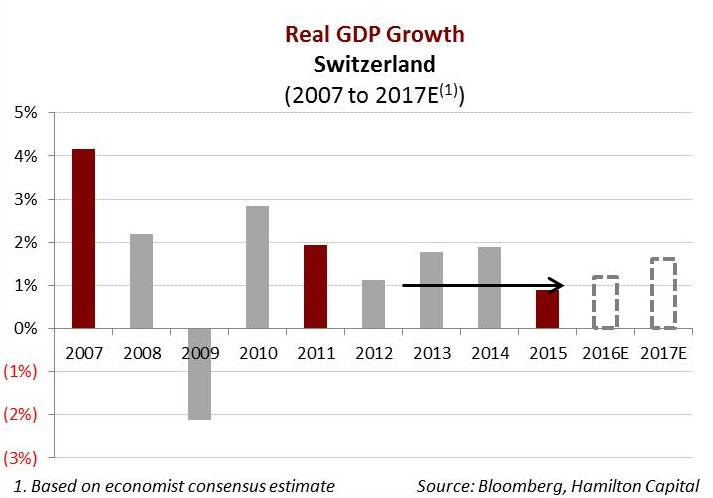

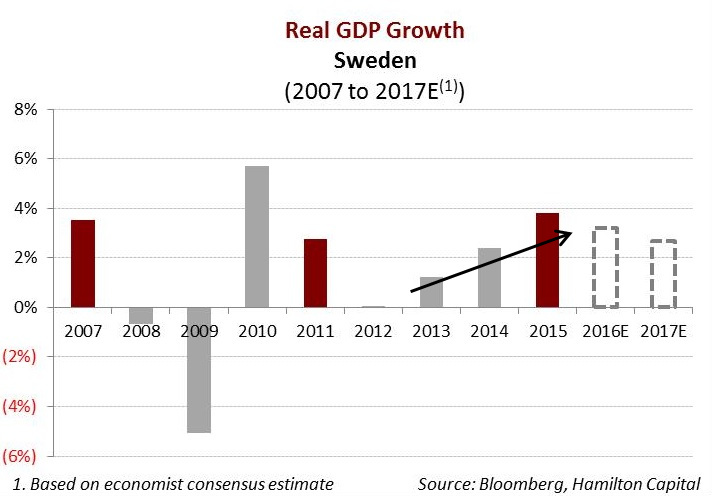

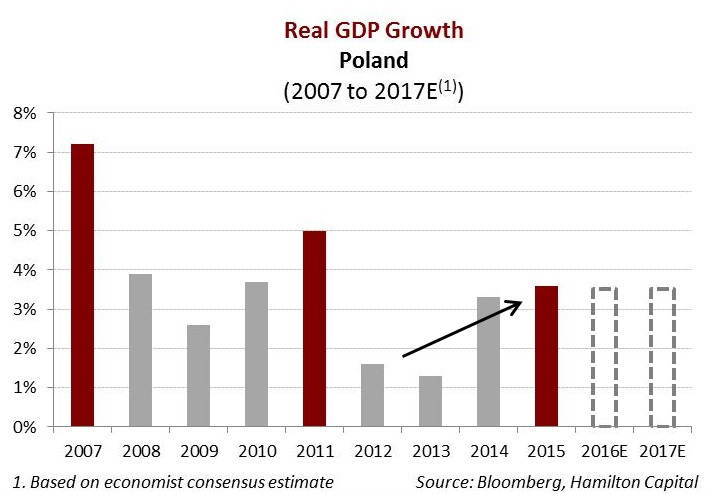

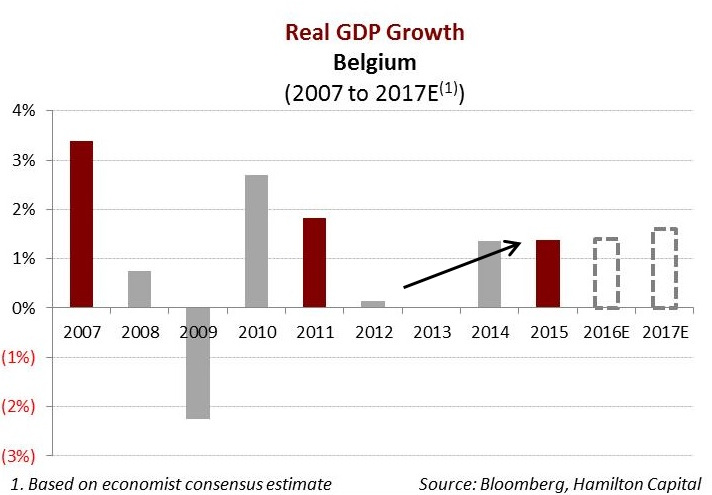

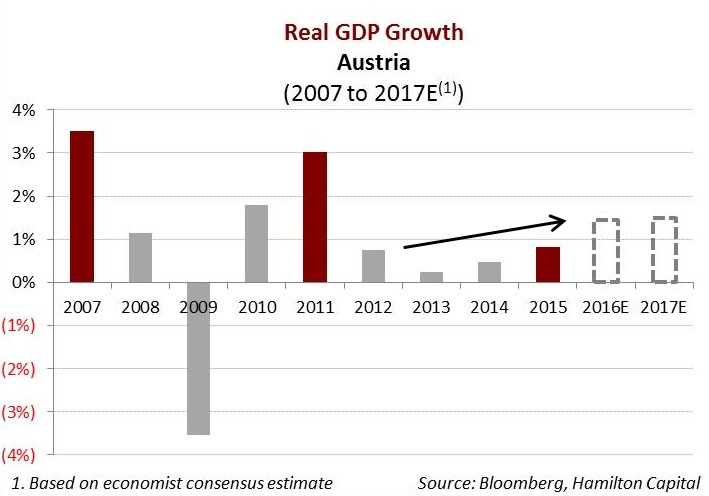

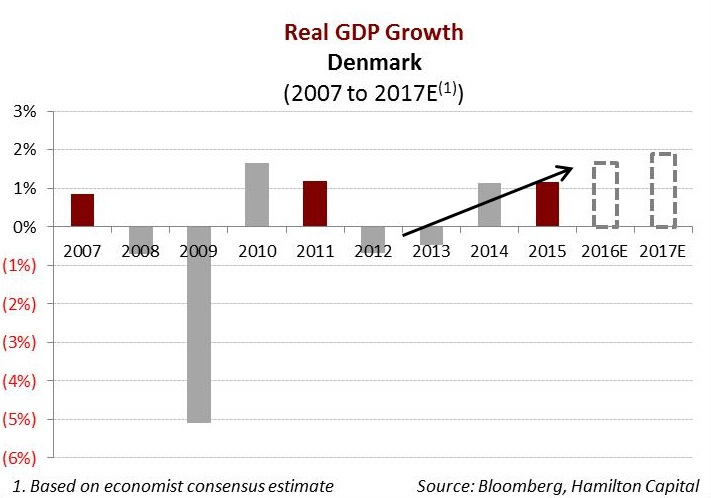

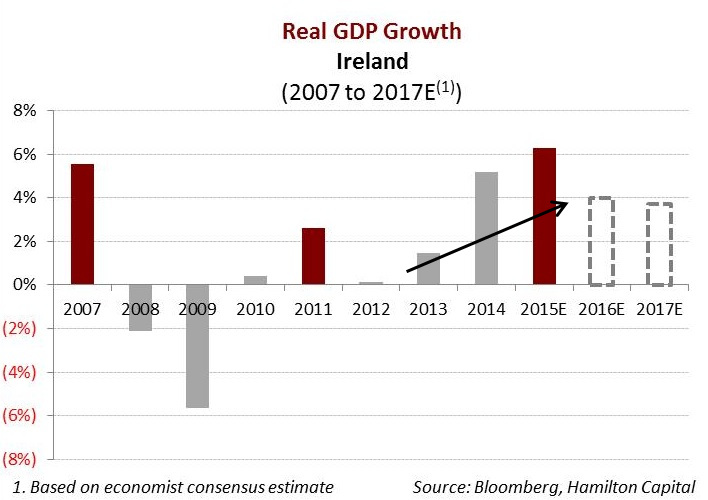

In light of a macro correction taking global banks down 15-20% from their December highs and the ECB’s cautionary comments on the back of global growth concerns, we believe it worth noting that Europe’s GDP growth levels have significantly improved since the trough in 2012 and remain solidly positive. Notwithstanding the negative sentiment, GDP growth for the European Union[1] is forecast to be at a respectable ~1.9% per annum, outpacing the eurozone’s ~1.6%, supported by non-eurozone economies such as the U.K., Sweden, and Poland.

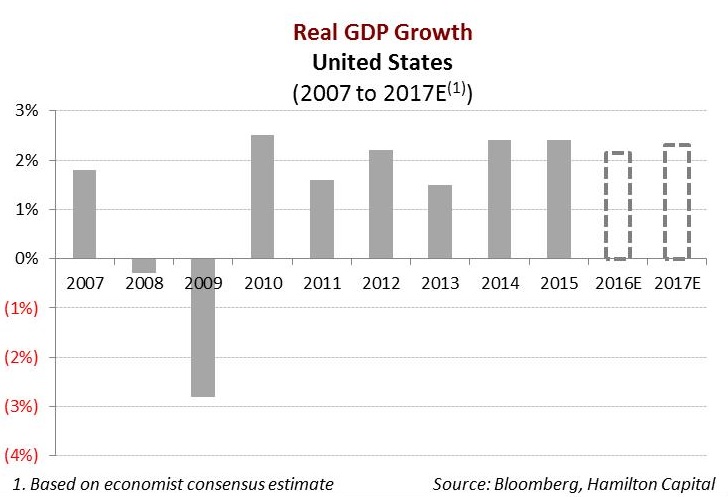

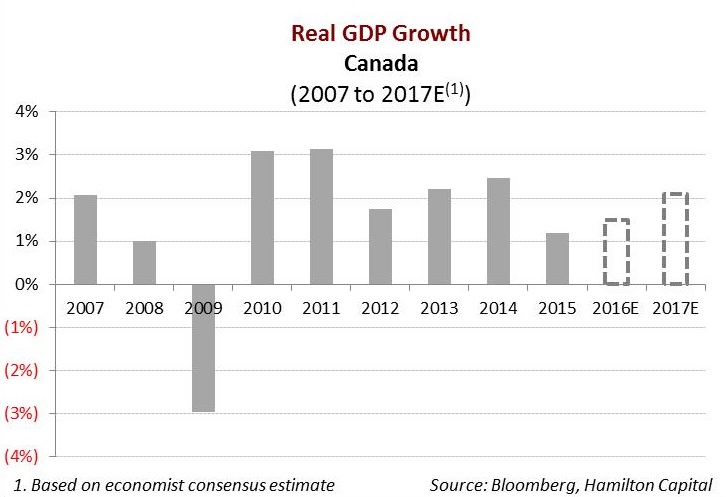

Below we show the GDP growth and outlook for various European economies, ordered by size. The sharpest recoveries can be seen in the GIIPS[2] countries (primarily Spain and Italy). Countries that were less affected by the crisis remain relatively stable (e.g., U.K., Norway). The diversity that exists among these economies is often overlooked when they are frequently lumped together as “Europe”. Scroll down for a view of the improvements in the GDP across Europe.

We have included Canada and the U.S. as well (second from the top) for reference. It is worth noting that Canadian 2015 GDP growth was lower than that of 22 of the 28 EU economies.

[column large=”6″ small=”12″ first_last=”first”]

[/column]

[column large=”6″ small=”12″ first_last=”last”]

[/column]

[column large=”6″ small=”12″ first_last=”first”]

[/column]

[column large=”6″ small=”12″ first_last=”last”]

[/column]

[column large=”6″ small=”12″ first_last=”first”]

[/column]

[column large=”6″ small=”12″ first_last=”last”]

[/column]

[column large=”6″ small=”12″ first_last=”first”]

[/column]

[column large=”6″ small=”12″ first_last=”last”]

[/column]

[column large=”6″ small=”12″ first_last=”first”]

[/column]

[column large=”6″ small=”12″ first_last=”last”]

[/column]

[column large=”6″ small=”12″ first_last=”first”]

[/column]

[column large=”6″ small=”12″ first_last=”last”]

[/column]

[column large=”6″ small=”12″ first_last=”first”]

[/column]

[column large=”6″ small=”12″ first_last=”last”]

[/column]

[column large=”6″ small=”12″ first_last=”first”]

[/column]

[column large=”6″ small=”12″ first_last=”last”]

[/column]

[column large=”6″ small=”12″ first_last=”first”]

[/column]

[column large=”6″ small=”12″ first_last=”last”]

[/column]

Notes

[1] The European Union (EU) includes 28 members, several of which are outside of the eurozone including the U.K., Sweden, Poland, Denmark, and numerous Eastern European/Balkan countries. Of significance, Switzerland and Norway are not in the EU or eurozone.

[2] GIIPS is an abbreviation that refers to the eurozone countries Greece, Ireland, Italy, Portugal, and Spain.