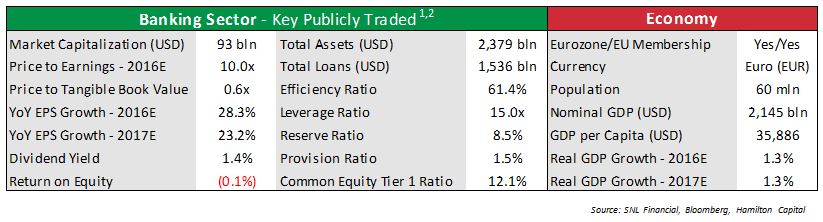

In this note, we provide a review of the Italian banking system, including an overview and a discussion of the most important issues facing the sector. Italian banks represent a deeply discounted, fragmented system undergoing a cyclical recovery while at the same time, undergoing regulatory reform, and potential M&A.

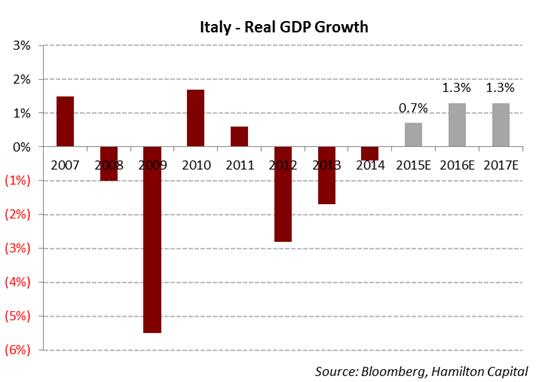

- 4th Largest European Economy, 8th Largest Globally: Italy has a developed and diversified economy, characterized by a distinct divide between its industrial north and less developed south. It is part of the eurozone and is a G8 member. Italy is a relatively wealthy country with a GDP/capita of ~US$35,000. Since taking office in early 2014, Matteo Renzi has pursued fiscal reform, helping Italy report its first year of positive GDP growth since the European debt crisis (see chart). Real GDP growth is forecast to be 1.3% in both 2016 and 2017, aided by fiscal reform, as well as lower oil prices (of which Italy is a net importer).

- Large Bifurcated Banking Sector: Italy’s banking sector has total assets of ~US$3.2 trillion, almost identical in size to Canada. Of that, over half of the assets are held at 18 publicly traded banks, the two largest being UniCredit, UCG and Intesa Sanpaolo, ISP (which together account for ~65% of the assets held by the publicly traded banks). It also has a large segment of popolari/cooperative credit banks, five of which are public and account for just under 15% of public bank assets[3]. Until recently, popolari banks were essentially controlled by community-focused/politically-minded foundations. As a result, their focus was often more oriented toward serving their communities than prudent lending and hence, they have, on balance, weaker credit quality.

- Popolari Bank Reform Expected to Result in M&A: In 2015, the government introduced reforms aimed at improving governance and removing the barriers to consolidation (through the removal of the one vote per shareholder rule) of the popolari banks, including requiring those with assets over €8 billion to either convert to joint-stock companies, wind-up or reduce their assets below the threshold by December 2016. All public popolari banks exceed this level, but to date only UBI Banca (UBI) has converted. Late last year, we met with executives of several Italian banks who spoke freely about their expectations for bank mergers in the short-term (see European Trip to London, Frankfurt and Madrid: Notes from the Field). Moreover, there have been repeated rumours in the media on possible combinations, including as recently as this past weekend. Italy remains one of the few countries globally where bank M&A is an important theme for investors.

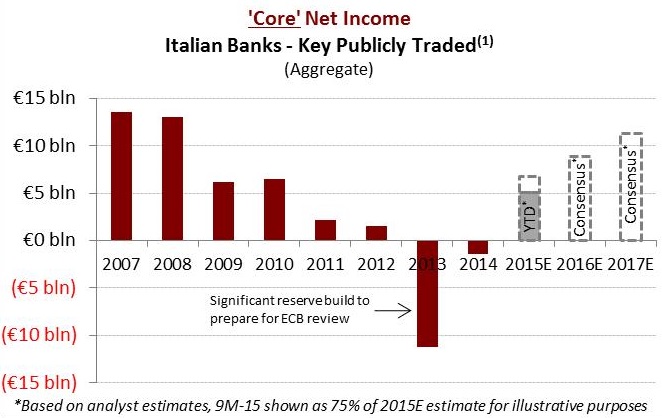

- Earnings Recovery for the Largest Banks Well Underway: Italian banks returned to profitability in 2015, with aggregate earnings for the largest public banks[1] expected to exceed €6.5 billion for the full year. The primary driver of the recovery is falling loan losses, which are currently ~50% of their peak for the group, at just under 1% in aggregate (~1.5% on average). Analysts expect earnings to be ~80%+ recovered to pre-credit crisis (2007) levels by the end of 2017. Specifically, as the chart highlights, consensus year-over-year aggregate earnings growth for the publicly traded banks is ~31% and ~28% for 2016 and 2017, respectively (the average growth rates are similar, but skewed lower by smaller banks). Of relevance, the two giant banks – i.e., ISP and UCG – have been safely profitable in 2015 (i.e., with €2.7 billion and €1.5 billion, respectively, in reported net income through Q3). Earnings season begins this month, and we expect a messy Q4 as banks continue to try to put legacy issues behind them.

- Multiple Positive Trends, Low Valuations Notwithstanding High NPLs: It is very well known that Italian banks have high non-performing loans (“NPLs”); it is the main reason why many Italian banks trade at close to 0.5x tangible book value (“TBV”). This topic rose in prominence again in January as the local market regulator (CONSOB) requested the publicly traded banks disclose if they had received an ECB request for details of their NPL portfolios; the Italian banks traded off materially, as they appeared to have been centred out and at risk of further provisions. Mario Draghi later clarified that other European (read: ‘non-Italian’) banks had received similar requests as part of the ECB’s normal ongoing review process, however, this news did not contribute to a full recovery in stock prices.

Headlines such as these have overshadowed many positive underlying trends for Italian banks. In fact, Italy is one of the few countries with a number of concurrent positive trends for its banking sector all moving together: improving profitability; fiscal/regulatory reforms (including electoral and bankruptcy reform); and bank reform (including bank governance reform, and a plan for a “bad bank”).

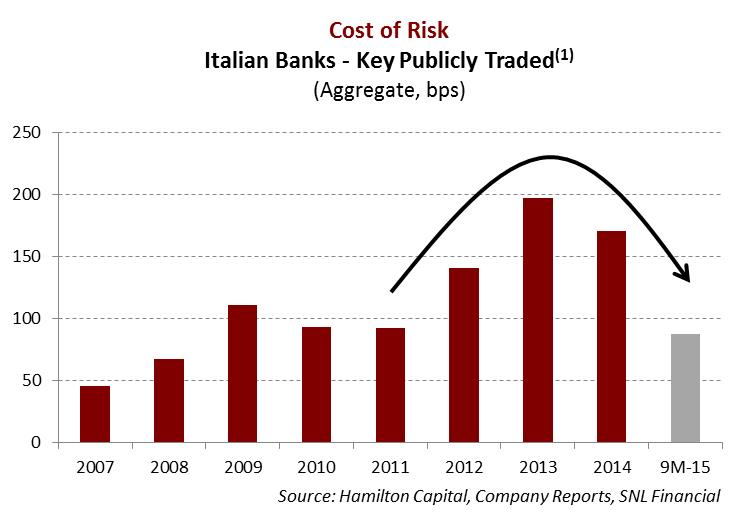

- Reserve Levels Remain Very High: Although the extremely high NPLs of the Italian banks is the focus of the market, Italian banks also have extremely high reserves. The largest public banks have reserves of 8% of total gross loans[4] available to absorb losses embedded within the 19% of loans classified as non-performing (i.e., excluding earnings cushions and collateral). These reserve levels would suggest a significant amount of credit problems have already been put through the income and capital accounts. Moreover, these high reserve levels are contributing to a large decline in credit costs (and shown on the chart), supporting the earnings recovery noted above. In our view, with Italy returning to positive GDP growth, and a reform tailwind, the level of reserves is sufficient to cover expected losses in a positive growth scenario (and possibly even a mild recession). Capital levels for the publicly traded Italian banks are also relatively high, having average common equity Tier 1 ratio in excess of 12%.

- Uncertainty Over NPLs, ‘Bad Bank’ Clouding Market Perception: Some market participants were hoping that an Italian “bad bank” would be established to buy NPLs from (some) of the country’s banks, thereby expediting the clean-up of their balance sheets. With new EU rules in place as of January 1st that preclude a bad bank structure similar to that successfully used by Spain and Ireland to clean up their banking sectors, the Italian government and EU have been working on a mechanism whereby the banks can sell (some of) their bad loans with a government guarantee, with the goal of stimulating demand for a secondary market. Policy pronouncements and speculation on this mechanism have added to the extremely high volatility for Italian bank stocks in January.

Of note, the bid/ask spreads on these loans are amplified by Italy’s multi-year bankruptcy process (resulting in Italian bank loan buyers requiring an additional rate of return to reflect the time value of money). This has contributed to an illiquid market, as this wide spread remains a significant barrier to offloading NPLs. In fact, to maximize recoverability, Italian banks have an incentive (for now) to work out the loans, and/or see the bankruptcy process through to its conclusion. Although positive to shareholders in the next several years (via ultimately higher recoverability), investors clearly favour a more rapid clean up even at the expense of higher losses, in order to achieve greater earnings and capital visibility (since NPLs tie up regulatory capital). For now, we see the current “bad-bank” proposal as a marginal positive.

Sources: SNL Financial, Bank of Italy, ECB, Hamilton Capital

Notes

[1] Includes UniCredit (UCG), Intesa Sanpaolo (ISP), Banco Popolare (BP), UBI Banca (UBI), Mediobanca (MB), Banca Monte dei Paschi Siena (BMPS), Banca Popolare di Milano (PMI), Banca Popolare dell’Emilia Romagna (BPE).

[2] Financial data as of Q3-15 (LTM) or 2014Y depending on availability. Market data as of February 1st, 2016. Dollar values are group aggregates, other values are group averages.

[3] Excludes UBI Banca, which recently converted from a popolari bank to a joint-stock company (SpA).

[4] For reference, U.S. banks and Canadian banks are at approximately ~1.25% and ~0.65%, respectively. Although it should be noted, that unlike Italian banks, both have very high asset quality.