In December 2012, we published a note, entitled “100 Bank Mergers”. In the original note, we predicted that, in the following 3 years, there would be approximately 100 bank deals in the U.S. mid-cap banking sector (i.e., representing ~25% of the approximately 450 publicly-traded U.S. banks). To support this prediction, we detailed five potential catalysts in 2012:

1) Deals beget deals … and deal activity had already started,

2) U.S. bank profitability had completely recovered,

3) Deeply discounted FDIC banks (i.e., failed banks) were no longer available,

4) Over-capitalization was hurting bank ROEs (both buyers and sellers), and

5) While valuations were recovering, there was still a lot of room to go

Highlights

- In late 2012, we predicted that there would be over 100 mergers in 36 months, or ~25% of all publicly traded banks.

- Revisiting this prediction three years later, there have been 85 mergers (for over $39 bln in deal value), representing ~20% of all publicly traded banks. Target banks have been mostly mid-caps (with less than $20 bln in assets), resulting in fewer, but larger, banks.

- While this rate was robust, it was somewhat slower than expected as two main factors slowed merger activity: (i) a low-rate environment slowed the normalization of earnings, and (ii) regulatory uncertainty hindered deal activity.

- We continue to believe that the U.S. mid-cap banking sector remains an attractive investment universe within the global banking sector (with rate normalization, solid U.S. GDP growth, and M&A expected to continue).

Three Years Later – What Happened?

As the three year anniversary of our original note approaches, we thought it would be appropriate to revisit the investment thesis of U.S. mid-cap bank M&A, which we still believe to be an important theme within the global financial services universe. Note, all currency is in U.S. dollars, unless otherwise indicated.

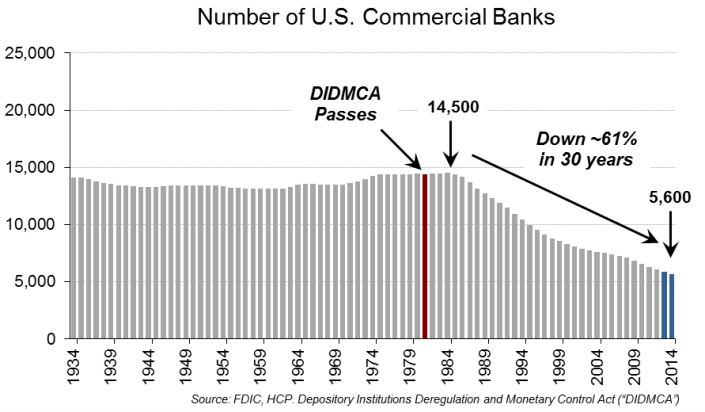

There were actually 85 bank mergers (proposed/completed) representing about 20% of all publicly-traded U.S. banks, versus our prediction of 25%. If one includes all U.S. banks – i.e., public and private – total merger activity shows over 700 proposed/completed acquisitions since December 2012, bringing the number of private/public banks to ~5,600.

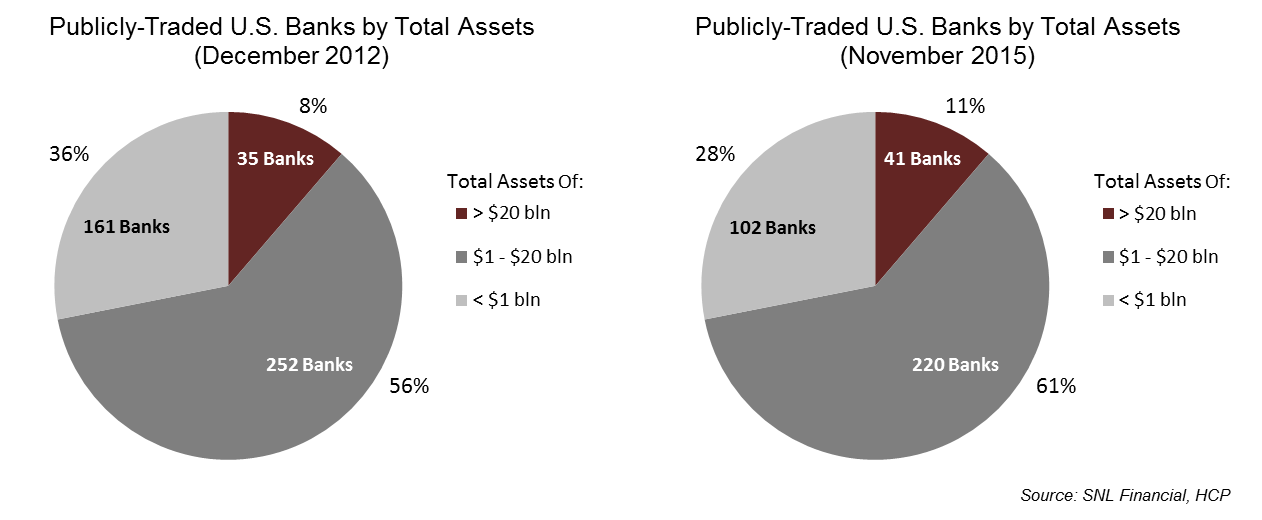

As predicted, the majority of publicly-traded bank M&A activity involved target banks that were mid-cap and small-cap, i.e., less than $20 bln in assets. Of the 85 banks acquired in the past three years, there were (i) 3 deals with >$20 bln in assets, (ii) 42 deals between $1 and $20 bln in assets, and (iii) 40 deals with <$1 bln in assets.

The transactions were beneficial for shareholders. Total disclosed deal value, according to SNL Financial, exceeded $39 bln over the past 12 quarters, with the average premium paid ~28% (to the pre-announcement price). As we predicted, there was very little deal activity in the regional bank universe (i.e., banks with assets over $50 bln) – in fact, there was none. The largest transaction was RBC’s acquisition of City National (deal value of $5.4 bln), which, along with KeyCorp’s announced acquisition of First Niagara (deal value of $4.1 bln) and M&T’s acquisition of Hudson City (deal value of $3.7 bln), was one of three deals for targets that had over $20 bln in assets. Other larger transactions include the more recent BB&T acquisition of Susquehanna (deal value of $2.5 bln) and New York Community Bancorp’s announced Astoria Financial acquisition (deal value of $2.0 bln), to name a few[1].

We continue to believe that none of the regional banks are likely to be acquired in the next five years and believe the sale of a top 20 bank is very unlikely. However, we do believe the 35-year cyclical trend of consolidation will continue for several more years. The primary reason is that there are still too many banks. The universe of publicly-traded banks most likely to sell – i.e., those with assets less than $20 bln – remains a very high 322 banks.

The pie charts below show the breakdown of this universe then and now, and highlight that domestic consolidation continues to result in fewer, but larger banks.

Although there were over 80 bank mergers, this was fewer deals than we would have expected. So, what held back M&A activity?

First, the prolonged low-rate environment presumably had a negative impact on bank M&A volume. We suspect that many potential sellers delayed their plans, on the hopes that the Federal Reserve would raise rates, improving their profitability levels and valuation, thus garnering them a higher sale price.

Second, and more importantly, regulatory uncertainty and intervention have definitely hindered bank M&A. When asked what could serve as a catalyst for further M&A, 61% of attendees at a recent global bank conference chose “Regulatory Clarity” as their answer. We agree. For example, we believe some potential acquirers are awaiting the results of challenges to SIFI (i.e., strategically important financial institution) limits to see if the regulatory threshold for assets is increased from the current level of $50 bln.

Aside from the slowdown in activity caused by this uncertainty, regulators have shown a willingness to directly intervene and prevent deals from closing, e.g., M&T’s acquisition of HCBK. The former is one of the best run banks in the United States, while the latter was a struggling thrift. We surmise that many potential acquirers concluded that if the highly-respected M&T could not get a deal past the regulators, then it made sense to wait for additional regulatory clarity. Note, after an incredibly long 37 months, this deal was only recently approved and closed. In our view, this will likely be perceived as a positive. In fact, we are optimistic that the regulatory sign-off on M&T/HCBK, New York Community Bancorp’s acquisition of Astoria Financial, and First Niagara’s recent sale to KeyCorp will prompt deal activity to start again.

We believe most of the potential catalysts for bank M&A outlined in our original note will continue to support deal activity. Additionally, although regulators have hindered M&A by creating uncertainty and an interventionist approach, the cyclical and secular forces outlined in our initial “100 Bank Mergers” remain intact.

The mid-cap banking sector in the U.S. remains a compelling category of banks in the global banking sector, with solid GDP forecast for the U.S., above-average interest rate sensitivity (providing potential EPS upside), and of course, the potential for merger activity to result in either multiple expansion and/or merger premiums.

Related Funds

Hamilton Capital Global Financials Fund LP

Related Posts

U.S. Banks: Two Significant Deals in Two Days Met with Market Skepticism

100 Bank Mergers

Notes

[1] Source: SNL Financial. Deal value as reported. M&T first announced its acquisition of Hudson City (HCBK) on August 27, 2012. In April 2013, the Federal Reserve declined to provide the necessary regulatory permission, citing concerns with M&T’s procedures, systems and processes relating to the bank’s Bank Secrecy Act and anti-money-laundering compliance program. While M&T worked to address regulatory concerns, the merger agreement was officially extended in December 2013, December 2014, and April 2015. M&T received regulatory approval from the Federal Reserve to acquire HCBK on September 30, 2015.