Does worse = better for the Canadian banks when they report Q4 earnings later this month? In this 10-minute video, Rob Wessel discusses three ways the banks might “clean-up” fQ4 earnings to try to set the stage for an improved f2024.

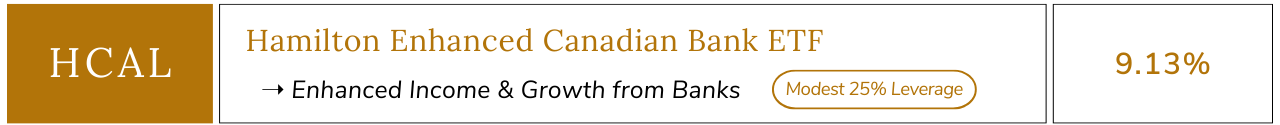

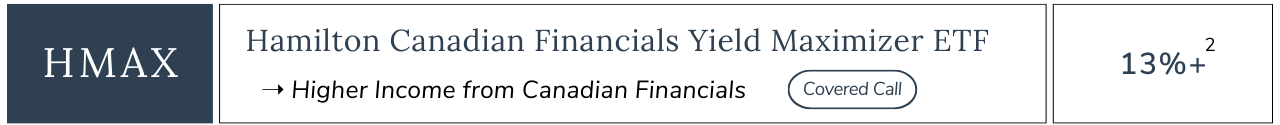

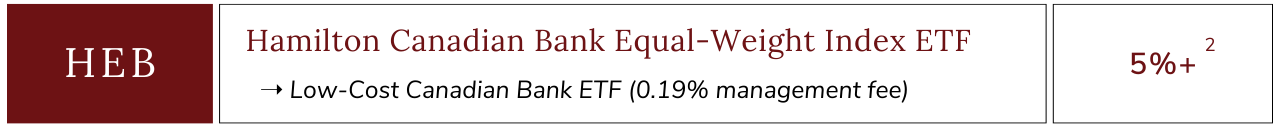

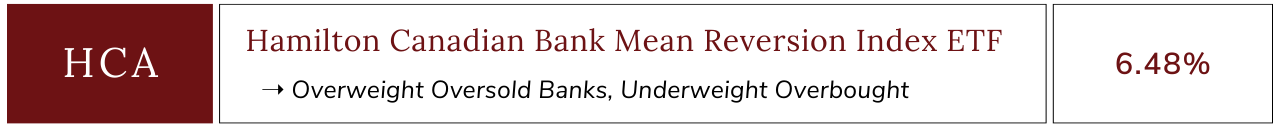

Tax Loss Switch Ideas: With Canadian banks down over the last two years and trading at depressed valuations, we highlight our suite of Canadian bank ETFs for investors considering tax loss selling (see table of Hamilton Canadian bank ETFs below).

For more commentary, subscribe to our Insights.

Disclaimer:

Commissions, management fees and expenses all may be associated with investments in exchange traded funds (ETFs) managed by Hamilton ETFs. Please read the prospectus before investing. Indicated rates of return are the historical annual compounded total returns including changes in per unit value and reinvestment of all dividends or distributions and does not take into account sales, redemptions, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns. Only the returns for periods of one year or greater are annualized returns. ETFs are not guaranteed, their values change frequently and past performance may not be repeated.

Certain statements contained in this video may constitute forward-looking information within the meaning of Canadian securities laws. Forward-looking information may relate to a future outlook and anticipated distributions, events or results and may include statements regarding future financial performance. In some cases, forward-looking information can be identified by terms such as “may”, “will”, “should”, “expect”, “anticipate”, “believe”, “intend” or other similar expressions concerning matters that are not historical facts. Actual results may vary from such forward-looking information. Hamilton ETFs undertakes no obligation to update publicly or otherwise revise any forward-looking statement whether as a result of new information, future events or other such factors which affect this information, except as required by law.

1. An estimate of the annualized yield an investor would receive if the most recent distribution remained unchanged for the next 12 months, stated as a percentage of the price per unit on October 31, 2023

2. An estimate of the annualized yield an investor would receive if the initial distribution remained unchanged for the next 12 months, stated as a percentage of the net asset value per unit on January 20, 2023