In this ETF Comment, we: (a) explain why we agree with CIBC’s decision to increase its bid for PVTB, and (b) provide two reasons why the bank should walk away from their bid, if this new price is not accepted.

Although we did not own Private Bancorp (PVTB) before CIBC’s offer (and have not owned it since), it meets the basic profile of U.S. banks that we favour in the Hamilton Capital Global Bank ETF (HBG); assets < US$100 bln, higher EPS growth, higher rate sensitivity, and an attractive takeover target. In HBG’s most recent disclosure, we noted the fund had exposure to 25 U.S. mid-cap banks. Since the ETF was launched, HBG’s portfolio of mid-cap U.S. banks has generated portfolio-weighted EPS growth in the mid-teens, materially higher than other U.S. mid-caps, the U.S. regionals, and of course, the U.S. mega-caps, which have had close-to-zero EPS growth over the past four years.

With respect to the Hamilton Capital Global Financials Yield ETF (HFY), the U.S. bank allocation is very small at ~6%, largely because their dividend yields are among the lowest in global banking. We aspire to have HFY pay a “REIT-like yield, but with positive rate sensitivity” (note, its underlying portfolio currently has indicative net yield of ~4.5%). Therefore, the ETF focuses on high quality blue-chip global financials, mostly outside of the U.S. banking sector.

As it relates to CIBC’s higher bid for PVTB, it is our view that an increase was unavoidable. This higher bid simply reflects the fact that PVTB is likely worth more post-U.S. election, as the market is now pricing in the expected benefits of substantial (and possibly retroactive) corporate tax reductions and the easing of the current harsh regulatory environment. This rapid change in sentiment can also be linked to expectations for a more hawkish interest rate environment.

That said, we also offer two reasons why CIBC should walk away if this new/higher price is not accepted by PVTB shareholders.

First, although corporate tax reductions are likely in some form, the timing of legislation and magnitude remain large unknowns. With diverse factions within the U.S. House of Representatives and a narrow majority held by the governing party in the Senate, it is not difficult to envision a scenario where tax reform gets stalled and the market (including U.S. banks) experiences a material correction. To reflect this heightened political risk and the significant increase in U.S. bank valuations, in our Hamilton Capital Global Bank ETF (HBG), we have reduced our U.S. bank weighting during Q1 from near 50% to ~40%. Additionally, we increased our allocations to Australian and U.K. banks (and lifted our GBP currency hedges as the pound has fallen over 20% versus the CAD over the last year).

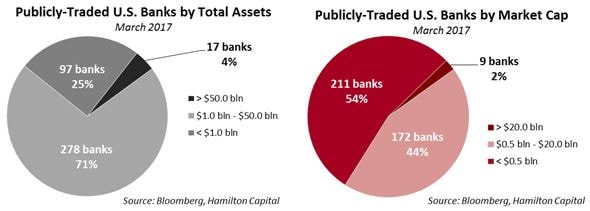

Second, while the strategic benefits from this acquisition are readily apparent, PVTB is not the only U.S. mid-cap bank that could be acquired. Although most U.S. bank investors generally focus on the top 13 U.S. banks (i.e. those with assets of US$50 bln or higher), as the chart below highlights, there are actually over 250 publicly traded U.S. banks with assets between US$1 bln and US$50 bln.

CIBC’s new bid equates to 2.7x tangible book value per share (TBV), a fair price. But, this is much higher than the median multiples paid post-election (2.2x)[1], which is why CIBC should walk away if its updated bid is rejected. If CIBC’s acquisition of Private Bancorp (PVTB) is successfully completed, we expect to comment further on its strategic implications.

Notes

[1] Source: Bank of America Merrill Lynch. Since the U.S. election in November, bank M&A transactions for targets with assets over US$1 bln in deal value. As at March 31st, 2017.

Note: Comments, charts and opinions offered in this commentary are produced by Hamilton Capital and are for information purposes only. They should not be considered as advice to purchase or to sell mentioned securities. Any information offered is believed to be accurate, but is not guaranteed.