We are excited to announce the launch of the Hamilton Enhanced Canadian Bank ETF, which will begin trading on the TSX under the ticker HCAL on Thursday, October 15th. HCAL will provide exposure to Canada’s ‘big 6’ banks, with enhanced yield and return potential, with distributions paid monthly.

HCAL builds on our innovative Canadian Bank mean reversion strategy. Specifically, HCAL’s investment objective is to replicate, before expenses, a 1.25 multiple of the Solactive Canadian Bank Mean Reversion Index (“SOLCBMRT Index”). How? For every $100 invested in HCAL, HCAL will invest $125 in the Hamilton Canadian Bank Mean Reversion Index ETF (ticker: HCA)[1].

Why HCAL? Higher growth potential + higher yield

We believe HCAL provides Canadian bank investors with an attractive vehicle for exposure to the sector, with:

- higher potential returns in a recovery as the sector currently trades at depressed prices and has a strong history of making full recoveries;

- one of the highest dividend yields among all Canadian bank ETFs;

- exposure to an innovative mean reversion strategy which seeks to replicate an unlevered index with highly material outperformance versus both equal weight and covered call strategies over multiple decades (see more detail below);

- depressed stock prices create an opportunity for tax efficient switches out of equal weight and/or covered call strategies (same for investors concerned the capital gains tax inclusion rate will be increased); and

- lower cost financing, as the cost of leverage is at institutional rates, which is a fraction of the rate charged on retail margin accounts.

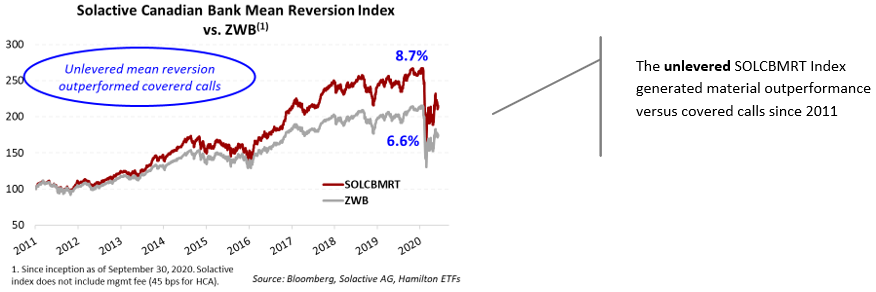

Mean reversion vs performance-challenged Canadian bank covered call strategies

HCAL offers one very important benefit versus covered call strategies: a comparable dividend yield without an options strategy capping the upside (and potentially driving large underperformance). This is important because over the past 9 years the covered call options overlays have generated losses/forgone profits causing significant and persistent underperformance versus other Canadian bank investment strategies, especially mean reversion. Moreover, this dynamic has necessitated that dividends from covered call strategies be heavily supported with return of capital (usually greater than 30% per year). The chart below shows the unlevered Solactive Canadian Bank Mean Reversion index versus the BMO Covered Call Canadian Banks ETF (ticker: ZWB) since the latter’s launch[2].

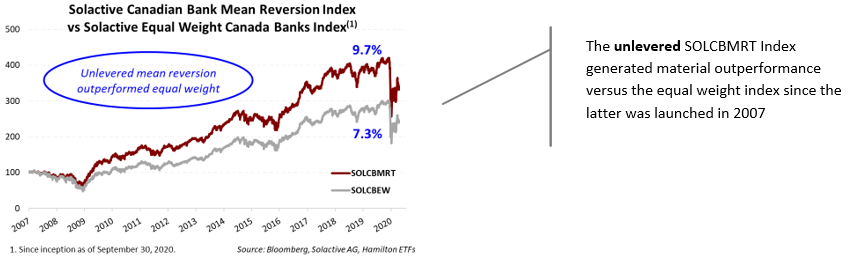

Mean reversion vs equal weight

Compared to an equal weight Canadian bank strategy, HCAL offers the following benefits: (i) exposure to a mean reversion strategy based on an index with significant historical outperformance versus equal weight over multiple periods spanning three decades, (ii) greater potential upside in a credit recovery, and (iii) a materially higher dividend yield. The chart below highlights the outperformance of mean reversion versus equal weight since 2007.

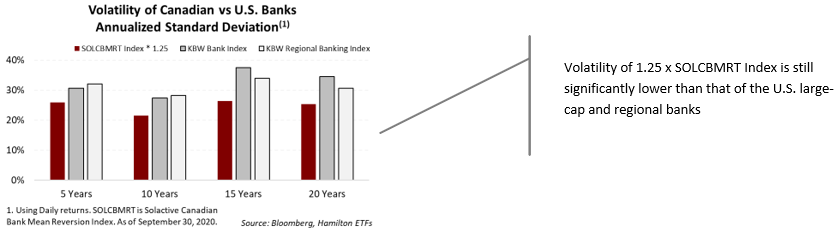

Volatility? Significantly lower than U.S. banks, even with 25% leverage

Even though the volatility of Canadian bank stocks is among the lowest in global banking, there is no question that adding 25% leverage will increase the volatility of HCAL returns relative to its unlevered peer, the Hamilton Canadian Bank Mean Reversion Index ETF (HCA). However, interestingly, as the chart below highlights, the volatility of 1.25 times the Solactive Canadian Bank Mean Reversion Index is still significantly lower than that of the U.S. large-cap and regional banks over multiple time periods.

Investors interested in gaining exposure to mean reversion, but without leverage should consider the Hamilton Canadian Bank Mean Reversion Index ETF, which trades under the ticker HCA. To learn more about the historical outperformance of the Solactive Canadian Bank Mean Reversion Index, which HCAL and HCA seek to replicate in different forms, please read our insight “Canadian Banks: Outperformance from Mean Reversion (in 7 Charts)“.

Notes

[1] HCAL uses leverage, in the form of 25% cash borrowing from a Canadian financial institution. The investment strategy of the Hamilton Canadian Bank Mean Reversion Index ETF (HCA) is to seek to replicate, before expenses, the SOLCBMRT Index.

[2] Note, the BMO Covered Call Canadian Banks ETF (ticker: ZWB) return figure includes a 65 basis point management fee plus taxes and other expenses.

A word on trading liquidity for ETFs …

Hamilton ETFs are highly liquid ETFs that can be purchased and sold easily. ETFs are as liquid as their underlying holdings and the underlying holdings trade millions of shares each day.

How does that work? When ETF investors are buying (or selling) in the market, they may transact with another ETF investor or a market maker for the ETF. At all times, even if daily volume appears low, there is a market maker – typically a large bank-owned investment dealer – willing to fill the other side of the ETF order (at net asset value plus a spread). The market maker then subscribes to create or redeem units in the ETF from the ETF manager (e.g., Hamilton ETFs), who purchases or sells the underlying holdings for the ETF.