When most investors think of the financial sector, they think about the traditional financial subsectors, like commercial banks, investment banks, and insurance. However, the rapid advancement of technological innovation has created an entirely new category of financials and transformed others. In our view, this category has become so large and established that it should comprise a material portion within all investors’ financial sector equity allocations. Not only does this category offer investors exposure to superior EPS growth and higher ROEs, but it also offers significant diversification from the dominant risk factors in most Canadian financials portfolios – interest rate risk and credit risk. The latter is particularly important in a market where macro volatility has become an important driver of portfolio volatility.

This is why we launched the Hamilton Financials Innovation ETF (HFT) on June 1, 2020. HFT invests in a blue-chip portfolio of established global financial services firms benefiting from powerful secular trends and/or disruption within the financial sector. With over 30 positions from around the globe (but with a U.S. focus), HFT provides investors with diversification (against both category and single name exposure), a key feature in our view for a subsector characterized by higher growth and corresponding valuation premiums. Together, we believe these attributes make HFT an attractive tool for investors looking for exposure to this powerful investment theme of financial innovation, as well as a good complement to their core Canadian bank positions.

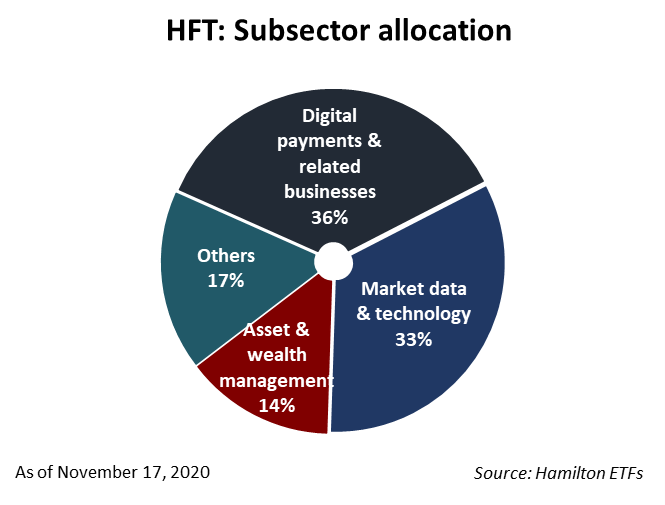

To take advantage of the most important secular themes driving innovation in the global financial sector, we have structured HFT into three key categories:

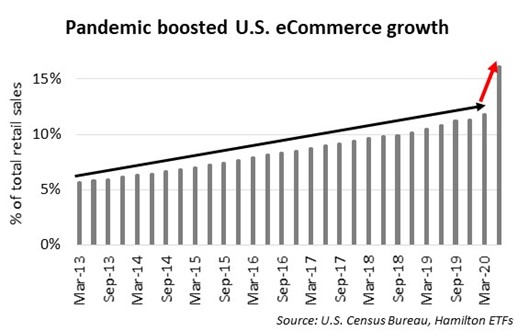

- Digital payments and related businesses – facilitating the shift towards a cash-less economy (~35% of NAV): The COVID-19 pandemic has accelerated a multi-decade, structural shift away from cash transactions. Beneficiaries of this powerful shift include the card networks, merchant acquirers, processors, mobile payments (in-store), payment gateways, and even electronic invoicing and global remittance companies. According to a U.S. Census Bureau report, the pandemic significantly boosted eCommerce sales (see chart below) resulting in a surge in user adoption, volume, and revenue growth in digital payments, benefiting most payment companies – a trend we do not believe will reverse post-pandemic as many first time users convert to full-time users. Supported by these powerful secular trends, payments and related businesses are expected to continue to generate materially higher EPS growth and ROEs than traditional financial intermediaries for the foreseeable future.

- Market data and technology – driving electronification and digitization of global capital markets (~35% of NAV): Global capital market-related businesses have benefitted from technological innovation, allowing them to capitalize on regulatory and policy reforms introduced after the global financial crisis. These reforms have resulted in an increasing share of asset classes – equities, foreign exchange, and more recently fixed income – being traded electronically. In recent years, M&A within the space and more significantly with ancillary businesses has created diversified business models that are benefiting from multiple secular trends (e.g., the growth of ETFs; the growing dominance of quantitative/algorithm trading). Broadly, these diversified business models often benefit from greater market turbulence, which should reduce the volatility of HFT while preserving its strong growth outlook.

- Other innovators, including wealth management (~30% of NAV): HFT also has exposure to many other businesses benefiting from technological innovation and/or disruption include ETF managers, online brokers, market makers, and other miscellaneous businesses. With respect to ETFs, the multi-year shift from higher cost mutual funds to lower fee ETFs (including active to passive) has been a powerful trend, creating structural winners (and losers) in investment management. Online brokers continue to benefit from the secular shift to self-directed investing and the broadening of their business models to include related activities, while using their increasing scale to place downward pressure on trading commissions and launching new divisions (like robo-advisory).

Developing themes (not currently in HFT): branchless or digital banks, robo-advisers, blockchain, insurtech

The investment case for various other segments of fintech remains less clear and hence these are not part of HFT’s current strategy, which, as noted above, is focused on established innovators within the sector.

Pure standalone internet banks (or branchless banks) face structural challenges to their business model related to risk management (underwriting), access to funding and regulatory capital while trying to compete with very powerful incumbents. Until a competitor(s) emerges with a viable business model to deal with these challenges, HFT will retain zero exposure. The issues for robo-advisors are different. The category continues to experience very high growth and therefore has access to capital, but its low fee structure creates challenges to reaching scale. That said, there are currently no viable public “pure play” firms in which to invest (HFT does have exposure to robo-advisory business within its online brokerage holdings). Other segments/themes like blockchain and insurtech are too disparate, early stage and/or too speculative in our view for inclusion at this time.

We continue to closely monitor the investment and competitive landscape in these rapidly evolving categories.

Powerful long-term secular tailwinds support robust long-term outlook for HFT

In our view, Hamilton Financials Innovation ETF (HFT) is an excellent complement to Canadian investors’ current financial holdings (which tend to be dominated by Canadian banks), adding growth and diversification. As the global financial services sector evolves and innovates, HFT’s focus on digital leaders provides investors with exposure to established companies benefitting from favorable, secular and structural trends within the sector and that are generating higher ROEs and EPS growth but with lower macro risk.

Within its three broad categories, HFT offers a diverse array of businesses and themes, while limiting exposure to emerging themes that are more speculative and volatile (like blockchain). Crucially, HFT does not have material exposure to the most important risks dominating most financial services investors’ portfolios – namely credit risk, interest rate risk, principal trading and insurance underwriting – which can be particularly volatile during periods of heightened macro uncertainty. In our view, HFT offers Canadian investors a high-quality diversified portfolio with an attractive balance between growth, volatility, and valuation.

Related Insights

Global Financials: The Most Attractive/Important Investment Themes in 2021 (November 16, 2020)

Hamilton ETFs Launches Hamilton Financials Innovation ETF (June 1, 2020)

Global Exchanges, E-Brokers and Fintech: Secular and Structural Growth Drivers Abound (June 15, 2019)

A word on trading liquidity for ETFs …

Hamilton ETFs are highly liquid ETFs that can be purchased and sold easily. ETFs are as liquid as their underlying holdings and the underlying holdings trade millions of shares each day.

How does that work? When ETF investors are buying (or selling) in the market, they may transact with another ETF investor or a market maker for the ETF. At all times, even if daily volume appears low, there is a market maker – typically a large bank-owned investment dealer – willing to fill the other side of the ETF order (at the bid/ask spread).