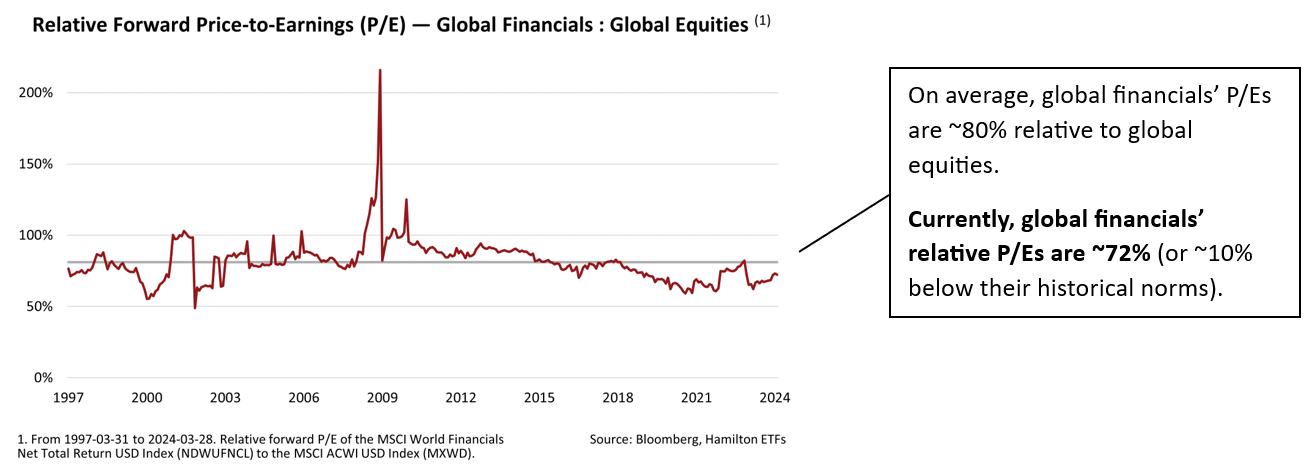

The Hamilton Global Financials ETF (HFG) continues to benefit from excellent performance, having materially outperformed Canadian financials in the last 1, 2, and 3-year periods with lower volatility. Despite the global financial sector’s strong performance over the last six months, there has been remarkably little discussion about it as current interests (AI, the “magnificent 7”, and a fixation on the Federal Reserve/the path for interest rates) have drawn investor attention away from the financials’ attractive fundamentals and valuations. While global financial stocks are showing strong momentum, their valuations remain attractive relative to global equities (see figure 1). We believe this momentum is likely to continue with higher earnings per share (EPS) given economists’ expectations looking for improving global GDP growth (including the U.S.) and the potential for modest rate cuts later in the year.

These factors combined with attractive valuations provide a favourable backdrop for financial services investors. In this Insight, we outline why we believe the Hamilton Global Financials ETF (HFG) can add important diversification to investors’ Canadian financials holdings, which are being negatively impacted by lower domestic GDP growth and productivity.

HFG – Outperforming Canadian Financials with Lower Volatility

With an annualized return of +17.8% since inception[1] and outperformance versus Canadian financials over 1-year, 2-year, 3-years, the Hamilton Global Financials ETF (HFG) is an attractive complement, in our view, for Canadian investors seeking to add diversification to their core Canadian bank/financials holdings while maintaining a comparable volatility profile. HFG is actively managed and provides exposure to the most attractive themes in global financials. Currently, HFG holds 61 positions across 9 sub-sectors, in 17 countries.

Global Financials — Enormous Sector, Favourable Outlook

Notwithstanding some idiosyncratic situations over the past few years, the broader financial sector has proven extremely resilient. It has adjusted to: (i) the failures of three regional U.S. banks and Credit Suisse (which HFG did not own); (ii) heightened competition for deposits; and (iii) the ongoing scrutiny of exposures to commercial real estate (CRE)[1], by marshalling capital, limiting lending, and raising excess liquidity.

Looking ahead, declining inflationary pressures and the potential for interest rate declines in many jurisdictions is expected to support economic growth. At the same time, we believe lower rates should reduce the risk of tail events that depressed valuations in 2022/2023. A reduction in these risks strengthens the argument for higher valuations and returns from the sector.

With economic growth still resilient in the U.S. and forecast to gradually accelerate in Europe, the backdrop for financial sector investments, including HFG, appears attractive.

United States (~45% of HFG) — Strong Economy, Attractive Valuations [2]

The U.S. has the strongest expected economic growth in real GDP amongst the G-10 (2.2%) for 2024[3]; its 3-year growth is forecast to remain elevated relative to peers. In addition to improving fundamentals, the U.S. financials are attractively valued relative to broader U.S. equities (figure 2).

Within the U.S., HFG holds a mix of high-quality, long-term compounders of value (including banks, insurers, and asset managers). In addition, HFG owns companies with relatively low valuations, and earnings trends that are expected to sustainably improve in the latter half of 2024 and into 2025.

Europe (~33% of HFG) — Accelerating Growth Forecasts, Compelling Valuations [4]

Having endured very slow growth for most of 2023, Europe is forecast to see its GDP growth gradually accelerate throughout the next six quarters. We believe European financials are attractive given improving economic performance, strong capital returns (dividends and share buybacks), and compelling valuations.

Within Europe, HFG holds a diversified mix of high-quality financials across 6 countries. Their strong long-term earnings growth is complemented by select companies where valuations and earnings have the potential to exceed expectations. Currently, we believe European banks present an attractive opportunity and have allocated 13% in HFG. Their ROEs (return on equity) have improved enormously in recent years but without the commensurate change in valuations (figure 3). While we generally expect banks with similar ROEs to trade at similar P/B (price-to-book) ratios, European banks currently have ROEs comparable to those of Canadian/U.S. banks but trade at much lower P/Bs (figure 4).

Specifically, European banks would need to appreciate by ~50% and ~70% to achieve similar P/B valuations as the U.S. and Canadian banks, respectively. Although we do not expect European banks to trade at par with their Canadian or U.S. peers, we are optimistic that the gap can narrow materially, which would support strong relative performance.

HFG – Strong Performance and Exposure to the Most Attractive Themes and Opportunities in Global Financials

The Hamilton Global Financials ETF (HFG) aims to provide Canadian investors with diversified exposure to the most attractive themes within the global financials sector while maintaining a volatility profile not materially different from that of Canadian financials. To achieve this, HFG focuses on a diversified portfolio (by country/region/sub-sector) of high quality global financial stocks with strong balance sheets, varied income streams and exposure to favourable medium/long-term cyclical trends.

Given its strong performance and its portfolio of high-quality diversified global financials, it is our view that HFG will continue to be an attractive complement to investors’ core Canadian bank/financials holdings.

Figure 1 — Global Financials are Quite Cheap Relative to Broader Markets

Figure 2 — U.S. Financials Remain at a Discount to the S&P500

Figure 3 — European Bank ROEs have Converged with Canadian and U.S. Peers

Figure 4 — European Banks Remain Attractively Valued

For more commentary, subscribe to our Insights.

Recent Insights

Replay: Market Outlook with Ed Yardeni — Roaring 20s Still Ahead? | April 18, 2024

Canadian Banks: Buying Opportunity? (BNN Video) | February 27, 2024

BMO/BNS Q1 2024 Takeaways (BNN Video) | February 27, 2024

BNS: Q4 Results Not as Bad as they Look (BNN Video) | November 29, 2023

Video: History Favours the Canadian Banks in 2024 | November 27, 2023

____

A word on trading liquidity for ETFs …

Hamilton ETFs are highly liquid ETFs that can be purchased and sold easily. ETFs are as liquid as their underlying holdings and the underlying holdings trade millions of shares each day.

How does that work? When ETF investors are buying (or selling) in the market, they may transact with another ETF investor or a market maker for the ETF. At all times, even if daily volume appears low, there is a market maker – typically a large bank-owned investment dealer – willing to fill the other side of the ETF order (at net asset value plus a spread). The market maker then subscribes to create or redeem units in the ETF from the ETF manager (e.g., Hamilton ETFs), who purchases or sells the underlying holdings for the ETF.

[1] HFG’s total return from June 26, 2020, through March 28, 2024.

[2] As well noted in the financial press, CRE has seen its value decline with higher rates, and for offices, the trend toward working from home.

[3] As at March 28, 2024

[4] Source: Bloomberg

[5] As at March 28, 2024

Commissions, management fees and expenses all may be associated with investments in exchange traded funds (ETFs) managed by Hamilton ETFs. Please read the prospectus before investing. Indicated rates of return are the historical annual compounded total returns including changes in per unit value and reinvestment of all dividends or distributions and does not take into account sales, redemptions, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns. Only the returns for periods of one year or greater are annualized returns. ETFs are not guaranteed, their values change frequently and past performance may not be repeated.

Certain statements contained in this website may constitute forward-looking information within the meaning of Canadian securities laws. Forward-looking information may relate to a future outlook and anticipated distributions, events or results and may include statements regarding future financial performance. In some cases, forward-looking information can be identified by terms such as “may”, “will”, “should”, “expect”, “anticipate”, “believe”, “intend” or other similar expressions concerning matters that are not historical facts. Actual results may vary from such forward-looking information. Hamilton ETFs undertakes no obligation to update publicly or otherwise revise any forward-looking statement whether as a result of new information, future events or other such factors which affect this information, except as required by law.