Last week, Bank of Nova Scotia reported its Q3 results and its International Banking division generated solid double-digit earnings growth, supported by a strong economic backdrop and acquisitions. Within this segment is the Bank’s operations in the Pacific Alliance, the Latin American trade bloc that includes Peru, Chile, Columbia, and Mexico. This very large emerging markets platform has over $100 bln in loans, generates earnings of ~$500 mln a quarter and has been a significant contributor to the earnings growth of Scotia’s International Banking in the last several years.

Note to Reader: This Insight includes references to certain Hamilton ETFs that were active at the time of writing. On June 29, 2020, the following mergers took place: (i) Hamilton Global Financials Yield ETF and Hamilton Global Bank ETF into the Hamilton Global Financials ETF (HFG), (ii) Hamilton Australian Financials Yield ETF into the Hamilton Australian Bank Equal-Weight Index ETF (HBA); (iii) Hamilton Canadian Bank Variable-Weight ETF into the Hamilton Canadian Bank Mean Reversion Index ETF (HCA), and (iv) Hamilton U.S. Mid-Cap Financials ETF (USD) into the Hamilton U.S. Mid/Small-Cap Financials ETF (HUM).

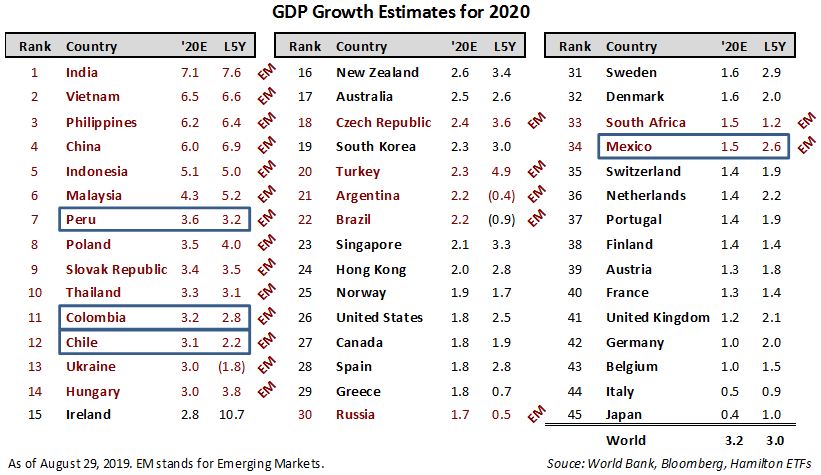

A key source of this platform’s strength is that it operates in some of the fastest growing countries globally. The table below shows both the average annual GDP growth for the last five years, as well as the forecast GDP growth for f2020 (the table is ranked from highest to lowest on forecast GDP growth).

Note, three of the four Pacific Alliance economies rank near the top globally for 2020 forecast growth – Peru (#7 at 3.6%), Columbia (#11 at 3.2%) and Chile (#12 at 3.1%). While Mexico ranks below Canada for forecast growth next year (#34 at 1.5%), its GDP growth over the past five years was materially higher than that of Canada (2.6% versus 1.9%).

Global Growth Takeaways

Reviewing the above forecasts for global growth in 2020, we would offer five key takeaways:

First, notwithstanding fears of a global recession, forecast global GDP growth for 2020 is a very healthy 3.2% (source: Bloomberg). Since the European sovereign debt crisis (when GDP was 2.5%) in 2012, the market experienced several large macro corrections primarily as a result of “growth scares”. It is worth noting that over this period, not only did global GDP not slow, it actually increased (i.e. the market’s predictions were not correct).

Second, 14 of the 15 countries forecast to grow 2020 GDP the fastest are emerging markets, with populous countries like India, China and Indonesia in the top five. In the top 20 countries, a full 16 are emerging markets including four from central and eastern Europe (CEE).

Third, Australia is expected to be fastest growing “larger” economy with forecast GDP growth of 2.5%, well ahead of Canada. New Zealand is forecast to grow at 2.6%. This is relevant to our Hamilton Australian Financials Yield ETF (HFA).

Fourth, Canada ranks 27th and is forecast to grow at a respectable 1.8% next year. This is inline with the United States and higher than the 1.4% forecast for this year. For 2019, GDP growth for the U.S. is forecast to be considerably higher than Canada (2.3%).

Fifth, while two of the largest economies in the eurozone, Italy and Germany, are forecast to produce mediocre GDP growth (0.1% and 0.6%, respectively), many other European countries are expected to fare a lot better. This includes several peripheral countries (Spain, Greece and Portugal) and most major Northern European countries (like Norway, Sweden, Denmark).

Note to Reader:

Hamilton ETFs hold positions in Bank of Nova Scotia in the Hamilton Global Bank ETF (HBG), Hamilton Global Financials Yield ETF (HFY) and the rules-based Hamilton Canadian Bank Variable-Weight ETF (HCB).

____

A word on trading liquidity for ETFs …

Hamilton ETFs are highly liquid ETFs that can be purchased and sold easily. ETFs are as liquid as their underlying holdings and the underlying holdings trade millions of shares each day.

How does that work? When ETF investors are buying (or selling) in the market, they may transact with another ETF investor or a market maker for the ETF. At all times, even if daily volume appears low, there is a market maker – typically a large bank-owned investment dealer – willing to fill the other side of the ETF order (at net asset value plus a spread). The market maker then subscribes to create or redeem units in the ETF from the ETF manager (e.g., Hamilton ETFs), who purchases or sells the underlying holdings for the ETF.

Related Insights

Cdn/Aust’n Banks: Why the Big Housing Short is So Difficult (and the Risk of a ‘Direct Hit’ Remains Low) –April 9, 2019

Canadian Banks: Why Volatility Will Likely Rise (and a Comment on Mean Reversion April 18, 2019

Canadian Banks: Five Takeaways from BBT/STI, Accelerating U.S. Bank M&A – February 11, 2019

Note: Comments, charts and opinions offered in this commentary are produced by Hamilton ETFs and are for information purposes only. They should not be considered as advice to purchase or to sell mentioned sec