On Thursday morning, BB&T (BBT) and SunTrust (STI), two of the largest banks in the U.S. Southeast, announced a merger of equals (“MOE”). With an aggregate deal value approaching US$66 billion, the transaction marks the largest bank M&A deal since the 2008 financial crisis and will create the 6th largest bank in the United States. In this update we provide our thoughts including the main takeaways of what the deal means to U.S. banks.

Expect M&A to Be Key Theme for SMID Banks

As we explain below, we expect U.S. bank consolidation will accelerate but that M&A deal activity will predominately be within the small and mid-cap banks (or “SMID banks”). The Hamilton Capital U.S. Mid-Cap Financials ETF (USD) (ticker: HFMU.U) has exposure to 40 U.S. mid-cap banks, accounting for ~70% of exposures, while the Hamilton Capital Global Bank ETF (ticker: HBG) has exposure to over 20 U.S. mid-cap banks, accounting for ~45% of exposures.

The U.S. bank holdings in both HFMU.U and HBG continue to generate excellent fundamental performance with EPS growth materially above their broader categories, supported by a favourable economic backdrop, stock selection, and an emphasis on higher GDP growth markets/MSAs. Last year, EPS growth for the entire U.S. banking sector was particularly high with margin expansion (from a rising Fed funds rate) and the reduction in corporate taxes as key contributors.

U.S. Bank M&A, A Secular and Cyclical Theme

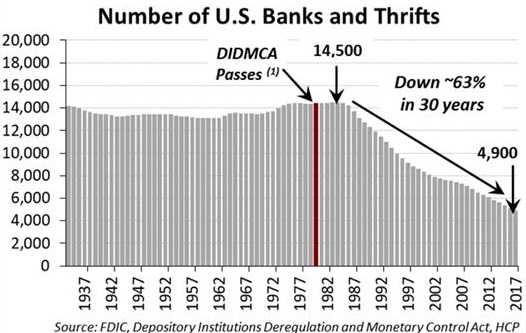

In the last 40 years, U.S. bank consolidation has been a secular theme, as the number of U.S. banks has fallen by nearly two-thirds since the early 1980s (see chart). We expect consolidation to continue for at least another 10 years.

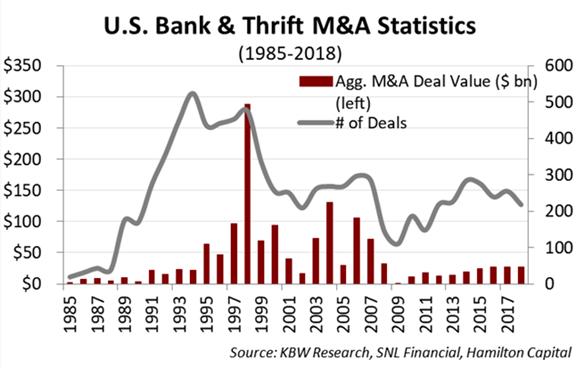

U.S. bank consolidation has also been a cyclical theme, meaning activity has varied widely between certain time periods. The 20 year period from 1995 to 2005 saw robust M&A activity. However, M&A activity has been relatively low since the financial crisis.

While both HBG and HFMU.U have benefited from bank M&A, the overall impact has been small given the relatively low activity/deal values. That said, we believe the BBT/STI merger is significant as it signals (a) U.S. bank M&A activity is likely to accelerate in the coming years, and (b) the nature of M&A is likely to be different, at least in the next few years (i.e., more MOEs/low premium transactions).

Key Takeaways from the Largest U.S. Bank Deal in a Decade

The BBT/STI deals marks the second U.S. bank MOE in two weeks, following the merger of two mid-cap Midwestern banks – HFMU.U holding, Chemical Financial (CHFC) with TCF Financial (TCF) – on January 28th. Notably, both MOE deals were met with enthusiasm by investors, a sharp contrast to the most recent prominent “premium” transaction: Fifth Third (FITB) buying MB Financial (MBFI)[1].

We wrote in our May 2018 insight, “U.S. Banks: 3 Deals in 3 Weeks. Will M&A Accelerate Post-Dodd-Frank?”, that we believed the bipartisan Crapo bill passed by Congress removed key impediments to consolidation, particularly for the SMID-cap banks[2]. After nearly a decade of relatively low deal values, we expect M&A activity will accelerate in 2019 and 2020, particularly now that much of the “easy” earnings from a rising Fed Funds rate have been realized.

Key takeaways from the BBT/STI deal:

- Size of deal is significant: First and foremost, the sheer size of this deal would imply a more favourable regulatory environment (i.e., the regulators are more amenable to consolidation);

- Powerful market preference for low premium/MOE deals: The market has shown a clear preference for MOEs/low premium deals, believing they offer accretions/synergies with lower deal/execution risk. The market pushed both BBT and STI higher, recognizing the significant overlap that offers outsized synergies and accretions shared by all shareholders. The best contrasting example is the market’s negative reaction to FITB paying a 20%+ premium for MBFI. Despite the strong strategic rationale (including creating the #2 bank in Chicago MSA), the market balked at the high premium and the potential execution risk, causing FITB to experience material ~10% underperformance since the announcement last May.

- Few remaining opportunities for regional bank MOEs: We do not believe this deal – namely two equal sized regional banks merging in a pure MOE – will be significant theme for regional banks (i.e., those with more than $50 billion in assets) simply because there are only nine other banks with assets over $100 bln and another five with assets between $50 bln and $100 bln[3]. And among this universe of 14 banks, only a handful have substantial overlap;

- With over 350 SMID-cap banks, significant opportunities for MOEs: While there might only be 14 regional banks, there are over 350 small and mid-cap banks (SMID), including over 150 mid-cap banks. With a still fragmented U.S. banking sector and larger banks consolidating we believe M&A in this category provides a greater investment opportunity. (HFMU.U and HBG hold 40 and 20 mid-cap banks, respectively).

U.S. bank M&A is one of the investment themes that we believe could positively impact the Hamilton Capital U.S. Mid-Cap Financials ETF (USD) (HFMU.U) and the Hamilton Capital Global Bank ETF (HBG) in the coming years.

Next week, we will provide our views on what this deal might mean to the U.S. platforms of the Canadian banks.

Notes

[1] FITB experienced a sharp correction and material underperformance relative to the BKX Index after the transaction’s premium pricing (at 2.8x P/TBV and 7.8% tangible BV dilution) became known.

[2] The legislation passed was the Economic Growth, Regulatory Relief, and Consumer Protection Act (S.2115) which included lower asset thresholds for enhanced regulation, lowering the hurdles to making acquisitions

[3] From largest to smallest by assets these banks are: USB ($467 bln), PNC ($382 bln), COF ($373 bln), CFG ($160 bln), FITB ($146 bln), KEY ($139 bln), RF ($126 bln), MTB ($120 bln), HBAN ($109 bln), FRC ($99 bln), CMA ($71 bln), ZION ($69 bln), SIVB ($57 bln), and the only thrift, NYCB ($52 bln). Total assets as of Q4 2018. Source: Bloomberg.