In today’s insight – part of our financial innovation series – we highlight how a string of large, transformational acquisitions by market data and technology companies in the Hamilton Financials Innovation ETF (HFT) over the course of 2019 and 2020 have boosted the ETF’s exposure to secular investment themes brought forward by the pandemic. Crucially, the acquisitions provide investors in HFT exposure to emerging themes with large addressable markets such as active non-transparent ETFs, Environmental, Social and Governance (ESG) investing, custom indexing, and others. We expect the resultant earnings mix shift to drive re-rating via multiple expansion.

Part I: Can Standalone Digital Banks Disrupt the Incumbents? (January 14, 2021)

Part II: Four Themes Driving Innovation in Global Financials (January 25, 2021)

Part III: Market Data M&A Accelerates Pivot to a Digital Future

M&A boosts exposure to favorable secular trends

Amid a pandemic-driven global economic slowdown and as traditional financial services M&A came to a virtual standstill, 2020 was a busy year for M&A in the global market data and technology sector – a key, strategic focus area for HFT. Taking advantage of historically low interest rates and responding to changing client technology needs, several of HFT’s portfolio companies made large and transformational acquisitions in data, analytics, indexing, compliance, and other related businesses.

We believe three key secular investment trends have been the primary drivers of the recent round of M&A in the market data and technology sector:

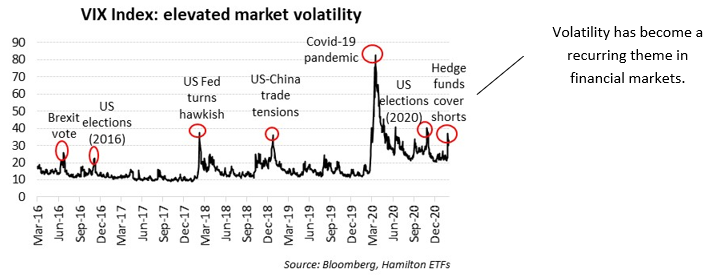

1. Rising market volatility creates demand for hedging, trading strategies: Over the past decade, market volatility has increased and remained elevated for extended periods driven by unexpected global macroeconomic and policy outcomes such as the Brexit vote, U.S.-China trade tensions, general elections in key global economies, and most recently the economic slowdown from the Covid-19 pandemic (see figure below). HFT portfolio companies in the market data and technology sector (especially the exchanges, market makers) reported robust revenue growth during these periods of elevated volume and volatility. Moreover, the recurring market volatility has created steady demand for the risk management, hedging and trading products provided by these companies.

Key transactions:

- London Stock Exchange (LSE) bought financial markets data and infrastructure company Refinitiv (spin-off from Thomson Reuters) to add new trading platforms and strengthen its data and analytics offering; transaction value US$27 bln[1]

- Nasdaq acquired anti-financial crime technology company Verafin to capitalize on growing demand for anti-money laundering (AML)/know-your-client (KYC) tools from banks/financial institutions[2]; transaction value US$2.8 bln

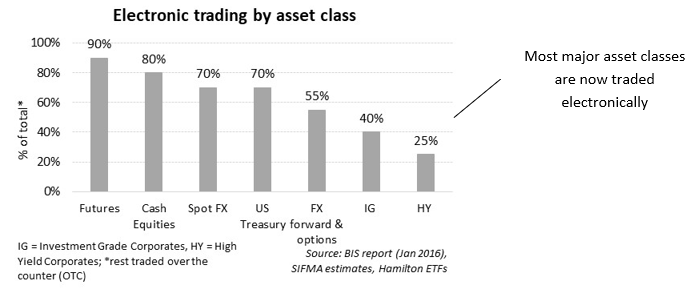

2. Continued digitization of capital markets (OTC to exchanges): Post-GFC regulatory and compliance reforms have resulted in an increasing share of major asset classes being traded electronically on exchanges and other alternate exchange venues and away from traditional over-the-counter (OTC) markets (see figure below). More asset classes are now traded electronically than ever before, creating secular demand for data analytics across the capital markets and investing landscapes. This has allowed market data and technology companies in HFT to monetize valuable market data feeds.

Key transactions:

- Rating agency and index owner S&P Global acquired information services major IHS to bolster its data & analytics offering for financial markets; transaction value of US$44 bln

- Euronext bought European exchanges Oslo Bors and Borsa Italiana adding new asset classes (shipping, oil, government bonds, others) and markets (Norway, Italy); transactions valued at ~US$800 mln (closed July 2019) and ~US$5 bln (announced October 2020), respectively

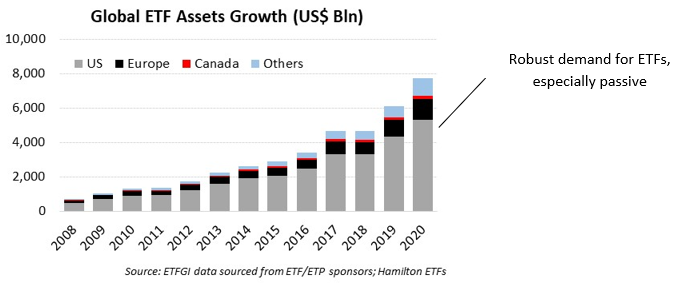

3. Structural shift to ETFs: The ongoing shift towards ETFs continues across most large, global markets and asset classes (see figure below). In fact, in the U.S., the world’s largest market for ETF investing with AUM of US$5.5 trn, ETFs saw inflows of US$490 bln in 2020 – the largest in history[3]. The rise of passive investing also continues to support growth at ETF managers, index providers, and data and analytics providers. Moreover, should the growth of active non-transparent ETFs (ANT) in the U.S. (which were only approved last year) follow the Canadian experience, this ETF category could reach 25% market share (or over $1 trn) in the next 5-7 years, fueling additional growth and new entrants.

We believe recent M&A provide HFT portfolio companies with exposure to new, fast-growing niches within passive investing such as ESG, thematic investing, as well as the newly emergent category of ANT ETFs.

Key transactions:

- European exchange Deutsche Bourse acquired 80% stake in U.S. based, governance company ISS to monetize a growing opportunity in ESG data and analytics as passive/ETF ESG asset demand grows[4]; transaction value US$1.8 bln

- Singapore Exchange bought a majority stake in smart-beta index provider Scientific Beta to boost index and data business; transaction value ~US$210 mln.

M&A accelerates strategic pivot to emerging, high growth businesses

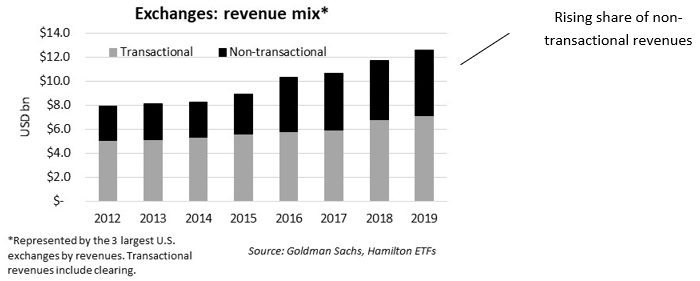

The acquisitions have added to revenue and earnings diversification for market data and technology companies, thus accelerating a multi-year journey away from transactional/cyclical businesses (see figure below) into non-transactional/stable businesses. They also have had the effect of lowering dependence on asset classes facing commoditization (e.g., futures and cash equities) and volume/volatility pressure in the current lower for longer interest rate environment (e.g., rates complex).

In addition, as we have highlighted earlier through many of these acquisitions, companies have added exposure to new and innovative areas with potentially sizeable opportunities such as ANT, ESG, custom indexing, and others.

As global capital markets digitize further, M&A in the market data & technology sector is likely to continue. We expect HFT’s portfolio of established financial innovators to lead the M&A wave to:

- build scale in businesses experiencing secular demand (and higher growth),

- capitalize on innovative investment trends, and

- further diversify revenues

Market data and technology is one of the three broad categories of financial innovators in the Hamilton Financial Innovation ETF (HFT). HFT offers a diverse mix of business lines and investment themes, while limiting exposure to those that are still emerging and more speculative in nature. With no material exposure to the most important risks dominating most financial services investors’ portfolios (namely credit risk, interest rate risk, principal trading, and insurance underwriting), HFT, in our view, offers Canadian investors a high-quality diversified way of getting exposure to an attractive balance between growth, volatility, and valuation and makes a good complement to investors’ core Canadian bank positions.

Related Insights

Part II: Four Themes Driving Innovation in Global Financials (January 25, 2021)

Part I: Fintech/Cdn Banks: Can Standalone Digital Banks Disrupt the Incumbents? (January 14, 2021)

Hamilton Financials Innovation ETF: Invest in Digital Leaders Reshaping the Financial Sector (November 19, 2020)

Global Financials: The Most Attractive/Important Investment Themes in 2021 (November 16, 2020)

Hamilton ETFs Launches Hamilton Financials Innovation ETF (June 1, 2020)

Global Exchanges, E-Brokers and Fintech: Secular and Structural Growth Drivers Abound (June 15, 2019)

A word on trading liquidity for ETFs …

Hamilton ETFs are highly liquid ETFs that can be purchased and sold easily. ETFs are as liquid as their underlying holdings and the underlying holdings trade millions of shares each day.

How does that work? When ETF investors are buying (or selling) in the market, they may transact with another ETF investor or a market maker for the ETF. At all times, even if daily volume appears low, there is a market maker – typically a large bank-owned investment dealer – willing to fill the other side of the ETF order (at the bid/ask spread).

Notes

[1] LSE/Refinitiv transaction received anti-trust approval from EU anti-trust regulators on January 13, 2021.

[2] An Oliver Wyman study estimates that the total annual spend in the anti-financial crime space across global banks and brokers is ~$42 bln, of which ~$12.5 bln is spent on technology (+17% per year, through 2024E) – and $6 bln of this on AML/fraud.

[3] Source: NBF ETF Research

[4] U.S listed ESG ETFs saw inflows of $34bn in 2020 quadrupling AUM in this nascent ETF category (NBF ETF Research)