The Australian financial sector is among the highest quality and strongest in the world (and very similar to that of Canada). Moreover, Australia is one of the wealthiest countries in the world with GDP/capita nearly 20% higher than that of Canada. It is also forecast to be one of the world’s fastest growing developed economies in 2020 (at 2.4%1), providing a supportive backdrop to the financial sector.

Note to Reader: This Insight includes references to certain Hamilton ETFs that were active at the time of writing. On June 29, 2020, the following mergers took place: (i) Hamilton Global Financials Yield ETF and Hamilton Global Bank ETF into the Hamilton Global Financials ETF (HFG), (ii) Hamilton Australian Financials Yield ETF into the Hamilton Australian Bank Equal-Weight Index ETF (HBA); (iii) Hamilton Canadian Bank Variable-Weight ETF into the Hamilton Canadian Bank Mean Reversion Index ETF (HCA), and (iv) Hamilton U.S. Mid-Cap Financials ETF (USD) into the Hamilton U.S. Mid/Small-Cap Financials ETF (HUM).

Investors seeking a similar return/volatility profile to the Canadian financials – but looking for diversification – could consider Hamilton Australian Financials Yield ETF (ticker: HFA), which has a dividend yield of 6.4% (paid monthly) and is currency hedged.

As we discussed in Cdn/Australian Financials – Fraternal Twins with Low Correlations & Near Identical Risk Rewards, the return/volatility profile of the two sectors has been nearly identical over the last 5, 10, 15 and 20 years. Yet, somewhat surprisingly, the monthly returns of the two sectors are not highly correlated (~60%). Therefore, a key advantage for Canadians investing in the Australian financial sector is that it provides the opportunity to gain similar exposure to the Canadian financials sector, while also offering diversification. This is important since the Canadian financials (and banks, in particular) are highly correlated, and diversification benefits fall to nearly zero when adding positions beyond three core holdings.

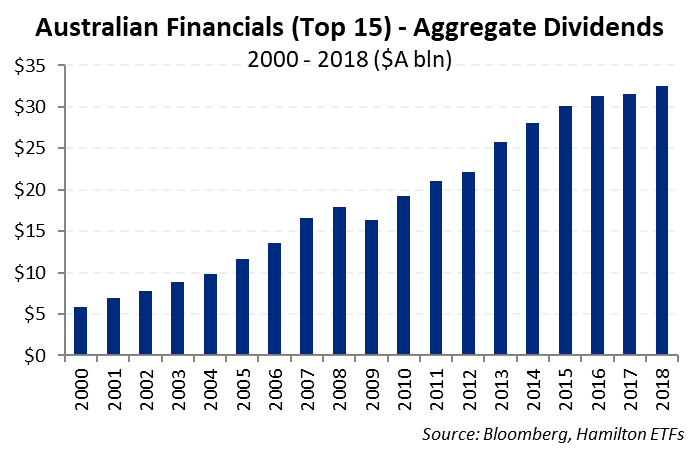

Anchored by some of the world’s best capitalized financials, strong earnings and high returns on capital, the Australian financial sector has been able to generate stable dividend growth over the long-term. As the chart below highlights, the largest 15 financials in Australia have reported strong and consistent dividend growth over the past 18 years.

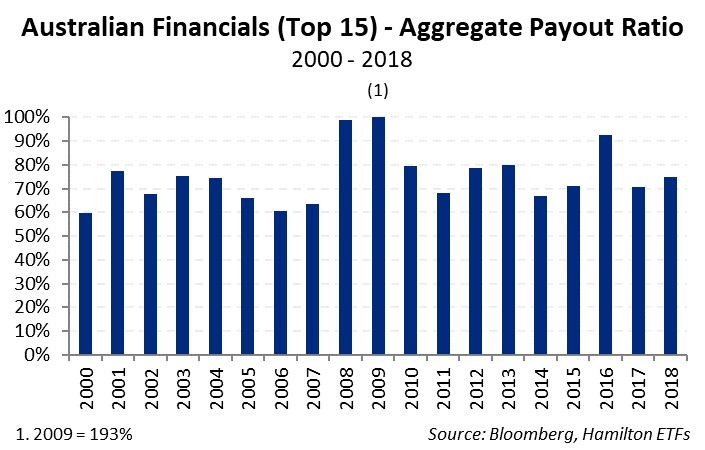

This consistent growth, combined with generally high dividend yields, makes the Australian financial sector attractive to investors, particularly those seeking income. The most important reason why Australian financials have such high dividend yields is that they have much higher payout ratios than most other global financial sectors. For example, the 2018 payout ratio for the top 15 financials in Australia was ~75%. (Although 2019 is not yet over, we expect this payout ratio to rise to ~80% for the year and for dividend growth to be roughly flat as the sector absorbs expenses largely resulting from the Royal Commission report.)

In effect, the Australian financial sector pays out virtually all capital not needed to fund organic growth in the form of dividends. This is made possible by the fact the Australian financial sector largely eschews foreign expansion, increasing the amount of capital available to return to shareholders. This is different from the Canadian financials, many of which have active foreign expansion strategies; their lower payout ratios (~40%) free up capital to fund those acquisitions.

Notwithstanding their outstanding record of dividend growth and stability, the Australian financials have, from time to time, reduced their dividends if earnings were set to decline or they needed capital (often to meet rigorous regulatory requirements). Because the Australian financials pay out nearly all capital to shareholders, it is well understood in the local market that modest dividend reductions – however infrequent – may occur, and as such, are generally not met with a severe market reaction2. In fact, slight dividend reductions in some cases have even been met positively by the market (when seen as prudent/conservative).

With strong earnings and payout ratios closer to 40%, the Canadian banks have been able to maintain growing dividends, preferring in times of distress to issue equity to replace lost capital versus reducing dividends (for example, in the face of enormous losses during the financial crisis, CIBC raised billions in equity, in lieu of cutting its dividend).

Australian Financials: History of Strong and Stable Dividends

In our view, Canadian investors seeking a return/volatility profile similar to that of the Canadian banks but looking for diversification could consider adding exposure to the Australian financials as an alternative, including the currency-hedged Hamilton Australian Financials Yield ETF (HFA), which has a yield of 6.4%, paid monthly. Over the years, the sector’s strong total return performance has been underpinned by a history of high payout ratios and strong dividend growth.

Related Notes

Cdn/Australian Financials: Fraternal Twins with Low Correlations & Near Identical Risk Rewards (September 6, 2019)

Election, RBA and Regulators Provide Good News for Australian Financials (May 21, 2019)

Cdn/Aust’n Banks: Why the Big Housing Short is So Difficult (and the Risk of Direct Hit Remains Low) (April 9, 2019)

Australian Banks Outperformed the Canadian Banks During the Financial Crisis (December 17, 2018)

Dividend-Heavy Australian Financials: History of Outperformance vs Canadian Peers (December 17, 2018)

A word on trading liquidity for ETFs …

Hamilton ETFs are highly liquid ETFs that can be purchased and sold easily. ETFs are as liquid as their underlying holdings and the underlying holdings trade millions of shares each day.

How does that work? When ETF investors are buying (or selling) in the market, they may transact with another ETF investor or a market maker for the ETF. At all times, even if daily volume appears low, there is a market maker – typically a large bank-owned investment dealer – willing to fill the other side of the ETF order (at net asset value plus a spread). The market maker then subscribes to create or redeem units in the ETF from the ETF manager (e.g., Hamilton ETFs), who purchases or sells the underlying holdings for the ETF.