The Australian financial sector is among the highest quality and strongest in the world. It is also very similar to the Canadian financial sector. Arguably, there are no two financial sectors globally that more closely resemble each other than Canada and Australia. A desire to provide Canadians with exposure to this great sector is why we launched the Hamilton Australian Financials Yield ETF (HFA), which has a 6%+ yield with monthly distributions.

Note to Reader: This Insight includes references to certain Hamilton ETFs that were active at the time of writing. On June 29, 2020, the following mergers took place: (i) Hamilton Global Financials Yield ETF and Hamilton Global Bank ETF into the Hamilton Global Financials ETF (HFG), (ii) Hamilton Australian Financials Yield ETF into the Hamilton Australian Bank Equal-Weight Index ETF (HBA); (iii) Hamilton Canadian Bank Variable-Weight ETF into the Hamilton Canadian Bank Mean Reversion Index ETF (HCA), and (iv) Hamilton U.S. Mid-Cap Financials ETF (USD) into the Hamilton U.S. Mid/Small-Cap Financials ETF (HUM).

Note to Reader: On September 3, 2019, we announced the proposed acquisition of the Purpose Global Financials Income Fund (ticker: PFG), which if approved will be merged with the Hamilton Australian Financials Yield ETF (ticker: HFA). For additional information, see the joint press release. Please email [email protected] if you hold PFG or have questions.

We believe Canada and Australia and their financial sectors are akin to fraternal twins. Like fraternal twins, they have a common parentage (as former British colonies) and similar upbringing (becoming independent within 25 years of each other). The two countries also possess common, but not identical, traits, including similar political systems, economies (with large resource sectors), population size, demographic profiles (strong, supported by immigration) allowing both countries to enjoy high GDP/capita.

Both countries also structured their financial sectors to be anchored by a dominant oligopoly banking sector overseen by a federal regulator (OSFI, APRA) separate and apart from the central bank (BoC, RBA). Their most important difference is that unlike their Canadian peers, the Australian financials largely eschew foreign expansion, preferring to pay out virtually all capital not required for growth in the form of dividends (which supports their higher-than-Canadian dividend yields).

Australian financials offer nearly identical return/volatility to Canadian peers …

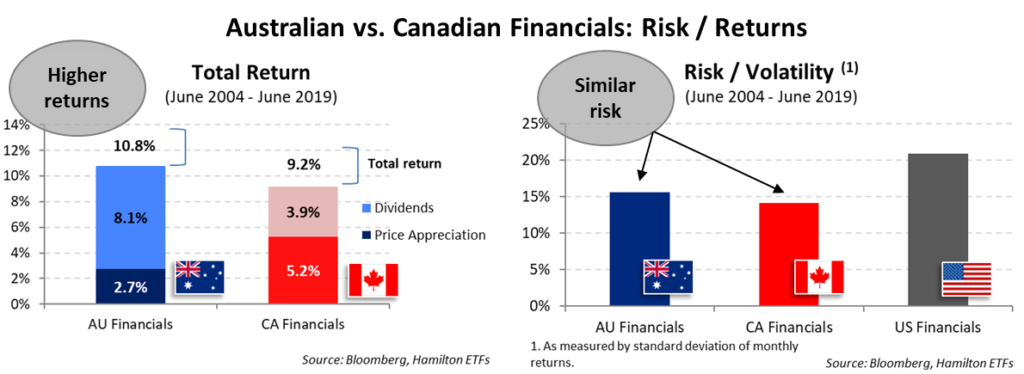

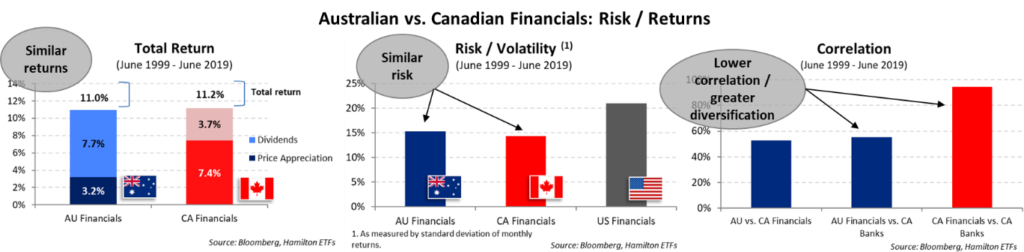

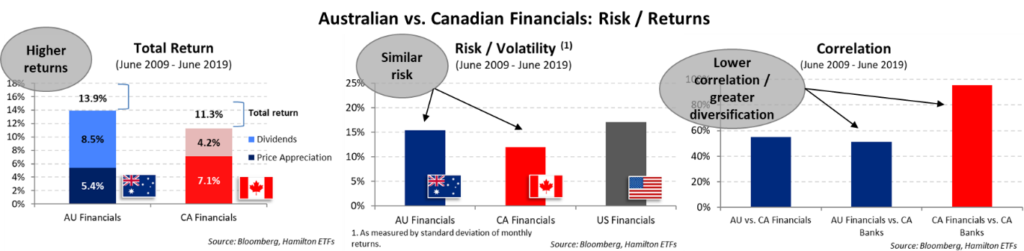

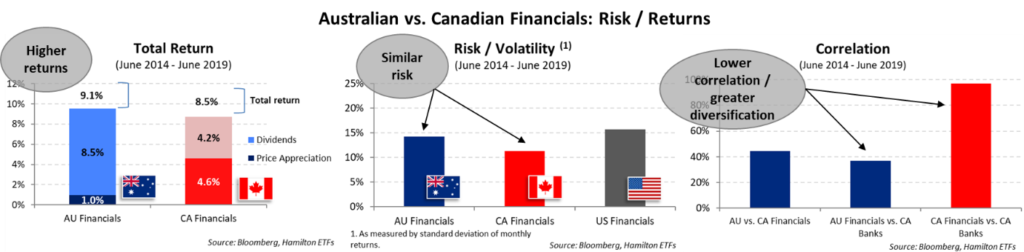

Given these significant similarities, it is not surprising that the two financial sectors have produced nearly identical returns and volatility over the past 5, 10, 15 and 20 years. As the charts below highlight, in the last 15 years, the Australian financials outperformed their Canadian counterparts, generating a 10.8% annualized return compared to 9.2% for the Canadian financials (left). In fact, the Australian banks even outperformed the Canadian banks during the global financial crisis. One of the main reasons the Australian financials have historically outperformed the Canadian financials is because Australia has generally produced higher GDP growth[1].

Of note, the aforementioned returns were generated with nearly identical volatility (right). This volatility was notably lower than their global peers, including the U.S. financials. These conclusions are the same using 5, 10 or 20 year periods – see charts at the bottom of this Insight.

… BUT, adding Australia provides diversification not achieved by adding more Canadian financials

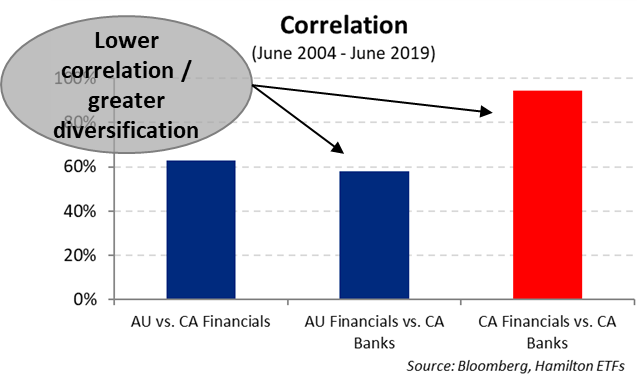

While the return/volatility profile of the two sectors has been nearly identical over the past two decades, they were not very correlated with each other[2]. As the chart illustrates, Canadian investors seeking to increase their financials exposure but achieve greater diversification could benefit from adding Australian financials (versus adding another Canadian financial holding).

This is an important differentiator since it helps Canadian investors cope with two challenges they face when considering individual and aggregate Canadian financials exposures (especially their bank holdings). The first challenge is concentration risk – the Canadian financial sector has few names of size, which often results in very large weights of particular holdings. The second is the extremely high correlations of the share prices of the individual holdings, which severely limits the benefits of diversification from adding additional Canadian names.

This brings us to HFA.

Australian vs Canadian financials: Taking different paths to the same destination

Until last December’s launch of the Hamilton Australian Financials Yield ETF (HFA), Canadian investors seeking exposure to sectors with a similar historical risk/reward to that of the Canadian banks/financials had limited options. As a result, many investors would default to simply adding additional Canadian financials exposure, without realizing the high correlations within the sector largely offset any possible diversification benefits. This is especially true for Canadian bank investors given the bank stocks’ significant historical correlation and mean reversion tendencies (of which our Hamilton Canadian Banks Variable-Weight ETF (HCB) is designed to benefit).

This is, however, not the case when adding Australian financials to a portfolio of Canadian financials. Although they have generated similar returns over the past two decades, the Australian financials have generally taken a different path to end up at the same destination as their Canadian peers. For this reason, we believe HFA provides Canadian investors with very similar exposure to their favoured Canadian financials, but critically, also provides diversification.

Additional Charts for Last 5, 10, and 20 Years

Last 20 Years

Last 10 Years

Last 5 Years

____

A word on trading liquidity for ETFs …

Hamilton ETFs are highly liquid ETFs that can be purchased and sold easily. ETFs are as liquid as their underlying holdings, and the underlying holdings trade millions of shares each day.

How does that work? When ETF investors are buying (or selling) in the market, they may transact with another ETF investor or a market maker for the ETF. At all times, even if daily volume appears low, there is a market maker – typically a large bank-owned investment dealer – willing to fill the other side of the ETF order (at net asset value plus a spread). The market maker then subscribes to create or redeem units in the ETF from the ETF manager (e.g., Hamilton ETFs), who purchases or sells the underlying holdings for the ETF.

Related Insights

Election, RBA and Regulators Provide Good News for Australian Financials (May 21st, 2019)

Cdn/Aust’n Banks: Why the Big Housing Short is So Difficult (and the Risk of “Direct Hit” Remains Low) (April 9th, 2019)

Australian Banks Outperformed the Canadian Banks During the Global Financial Crisis (December 17th, 2018)

Dividend-Heavy Australian Financials: History of Outperformance vs Canadian Peers (December 17th, 2019)

Notes

[1] While the outlook from both countries is contingent on many factors, it is worth noting that economists forecast Australia (and New Zealand) to – again – generate higher GDP growth than Canada in 2019 and 2020.. Source: Bloomberg.

[2] As measured by standard deviation of the monthly returns for the Australian financial (MSCI Australia Financials Index) Canadian bank (S&P/TSX Diversified Banks Total Return Index) and Canadian financial (MSCI Canada Financials Index) indices.

Note: Comments, charts and opinions offered in this commentary are produced by Hamilton ETFs and are for information purposes only. They should not be considered as advice to purchase or to sell mentioned sec