In 2022, our blue-chip Hamilton Australian Banks Equal Weight Index ETF (HBA) outperformed its 38 competitor financials ETFs, by rising ~1%, making it the top performing financials ETF in Canada – foreign or domestic[1]. This is the second year in a row that Hamilton ETFs had the top performing financials ETF in Canada[2]. In fact, HBA – which has a yield of 5.8% – was the…

Commentary: HBA

Australian Banks: Robust Earnings and Large Capital Return

A strong recovery of the Australian economy is underway as evidenced by the solid earnings growth seen at the Australian banks in their most recent reporting season. In this insight, we discuss the positive trends impacting the sector. Specifically, we elaborate on the recent operating results (both earnings drivers and capital returns), and other positive trends including economic growth supported by further reopening as well as…

Australian Banks: Earnings Recovery in Progress; Massive Capital Return Ahead

The recovery of the Australian economy and banks is accelerating. In this insight, we discuss how the Australian banking sector – one of the world’s strongest – has firmly entered the recovery stage of the credit cycle and what that means for share prices. In the past, we have described the Canadian and Australian banking sectors as being akin to fraternal twins given their significant similarities,…

Australian Banks: Entering Recovery Stage of Credit Cycle (in 6 Charts)

In this insight, we share 6 charts that, in our view, indicate that the Australian banking sector – one of the world’s strongest – has entered the recovery stage of the credit cycle, which should be supportive of share prices. In the past, we have described the Canadian and Australian banking sectors as being akin to fraternal twins given their significant similarities, as well as those…

Australian Banks: Outperformance vs Canada (akin to Canadian Bank #4)

In this insight we review the performance of the Australian banks versus the Canadian banks and discuss why Canadian bank investors should consider the Hamilton Australian Bank Equal-Weight Index ETF (ticker: HBA). Launched on June 29, 2020, HBA aims to replicate (net of fees) the performance of the Solactive Australian Bank Equal-Weight Index TR (SOLBAEWT) and is currency hedged. The SOLBAEWT index, which tracks the performance…

Hamilton ETFs Announces Proposed Merger of Hamilton Australian Financials Yield ETF into Hamilton Australian Bank Equal-Weight Index ETF

Toronto, Ontario – April 28, 2020 – Hamilton Capital Partners Inc. (“Hamilton ETFs”) is pleased to announce the next phase of enhancements to its investment fund platform. Subject to all required unitholder and regulatory approvals, Hamilton ETFs is proposing to merge (the “Merger”) Hamilton Australian Financials Yield ETF (TSX: HFA, the “Terminating Fund”) into Hamilton Australian Bank Equal-Weight Index ETF (proposed TSX ticker: HBA, the “Continuing…

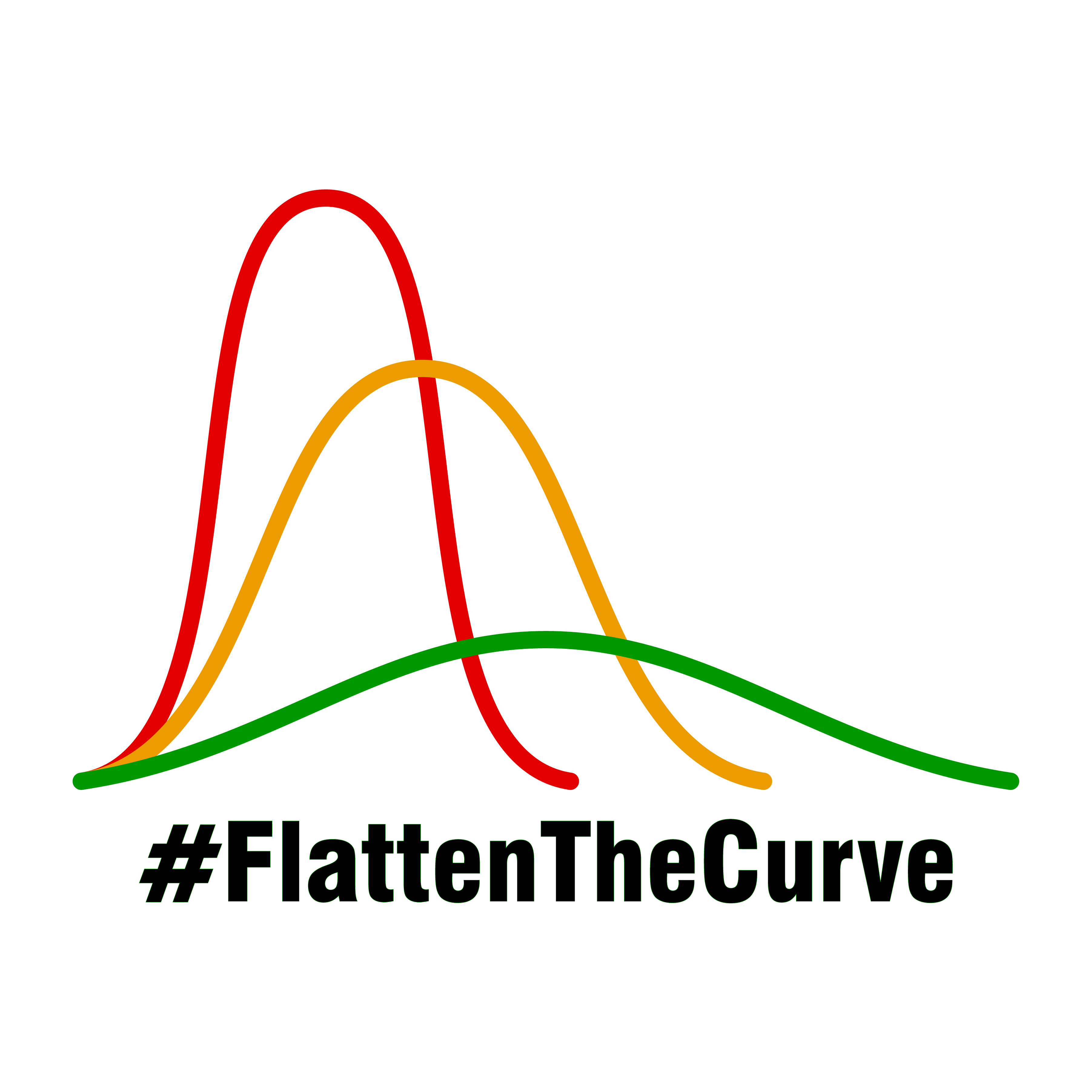

One Chart: Australia Appears to be Flattening the Curve Ahead of Other Countries (including Canada)

In our Insight, “Financials: Does COVID-19 Represent a Growth Scare, Credit Event or Crisis” (March 25, 2020), we discussed the implications of the global economy moving swiftly into an undetermined period of negative economic growth which has caused stocks to fall sharply. One critical variable for every country will be when they can restart their economies, which will be heavily influenced by each country’s ability to…

Update: HFA Outperforming the Canadian Banks with Lower Volatility (in Charts)

The Hamilton Australian Financials Yield ETF (HFA) invests in one of the world’s best financial sectors, anchored by some of the world’s best capitalized banks. As evidence of the quality of the Australian financial sector, the Australian banks outperformed the Canadian banks during the global financial crisis. This strong historical performance is underpinned by the fact Australia is a higher performing economy, with GDP growth consistently…

HFA: Identical Return to the Canadian Banks with Much Lower Volatility (and Lower Correlations)

The Hamilton Australian Financials Yield ETF (HFA) recently celebrated its one-year anniversary. Although the global financials and the Canadian banks experienced significant volatility since its launch in December 2018, HFA has produced consistent monthly returns and dividends as well as identical returns to the Canadian banks, but with much lower volatility (and relatively low correlations). Note to Reader: This Insight includes references to certain Hamilton ETFs…

Australian Financials: History of Strong/Stable Dividend Growth

The Australian financial sector is among the highest quality and strongest in the world (and very similar to that of Canada). Moreover, Australia is one of the wealthiest countries in the world with GDP/capita nearly 20% higher than that of Canada. It is also forecast to be one of the world’s fastest growing developed economies in 2020 (at 2.4%), providing a supportive backdrop to the financial…

Cdn/Aust’n Financials: Fraternal Twins w/ Low Correlations & Near Identical Risk Rewards

The Australian financial sector is among the highest quality and strongest in the world. It is also very similar to the Canadian financial sector. Arguably, there are no two financial sectors globally that more closely resemble each other than Canada and Australia. A desire to provide Canadians with exposure to this great sector is why we launched the Hamilton Australian Financials Yield ETF (HFA), which has…

Election, RBA and Regulators Provide Good News for Australian Financials

The Hamilton Capital Australian Financials Yield ETF (HFA) was launched in December 2018, with a targeted yield of 6.5% or higher, paid monthly (aided by covered calls). The Australian financials have a history of long-term outperformance versus the Canadian financials with lower volatility (including during the global financial crisis). Note to Reader: This Insight includes references to certain Hamilton ETFs that were active at the time of writing.…