The Hamilton Australian Financials Yield ETF (HFA) recently celebrated its one-year anniversary. Although the global financials and the Canadian banks experienced significant volatility since its launch in December 2018, HFA has produced consistent monthly returns and dividends as well as identical returns to the Canadian banks, but with much lower volatility (and relatively low correlations).

Note to Reader: This Insight includes references to certain Hamilton ETFs that were active at the time of writing. On June 29, 2020, the following mergers took place: (i) Hamilton Global Financials Yield ETF and Hamilton Global Bank ETF into the Hamilton Global Financials ETF (HFG), (ii) Hamilton Australian Financials Yield ETF into the Hamilton Australian Bank Equal-Weight Index ETF (HBA); (iii) Hamilton Canadian Bank Variable-Weight ETF into the Hamilton Canadian Bank Mean Reversion Index ETF (HCA), and (iv) Hamilton U.S. Mid-Cap Financials ETF (USD) into the Hamilton U.S. Mid/Small-Cap Financials ETF (HUM).

As we have previously written, with nearly identical return/volatility profiles over the past 5, 10, 15 and 20 years, the Canadian and Australian financials are, in our view, akin to fraternal twins.

HFA’s first year underscored this dynamic.

HFA up 12.4%[1], identical return to the Canadian banks …

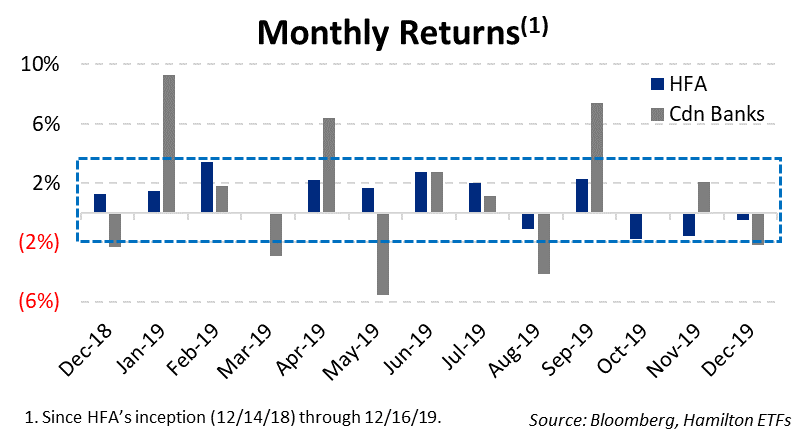

Since its inception, Hamilton Australian Financials Yield ETF has risen 12.42%, nearly identical to the Canadian banks[2]. Importantly, HFA generated this return with MUCH lower volatility than the Canadian banks. In fact, as the chart below highlights, the Canadian banks generated returns outside of HFA’s range in 7 of the 12 completed months.

… with significantly lower volatility/drawdown …

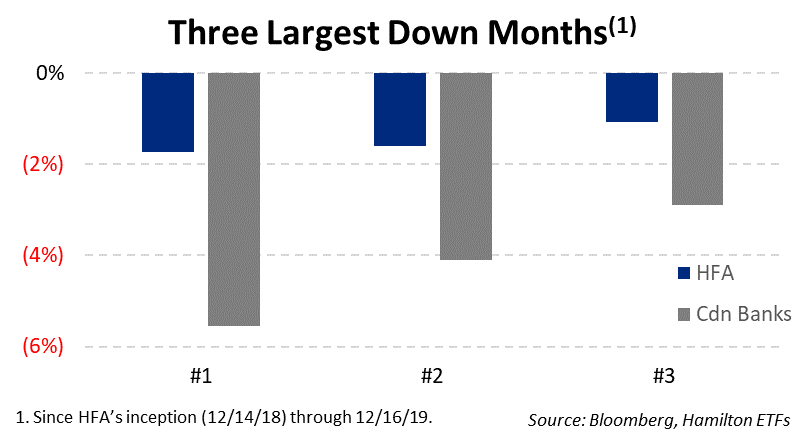

HFA also experienced lower drawdowns (versus the Canadian banks) over the year despite periods of heightened volatility, particularly surrounding the U.S. and China trade tensions that have been persistent since the ETF launched. Even with the ongoing trade tensions as well as regulatory risk for Australian banks rising in October, the three largest monthly declines of HFA were significantly lower than those of the Canadian banks.

In our view, regulatory risk is the biggest country-specific risk to investors of Australian financials. APRA[3] is among the strictest regulators in global banking. This is in stark contrast to OSFI, which is notable for its “light touch” pro-bank approach (relative to global peers). That said, we would point out that, over the past decade, multiple compression from rising regulatory risk has generally unwound as the risk recedes, implying the potential for multiple expansion from several of HFA’s holdings in the next 12-18 months.

… and with relatively low correlations

We believe a key benefit of HFA to Canadian investors is its relatively low correlations to both Canadian and U.S. bank/financial stocks. Canadian investors are aware that the correlations between the individual large-cap financials are extremely high, limiting diversification benefits. In fact, the Canadian banks are so highly correlated with one another that investors statistically achieve zero diversification benefit for each Canadian bank position after bank #3[4]. Therefore, investors adding Canadian bank #4 are not benefiting from diversification in the form of lower portfolio volatility (nor are they experiencing higher returns).

HFA: Canadian bank-like returns with lower correlations from a world class financial sector

The Australian financial sector is among the best in the world, and it operates in a higher growth economy. It is also worth noting that the Australian banks outperformed the Canadian banks during the global financial crisis. In the upcoming year, the Australian economy is forecast to grow by 2.4%, notably higher than the Canadian economy, which is forecast to grow at 1.6%[5].

As we explained in our “Fraternal Twins” insight, the Australian and Canadian financial sectors have exhibited similar returns/volatility, but with lower correlations to one another[6]. In our view, investors seeking a return/volatility profile very similar to the Canadian banks/financials – but with diversification – should consider the Hamilton Australian Financials Yield ETF (HFA), which has a dividend yield of 6.54%, paid monthly.

Notes

[1] Since inception through December 18, 2019.

[2] As of December 18, 2019. The Canadian banks were up 12.47% over the same period.

[3] Australian Prudential Regulation Authority

[4] From November 2009 to November 2019, there was no diversification benefit to having 4 vs. 3 Canadian bank positions.

[5] As of December 18, 2019. Source: Bloomberg.

[6] See our insight “Cdn/Australian Financials – Fraternal Twins with Low Correlations & Near Identical Risk Rewards” (September 6, 2019)

Related Insights

Australian Financials: History of Strong/Stable Dividend Growth (November 6, 2019)

Cdn/Australian Financials: Fraternal Twins with Low Correlations & Near Identical Risk Rewards (September 6, 2019)

Election, RBA and Regulators Provide Good News for Australian Financials (May 21, 2019)

Cdn/Aust’n Banks: Why the Big Housing Short is So Difficult (and the Risk of Direct Hit Remains Low) (April 9, 2019)

Australian Banks Outperformed the Canadian Banks During the Financial Crisis (December 17, 2018)

Dividend-Heavy Australian Financials: History of Outperformance vs Canadian Peers (December 17, 2018)

A word on trading liquidity for ETFs …

Hamilton ETFs are highly liquid ETFs that can be purchased and sold easily. ETFs are as liquid as their underlying holdings and the underlying holdings trade millions of shares each day.

How does that work? When ETF investors are buying (or selling) in the market, they may transact with another ETF investor or a market maker for the ETF. At all times, even if daily volume appears low, there is a market maker – typically a large bank-owned investment dealer – willing to fill the other side of the ETF order (at net asset value plus a spread). The market maker then subscribes to create or redeem units in the ETF from the ETF manager (e.g., Hamilton ETFs), who purchases or sells the underlying holdings for the ETF.