A strong recovery of the Australian economy is underway as evidenced by the solid earnings growth seen at the Australian banks in their most recent reporting season. In this insight, we discuss the positive trends impacting the sector. Specifically, we elaborate on the recent operating results (both earnings drivers and capital returns), and other positive trends including economic growth supported by further reopening as well as vaccination levels comparable to Canada and the U.K. (and well above the U.S.).

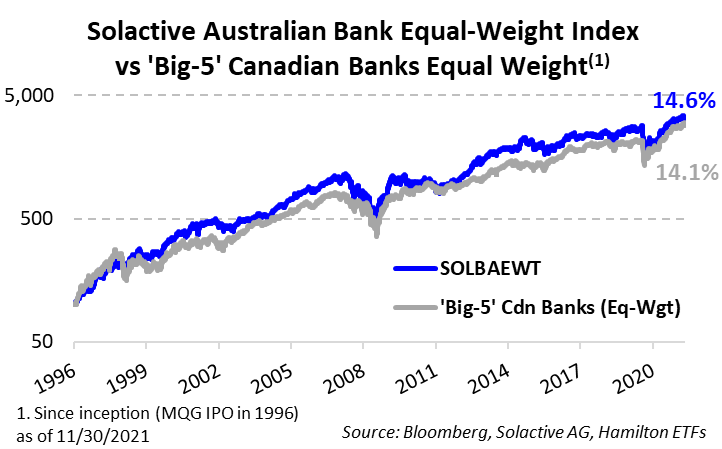

Given the Australian banks are among the strongest banks in the world, with a nearly identical historical risk/reward profile to the Canadian banks – but are not overly correlated – we believe Canadian investors should consider the Hamilton Australian Bank Equal-Weight Index ETF (HBA) as a complement to their core Canadian banks positions. Historically, a portfolio of Canadian and Australian banks has produced a higher return with lower volatility than a portfolio composed exclusively of banks from either country, generating a higher Sharpe Ratio (return, per unit of risk). Our Hamilton Global Financials ETF (HFG) has a 6% weighting in Australian banks as part of its ~40% weighting in banks. As the chart below highlights, the Australian banks have a history of outperformance versus the Canadian banks over the last 25 years (chart, left).

Yet, despite Australia having one of the best pandemic responses globally and its banks experiencing a comparatively milder credit cycle, Australian bank stocks have not recovered as sharply as their Canadian peers since the lows of March 2020. The Canadian banks benefited from a powerful and rapid recovery in investor sentiment and massive fiscal stimulus. Australia took a more conservative fiscal path even though it entered the pandemic with a debt-to-GDP of less than half of Canada. We believe the Australian banks offer a favourable risk/reward supported by the following:

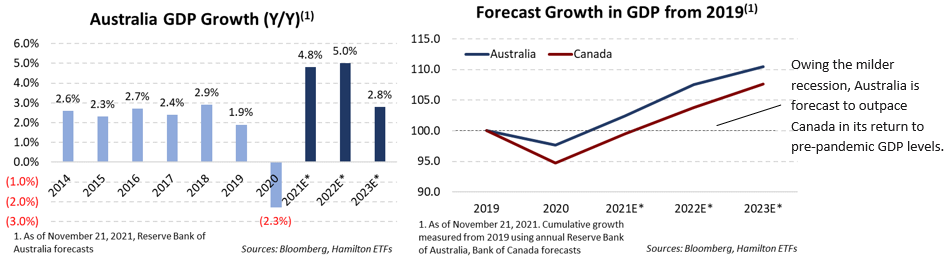

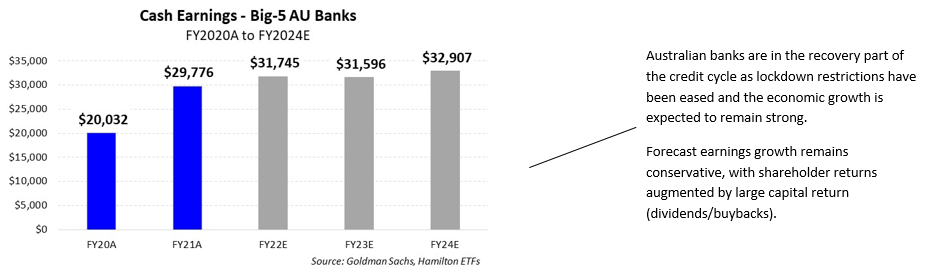

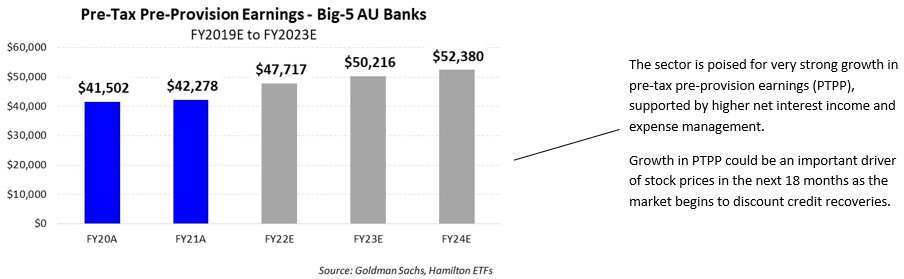

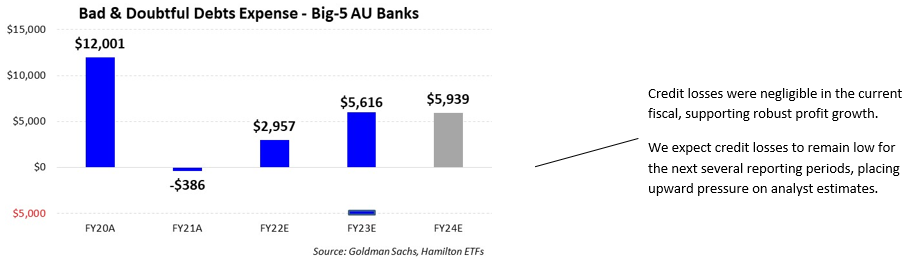

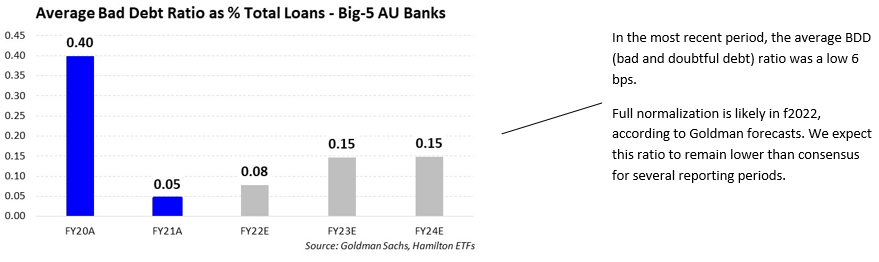

First, the sector continues to recover. As highlighted in charts below, earnings growth was nearly 50% supported by a near elimination of credit losses as ratio of bad and doubtful debts (or BDD). In the most recent semi-annual period, every single bank reported reserve releases which allowed the banks to report aggregate credit losses of close to zero. As a result, BDD ratio declined to 5 bps of loans, well below a mid-cycle average of 25 bps[1]. The banks also benefited from an impressive operating leverage of ~170 bps as revenues expanded (~0.6%) while expenses declined (~1.1%). Goldman Sachs (GS) forecasts aggregate earnings in the next two semi-annual periods to be ~10% – a very solid result. Even more important, GS currently forecasts pre-tax pre-provision earnings to grow by over 15% over the next two years.

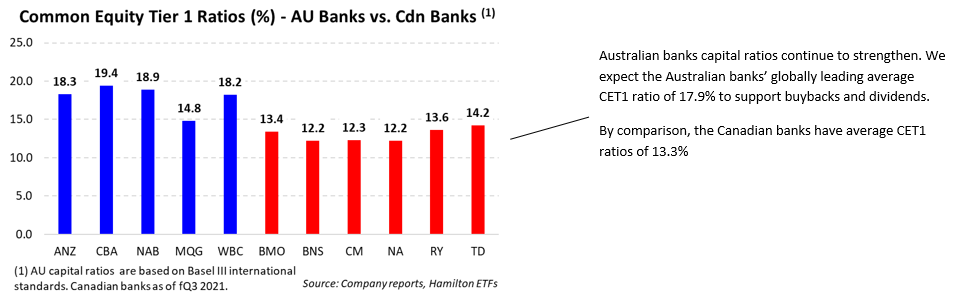

Second, capital return was substantial, and should remain so. The Australian banks remain among the best capitalized banks globally, with common equity tier one ratios of ~18% – well above the Canadian banks at 13%. Dividends essentially doubled, from their pandemic depressed levels and Goldman Sachs forecasts a further 10% growth this year supported by earnings growth. Post-pandemic, we expect payout ratios will normalize at ~65%, though well below 80% before the cycle began. As a result, we expect dividend yields should normalize at over 6.0%, a high level by global standards, but lower than pre-pandemic levels.

Capital return from buybacks should also be meaningful as four of the big-five Australian banks have announced billion-dollar buybacks. Collectively, the excess capital to be returned to shareholders by the four majors in the form of buybacks alone stands at $13.5 bln (~3% of market cap)[2] with the potential to increase. With the Australian banks carrying very substantial excess capital, we anticipate capital return to remain a very important driver of share prices.

Third, the economic outlook remains positive. As mentioned, Australia experienced a milder recession and in turn less severe credit cycle as a result of the pandemic. Recent RBA estimates expect the Australian economy to grow at a robust 5.0% pace in 2022 before moderating to 2.8% in 2023. Because Australia was one of the world leaders in preventing the spread of COVID, this initially reduced slowed the impetus for a rollout of vaccinations. However, this has changed dramatically in recent months. As of December 13, 2021, the Australia’s Department of Health reports that ~90% of the adult population (i.e., 16 years and above) in Australia is fully vaccinated. As a result of its rapid vaccination drive, Australia was successful in re-opening its international borders earlier this month.

In addition, the Reserve Bank of New Zealand became the first developed world central bank to exit post-pandemic ultra-loose monetary policy raising policy rates by 25 bps last month, and then again by 25 bps last week. The rate hikes should be supportive of margins for New Zealand loan books, which accounts for ~10-15% of total loans at the big-4 Australian majors.

Below, we include 5 charts that show the impact of the credit cycle and the expected pace of recovery (using Goldman Sachs forecasts) following the most recent reporting (quarterly/semi-annual, depending on the bank).

Note to reader: Unlike the Canadian banks, the Australian banks have different reporting periods[3]. The charts below reflect the totals for the fiscal periods indicated, which substantially overlap, but are not completely aligned. Ratios represent an average of the Big-5 Australian banks. Actual results are indicated in blue, while grey represent Goldman Sachs forecasts.

As noted above, an equal weight portfolio of Australian banks has outperformed an equal weight portfolio of Canadian banks in the last 25 years (i.e., since Macquarie went public in the late 1990’s). In our view, the ongoing powerful recovery in earnings and dividends forms a favourable backdrop for the Hamilton Australian Bank Equal-Weight Index ETF (HBA). Given the similarities of the long-term return/volatility profile of the two sectors, we believe HBA is an attractive complement to domestic investors seeking “Canadian bank-like” exposure, but with added diversification benefits and a yield of over 5%.

Recent Insights

Australian Banks: Earnings Recovery in Progress; Massive Capital Return Ahead (May 25, 2021)

Australian Banks: Entering Recovery Stage of Credit Cycle (in 6 Charts) (August 28, 2020)

Australian Banks: Outperformance vs Canada (akin to Canadian Bank #4) (July 8, 2020)

One Chart: Australia Appears to be Flattening the Curve Ahead of Other Countries (including Canada) (April 2, 2020)

____

A word on trading liquidity for ETFs …

Hamilton ETFs are highly liquid ETFs that can be purchased and sold easily. ETFs are as liquid as their underlying holdings and the underlying holdings trade millions of shares each day.

How does that work? When ETF investors are buying (or selling) in the market, they may transact with another ETF investor or a market maker for the ETF. At all times, even if daily volume appears low, there is a market maker – typically a large bank-owned investment dealer – willing to fill the other side of the ETF order (at net asset value plus a spread). The market maker then subscribes to create or redeem units in the ETF from the ETF manager (e.g., Hamilton ETFs), who purchases or sells the underlying holdings for the ETF.

[1] Source: RBA

[2] Recently announced buybacks are: ANZ $1.5 bln, NAB $2.5 bln, CBA $6 bln, WBC $3.5bn

[3] NAB, WBC and ANZ have September year-ends, while CBA and MQG have June and March year-ends, respectively. The banks report full results on a semi-annual basis, and less detailed trading updates quarterly.