In this One Chart, we compare the volatility profile of 1.25x the Solactive Canadian Bank Mean Reversion index (SOLCBMRT) – which the Hamilton Enhanced Canadian Bank ETF (ticker, HCAL) seeks to replicate before fees – to that of the Big-6 Canadian banks. We believe HCAL is a good choice for long-term investors, as its modest leverage offers the potential for higher returns in a steadily growing…

Insights: One Chart

Canadian Banks: Outperformance from Mean Reversion (in 7 Charts)

As all Canadian investors know, the stock prices of the Canadian banks are highly correlated, and the individual banks have generated similar returns over long periods of time. Over the past several decades, the Canadian banks that have underperformed tended to catch up to those that outperformed, and vice versa – i.e., their performance was “mean reverting”. In this Insight, we discuss these mean reversion tendencies…

Canadian Banks: Three Vulnerable Loan Exposures (in Charts)

In our Insight, Financials: Does COVID-19 Represent a Growth Scare, Credit Event or Crisis (March 25, 2020), we discussed the implications of the global economy moving swiftly into an undetermined period of negative economic growth. For the banks, we fully expect the result will be a credit cycle. Although the peak of losses and the duration are very much unknown, we believe this credit cycle is likely…

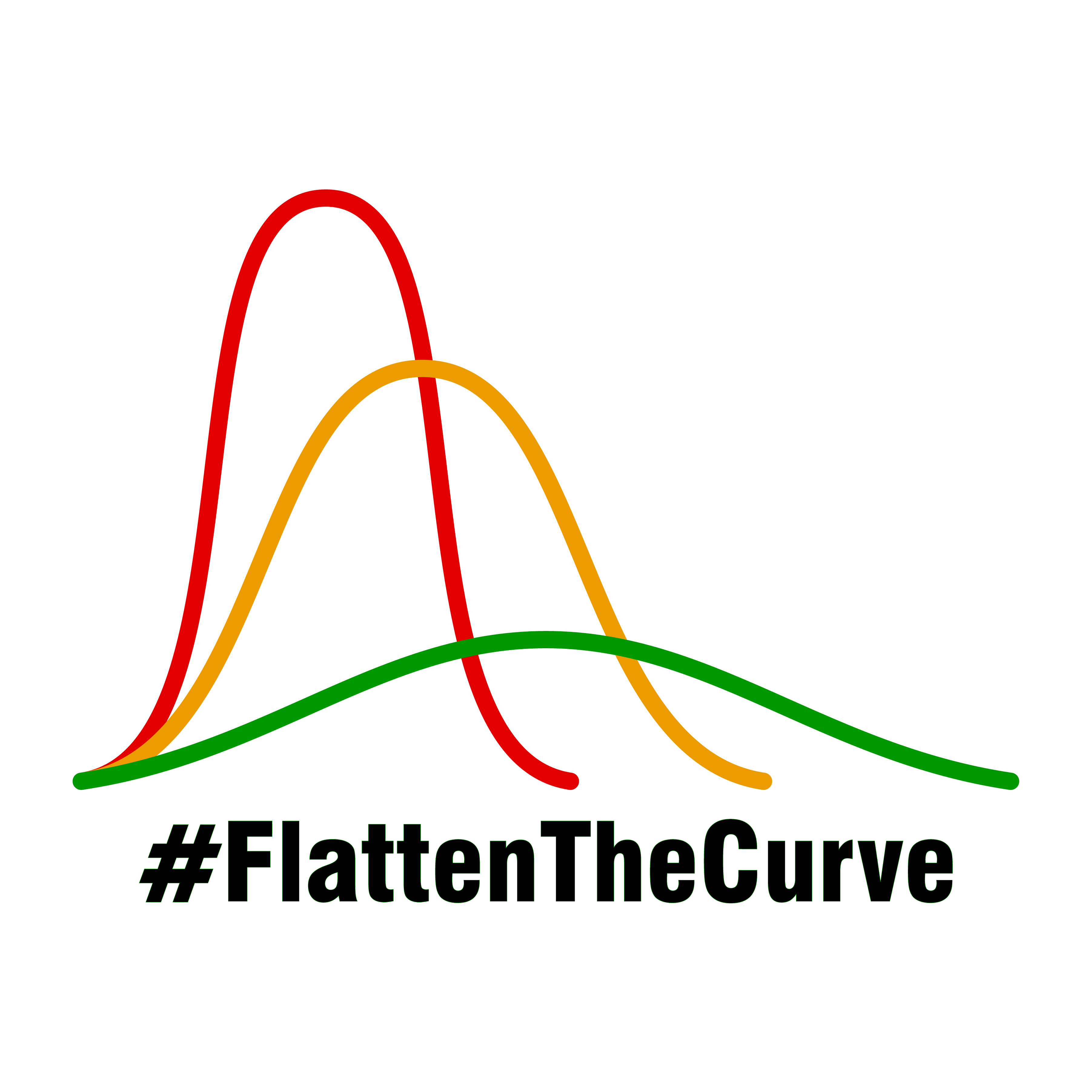

One Chart: Australia Appears to be Flattening the Curve Ahead of Other Countries (including Canada)

In our Insight, “Financials: Does COVID-19 Represent a Growth Scare, Credit Event or Crisis” (March 25, 2020), we discussed the implications of the global economy moving swiftly into an undetermined period of negative economic growth which has caused stocks to fall sharply. One critical variable for every country will be when they can restart their economies, which will be heavily influenced by each country’s ability to…

Update: HFA Outperforming the Canadian Banks with Lower Volatility (in Charts)

The Hamilton Australian Financials Yield ETF (HFA) invests in one of the world’s best financial sectors, anchored by some of the world’s best capitalized banks. As evidence of the quality of the Australian financial sector, the Australian banks outperformed the Canadian banks during the global financial crisis. This strong historical performance is underpinned by the fact Australia is a higher performing economy, with GDP growth consistently…

One Chart: When/Where the Canadian Banks Spent US$32 bln on U.S. Banks

All Canadian bank investors know that expansion into the U.S. personal and commercial (“P&C”) banking sector remains the focal point of capital deployment for the Canadian banks. In fact, US banking has been – by far – the largest destination of capital deployment since 2004 (when TD Bank acquired a majority stake in Banknorth), with the Canadian banks having spent a huge US$30 bln. The chart…

One Chart: U.S. Bank M&A Doubles in 2019 (and Why We Expect More)

In the 10+ years since the global financial crisis, deal values in U.S. bank M&A have been slow to reach pre-crisis levels. This is notable since in the nearly 25 years preceding the financial crisis bank M&A was an important theme (particularly between 1995 to 2007) as the chart below highlights. Note to Reader: This Insight includes references to certain Hamilton ETFs that were active at…

Canadian Banks: One Chart Showing Higher Volatility Since New PCL Accounting Took Effect

In April we wrote an Insight in which we explained why we believed the volatility of Canadian bank stocks was likely to rise[1]. Specifically, we cited two reasons: (i) rising acquisition risk, and (ii) implementation of the new provision accounting (IFRS 9). Since the first reporting season (February 2018) following the introduction of this new provision accounting, it does appear that the monthly volatility for the…

European Banks in Charts: Credit Normalization vs. Margins

The European banking sector includes some of the world’s largest banks, making its health and profitability very important to the global markets. Given the sustained weakness in the sector (the STOXX Europe 600 Banks has fallen ~30% since the beginning of 2018), we thought it would be helpful to review key balance sheet and income statement trends – in 14 charts – since the European sovereign…

U.S. Banks: Mega-Caps’ Q4 Results in 4 Charts

With reporting season now over, we thought we would offer some key takeaways for the four U.S. mega-cap banks (JPM, C, BAC, WFC). Given that these four firms account for over 33% of the U.S. financials index (S5FINL Index), they have a significant/disproportionate impact on the overall sector’s results and are therefore worth following. In this note, we show operating earnings trends for each bank. As…

Canadian Banks: More Risky vs. Less Risky Loans in One Chart

At present, the Canadian banks have outstanding asset quality. Although provisions rose notably for the second consecutive quarter in Q2, provision and gross impaired loan ratios remain below long-term averages. With Q3 reporting beginning August 23rd, we believe the market will be focused on two areas of potential deterioration: (i) energy loans (which have been driving higher loan losses), and (ii) Alberta consumer, particularly uninsured.