The Hamilton Australian Financials Yield ETF (HFA) invests in one of the world’s best financial sectors, anchored by some of the world’s best capitalized banks. As evidence of the quality of the Australian financial sector, the Australian banks outperformed the Canadian banks during the global financial crisis. This strong historical performance is underpinned by the fact Australia is a higher performing economy, with GDP growth consistently higher than that of Canada.

Note to Reader: This Insight includes references to certain Hamilton ETFs that were active at the time of writing. On June 29, 2020, the following mergers took place: (i) Hamilton Global Financials Yield ETF and Hamilton Global Bank ETF into the Hamilton Global Financials ETF (HFG), (ii) Hamilton Australian Financials Yield ETF into the Hamilton Australian Bank Equal-Weight Index ETF (HBA); (iii) Hamilton Canadian Bank Variable-Weight ETF into the Hamilton Canadian Bank Mean Reversion Index ETF (HCA), and (iv) Hamilton U.S. Mid-Cap Financials ETF (USD) into the Hamilton U.S. Mid/Small-Cap Financials ETF (HUM).

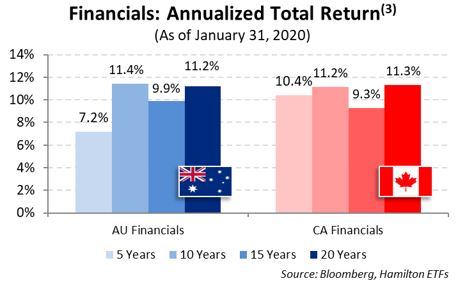

In our view, there are no two countries/financial sectors more alike than the Canadian and Australian financials. In fact, they have produced very similar – but relatively uncorrelated – returns for the last two decades. With similar histories, government structures, economies, and financial sector structures, Australia and Canada, we believe, are akin to fraternal twins.

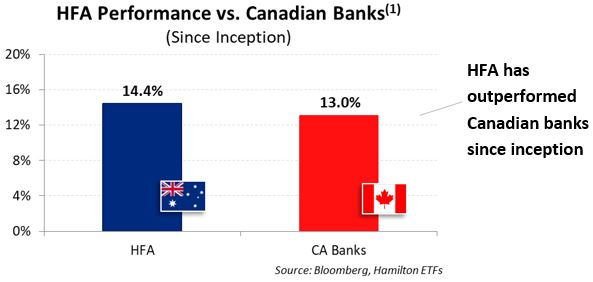

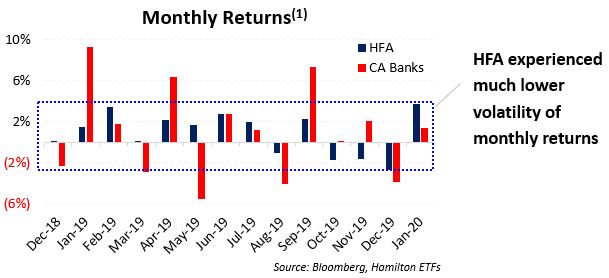

Because of this, we believe a comparison of the Hamilton Australian Financials Yield ETF (HFA) and Canadian banks makes for an interesting analysis. Since it was launched on December 14, 2018, the Hamilton Australian Financials Yield ETF (HFA) has outperformed the S&P/TSX Composite Diversified Bank Total Return Index (STDBNKR) by 140 bps with considerably less volatility as highlighted in the charts below.

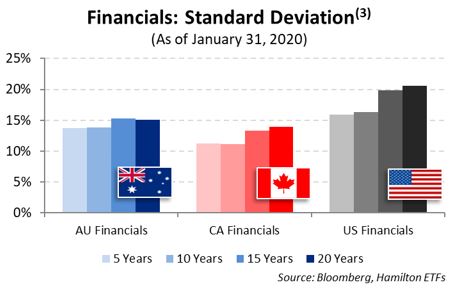

These similarities should not be overly surprising since the Canadian and Australian financial sectors have – as mentioned – had nearly identical return volatility profiles in the periods ending January 31, 2020 as shown by the charts below.

Notes

[1] Since HFA’s inception on December 14, 2018 through January 31, 2020; using NAV for HFA. CA Banks represented by the S&P/TSX Composite Diversified Bank Total Return Index.

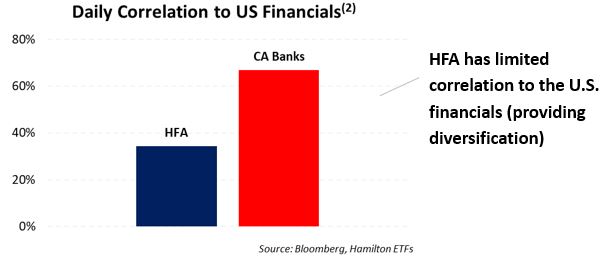

[2] Since HFA’s inception on December 14, 2018 through January 31, 2020; using daily price change. CA Banks represented by the S&P/TSX Composite Diversified Bank Total Return Index. US Financials represented by the S&P 500 Financials Total Return Index.

[3] AU Financials represented by the MSCI Australia Financials Index. CA Financials is represented by S&P/TSX Composite Financials Total Return Index. US Financials is represented by S&P 500 Financials Total Return Index. Annualized standard deviation of monthly returns.

Related Insights

Australian Financials: History of Strong/Stable Dividend Growth (November 6, 2019)

Cdn/Australian Financials: Fraternal Twins with Low Correlations & Near Identical Risk Rewards (September 6, 2019)

Election, RBA and Regulators Provide Good News for Australian Financials (May 21, 2019)

Cdn/Aust’n Banks: Why the Big Housing Short is So Difficult (and the Risk of Direct Hit Remains Low) (April 9, 2019)

Australian Banks Outperformed the Canadian Banks During the Financial Crisis (December 17, 2018)

Dividend-Heavy Australian Financials: History of Outperformance vs Canadian Peers (December 17, 2018)

A word on trading liquidity for ETFs …

Hamilton ETFs are highly liquid ETFs that can be purchased and sold easily. ETFs are as liquid as their underlying holdings and the underlying holdings trade millions of shares each day.

How does that work? When ETF investors are buying (or selling) in the market, they may transact with another ETF investor or a market maker for the ETF. At all times, even if daily volume appears low, there is a market maker – typically a large bank-owned investment dealer – willing to fill the other side of the ETF order (at net asset value plus a spread). The market maker then subscribes to create or redeem units in the ETF from the ETF manager (e.g., Hamilton ETFs), who purchases or sells the underlying holdings for the ETF.