In the almost two years since our last trip to Atlanta, a lot has changed in the banking sector (M&A) and a lot has not (strong growth). The opportunity to speak with 8 banks operating in and around Atlanta – several of which are holdings in the Hamilton Capital Global Bank ETF (HBG) and the Hamilton Capital U.S. Mid-Cap Financials ETF (USD) (HFMU.U) – provided some insight into just how good things to continue to be in the Southeast.

Note to Reader: This Insight includes references to certain Hamilton ETFs that were active at the time of writing. On June 29, 2020, the following mergers took place: (i) Hamilton Global Financials Yield ETF and Hamilton Global Bank ETF into the Hamilton Global Financials ETF (HFG), (ii) Hamilton Australian Financials Yield ETF into the Hamilton Australian Bank Equal-Weight Index ETF (HBA); (iii) Hamilton Canadian Bank Variable-Weight ETF into the Hamilton Canadian Bank Mean Reversion Index ETF (HCA), and (iv) Hamilton U.S. Mid-Cap Financials ETF (USD) into the Hamilton U.S. Mid/Small-Cap Financials ETF (HUM).

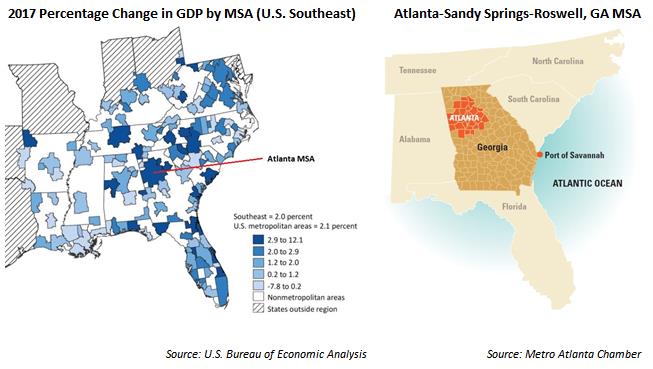

As a reminder for readers, the Atlanta-Sandy Springs-Roswell metropolitan statistical area (“Atlanta MSA”) is the largest MSA in the Southeast and the 10th largest MSA[1] in the United States and one of the fastest growing. Real GDP grew 20% between 2017 and 2012, or an average of 3.7% per year (well ahead of the U.S. average of 2.1%). The Atlanta MSA is home to over 5.8 million people and is the headquarters for a diverse group of 15 Fortune 500 companies including, Home Depot, UPS, Delta Airlines, Coca-Cola, SunTrust and PulteGroup[2].

Below are our key takeaways for our visit:

- The Atlanta MSA has seen 9 bank M&A transactions in the last year: Following the passing of last year’s Economic Growth, Regulatory Relief, and Consumer Protection Act (S.2115)[3], which was expected to spur bank M&A, the level of activity in the region has been impressive. All but one of the 8 banks we met had either recently announced or closed a deal in the last year. Moreover, all but one of those deals involved a bank BUYING an institution with a Georgian presence. Best known – and largest by far – is the SunTrust/BB&T (“STI/BBT”) merger-of-equals (“MOE”) announced in February[4].

- The STI/BBT MOE is a “once in a lifetime opportunity” to take market share: Although some bank executives were more forthright than others in their plans to take advantage of the employee/client disruption likely to accompany the STI/BBT merger, all expected it to be an opportunity to take market share. One team expected to advertise their Georgian roots and commitment, while multiple executives indicated plans to aggressively recruit lenders. Others expect to be patient, preferring to prioritize integrating their own acquisitions in 2019. One CEO pointed out that despite how it is positioned/explained, there is always an “unequal” in a merger-of-equals implying opportunities to recruit disgruntled key commercial bankers. Another noted that this deal will take years to integrate and there would be time to capitalize on the opportunity.

- The general atmosphere in Atlanta – status quo. Concerns seem to relate to political rather than business issues when speaking to clients. One banker, who is a member of the Federal Reserve Bank of Atlanta, indicated they have not identified any issues. The same CEO noted that while the U.S. recovery has been long, it has also been shallow – “the underpinnings are still strong” (supported by favourable demographics of Georgia specifically, and the Southeast generally).

- Asset quality remains “pristine” … “never been better than it is – that’s the only worry”: The consensus across the meetings was that we are somewhere late in the credit cycle, but the rationale for that description was only because of how long the cycle has been, not because anyone was seeing cracks. We believe last year’s corporate tax reduction increased the cash flows of many borrowers, providing further support for commercial credit quality.

- Loan growth still good, but expected to slow versus 2018: Banks were fairly consistent in their loan growth expectations for 2019 – slower than 2018, but still mid-to-high single digits. That said, several indicated that their slower forecast growth is somewhat self-imposed for several reasons. More than one CEO noted that they were turning down more loans because they felt the borrowers themselves have become more aggressive in their requests, particularly in terms of loan structure. Others noted, similar to the broader trend seen nationally, that they were “tapping the brakes” on certain portfolios, including restaurants and hotels. Others still indicated a desire to better match their loan growth to their deposit growth.

- Deposit cost pressure has diminished significantly: Consensus was that the aggressive deposit cost pressure experienced in the middle of 2018 had subsided, though there were differing opinions on whether that was related to the more dovish Fed stance. One bank attributed it to the slower associated loan growth.

- Technology is a hot topic, and that’s unlikely to change: Technology was a topic in every one of our meetings. Be it analyzing and capitalizing on one’s own data (read, cross-selling, risk management, etc.), offering market-leading options to clients (particularly, commercial and industrial – “C&I” – clients, who frequently require cash management and other treasury services) or maintaining robust cybersecurity, consensus was a need to continue to invest to keep pace and remain relevant.

Overall, our meetings reinforced that business in Atlanta – like most parts of the Sun Belt – continues to be quite strong, supported by favourable demographics and a pro-business regime. The attractiveness of the Atlanta MSA is evident given the number of banks that have chosen to buy into or bulk up their current platform in the region via M&A over the last year. It is this combination of solid growth with the possibility of M&A that makes the Southeast a heavier-weighted region in both our Hamilton Capital U.S. Mid-Cap Financials ETF (USD) and Hamilton Capital Global Bank ETF.

Related Insights

Canadian Banks: Five Takeaways from BBT/STI, Accelerating U.S. Bank M&A – February 11, 2019

U.S. Bank M&A: Implications from the Largest Deal in a Decade – February 8, 2019

U.S. Banks: High/Low Growth Areas in One Map (i.e., “Follow the Sun”) – January 24, 2018

Notes from the Field: Everything’s Peachy in Atlanta – June 13, 2017

Notes

[1] As of 2017. Source: U.S. Bureau of Economic Analysis. Measured by GDP.

[2] As of 2018. Source: Metro Atlanta Chamber

[3] Also known as the Crapo bill, after Mike Crapo, the senator who sponsored the bill.

[4] For our thoughts on the STI/BBT deal, see our February 2019 insight, “U.S. Bank M&A: Implications from the Largest Deal in a Decade”.

Note: Comments, charts and opinions offered in this commentary are produced by Hamilton Capital and are for information purposes only. They should not be considered as advice to purchase or to sell mentioned sec