We recently travelled to Nashville to meet with a small group of Tennessee-based banks, all of which operate in the state capital, and half of which are holdings in the Hamilton Capital Global Bank ETF (ticker: HBG) and the Hamilton Capital U.S. Mid-Cap Financials ETF (USD) (ticker: HFMU.U). We also had an opportunity to speak with the Nashville Area Chamber of Commerce. It was a great chance to see firsthand the dramatic change in the city known for its music scene but perhaps less so for its number one industry (healthcare)1.

Note to Reader: This Insight includes references to certain Hamilton ETFs that were active at the time of writing. On June 29, 2020, the following mergers took place: (i) Hamilton Global Financials Yield ETF and Hamilton Global Bank ETF into the Hamilton Global Financials ETF (HFG), (ii) Hamilton Australian Financials Yield ETF into the Hamilton Australian Bank Equal-Weight Index ETF (HBA); (iii) Hamilton Canadian Bank Variable-Weight ETF into the Hamilton Canadian Bank Mean Reversion Index ETF (HCA), and (iv) Hamilton U.S. Mid-Cap Financials ETF (USD) into the Hamilton U.S. Mid/Small-Cap Financials ETF (HUM).

The Nashville-Davidson-Murfreesboro-Franklin, TN metropolitan statistical area (“Nashville MSA”) is the 5th largest MSA in the Southeast and the 31th largest2 in the United States. It boasts a diverse economy, with the four primary industry drivers being healthcare, music and entertainment, advanced manufacturing and tourism/hospitality.

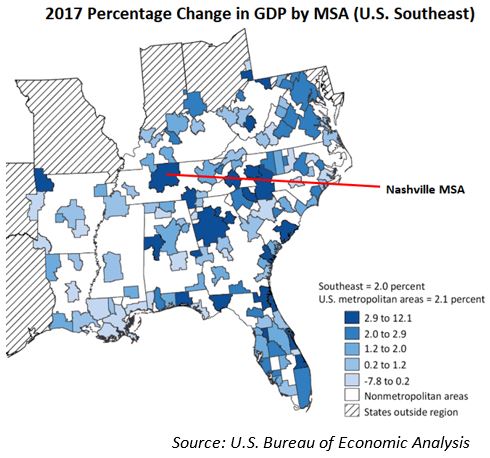

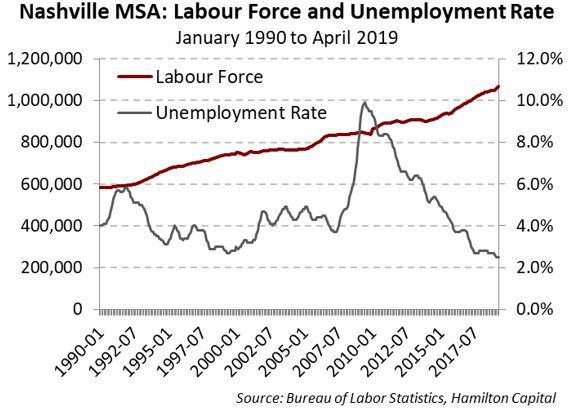

The MSA has experienced a population boom in recent years, increasing 25% between 2007 and 2017, and 10% between 2012 and 2017, bringing the population to 1.9 million3. However, even more impressive has been the economic growth. Over the same 5 year period, the Nashville MSA’s real GDP rose by more than 25%, or roughly 4.6% per year, making it the 5th fastest growing large MSA4 in the United States (vs. 2.1% for the U.S. metropolitan areas in aggregate).

To discuss the drivers of this growth and the outlook, we met with CEO of the Nashville Area Chamber of Commerce (“Chamber”), Ralph Schulz. Below are the highlights of that meeting:

- Nashville economy is largely driven by job creation. Since the financial crisis, nearly half a million people have moved to the Nashville MSA, largely owing to jobs. In fact, for the last six year, Nashville has been in the top ten metro areas in the U.S. for job growth, placing 3rd in 2017 with job growth of 3.17%. Notably, the jobless rate is 2.5% today, notwithstanding the population and labour force growth.

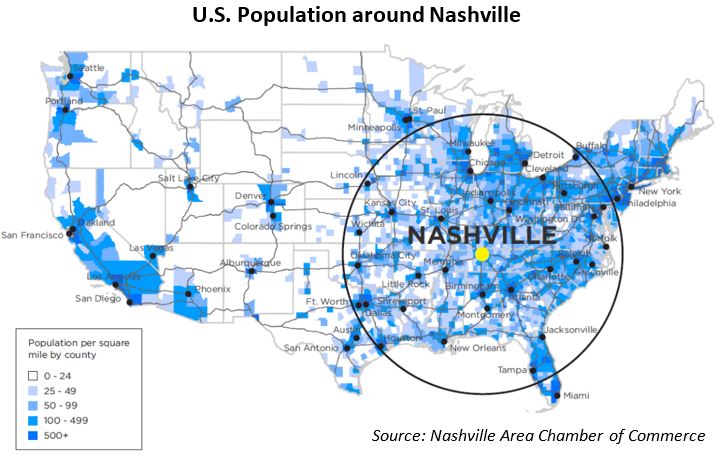

- Why Nashville/Tennessee? Tax structure, geography are important factors. Tennessee has no personal income tax and a low corporate income tax (6.5%). In terms of geography, the Chamber indicates that more than half of the U.S. population live within ~1,000 km of the Nashville MSA (see graphic) and 75% of the U.S. market is within a two-hour flight.

- Why do people want to live in Nashville? Competitive cost of living, culture. Although the cost of living in Nashville has risen from ~90% of the national average 10 years ago to about even today (~98.8% of the national average), it remains attractive. Nashville has seen considerable in-migration from cities with higher costs of living including, Los Angeles, Chicago and New York. Mr. Schulz noted the city’s culture – friendly, open, risk-taking, enterprising – as being its “hook”.

- The job pipeline remains strong, with 120+ leads on companies considering relocating to/expanding in the Nashville area. Schulz noted that more of these conversations – which can take upwards of 2 years to come to fruition – are happening with larger employers (i.e., 500-1,000 employees) today5. He indicated that AllianceBernstein’s decision to move its headquarters to Nashville has attracted a lot of positive attention and inquiries. Notably, Amazon recently announced a new operations center to be built in downtown Nashville, bringing another 5,000 jobs to the city.

- Music City Convention Center a huge draw for the local economy. The construction of the convention center was approved during the height of the financial crisis and completed in 2013. The largest facility of its kind in the Southeast at that time, today it is a draw for conferences (booking out as far as 2030) and has been the impetus for the hospitality construction boom in the city that continues today (the Four Seasons just broke ground in April).

The banks we met were similarly upbeat on the market and their businesses:

- Credit – no trends/concerns to date. Like other banks we have met recently, the Nashville banks noted that any credit issues observed have been idiosyncratic company-specific issues, rather than an indication of a developing trend/downturn. One bank executive pointed to healthcare (particularly acute hospitals) as a source of worry but expressed confidence to-date in his own portfolio, owing to its small size and granular nature. Another executive noted that hospitality is sometimes mentioned as a possible concern but felt the draw of the conference centre could absorb all projects underway.

- M&A still percolating, but mixed interest presently. All of the banks we met had completed a bank acquisition in the previous 12-24 months, and thus had varying appetites for pursuing another deal in the near term. One CFO noted they were fielding a lot of calls, both from investment bankers and (small, private) banks. He cited several motivators, including liquidity needs and generational changes. In contrast, another team indicated they didn’t spend a lot of time thinking about M&A (notwithstanding having specific criteria for – and a narrow list of – potential candidates).

- Excellent growth organic opportunities in their current markets. Another likely contributor to the staid M&A interest for some was the strong growth in Nashville and their other Southeast markets noted by the banks. On Nashville, one executive commented on the strong job pipeline for the city as a source of growth, noting that it is job creation – not real estate (like many MSAs) – that is the real driver of the local economy.

- Deposit competition still elevated, but the march higher in pricing has abated. While deposit pricing pressure has eased somewhat, the burden to find deposits – particularly core, non-interest-bearing deposits – remains high. One bank, which was noted by peers as being aggressive on pricing, commented that its primary competition has been switching from banks to brokerages, money market funds. This same bank noted that it would pay up for deposits, if necessary, to fund profitable loan growth.

- Preparations have begun for a downward movement in the Fed Fund rate. The most asset-sensitive of the banks we met – largely a C&I lender – noted it has been making changes at the top of the house to prepare for the rate trajectory now anticipated by the markets (as many as three Fed rate cuts in 2019, according to Bloomberg).

_____________

A word on trading liquidity for ETFs …

HFMU.U and HBG are highly liquid ETFs that can be purchased and sold easily. ETFs are as liquid as their underlying holdings and the global banking and the U.S. mid-cap financial services sectors have combined market cap of ~US$7 trillion and ~US$4 trillion, respectively.

How does that work? When ETF investors are buying (or selling) in the market, they may transact with another ETF investor or a market maker for the ETF. At all times, even if daily volume appears low, there is a market maker – typically a large investment bank – willing to fill the other side of the ETF order (at net asset value plus a spread). The market maker then subscribes to create or redeem units in the ETF from the ETF manager (e.g., Hamilton Capital), who purchases or sells the underlying holdings for the ETF.

_____________

Related Notes

U.S. Banks: The Sun’s still shining on Mid-Caps

U.S. Bank M&A: 8 Drivers as Described by Industry Giant, Rodgin Cohen

Global Banks Still Thriving; HBG Posts Robust 12% EPS Growth Y/Y

HFMU.U Posts Robust 13% EPS Growth Y/Y; 500 bps Ahead of Large-Cap Financials