New York City in May means a lot of traffic, but also beautiful weather and a chance to catch up with a collection of mid-cap banks from across the U.S. in one trip. In all, we sat down with 8 executive teams, primarily from banks operating in the U.S. Sunbelt (i.e., from California to Florida), including 7 owned by the Hamilton Capital U.S. Mid-Cap Financials ETF (USD) (ticker: HFMU.U) and the Hamilton Capital Global Bank ETF (ticker: HBG).

Note to Reader: This Insight includes references to certain Hamilton ETFs that were active at the time of writing. On June 29, 2020, the following mergers took place: (i) Hamilton Global Financials Yield ETF and Hamilton Global Bank ETF into the Hamilton Global Financials ETF (HFG), (ii) Hamilton Australian Financials Yield ETF into the Hamilton Australian Bank Equal-Weight Index ETF (HBA); (iii) Hamilton Canadian Bank Variable-Weight ETF into the Hamilton Canadian Bank Mean Reversion Index ETF (HCA), and (iv) Hamilton U.S. Mid-Cap Financials ETF (USD) into the Hamilton U.S. Mid/Small-Cap Financials ETF (HUM).

Readers of our previous Insights will know our preference for U.S. mid-caps banks, which account for ~65% of HFMU.U’s invested portfolio and ~50% of HBG’s. Particularly, we focus on institutions operating in high growth areas, most of which are located in the Southeast, Southwest and West regions of the United States. Augmenting organic growth, M&A is expected to continue and will favour the small and mid-cap banks, in our opinion, since they are most likely to participate and benefit from the synergies generated. These banks are also less burdened by regulatory oversight than their large and mega-cap peers.

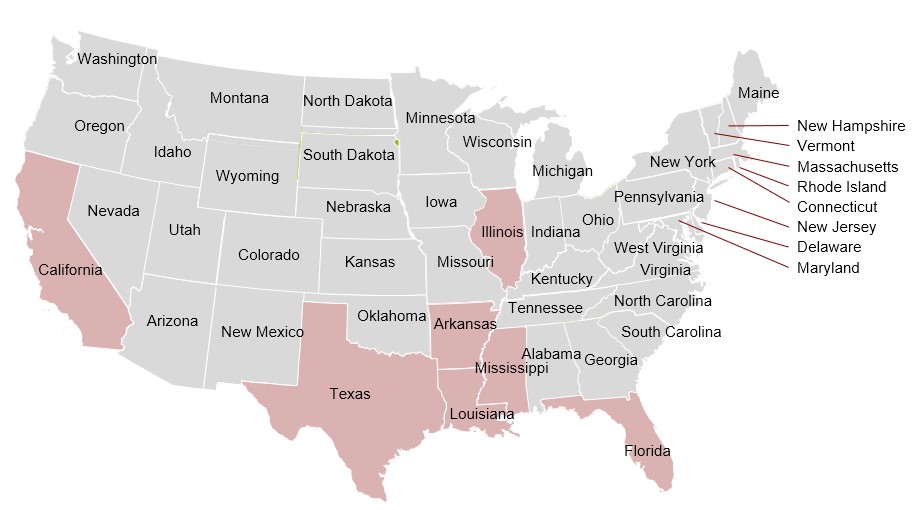

State headquarters of the 8 banks we recently met in NYC:

Below are the key takeaways from our meetings:

- With the shift in the domestic interest rate outlook, banks are taking steps to reduce asset sensitivity. A year ago, expectations were that the Federal Reserve would raise rates at least once in 2019. Today, market expectations are for as many as three rate cuts in 2019 (and another 1-2 in 2020) and we’re already 5 months through the year with no cuts thus far. The change in rate outlook has incited several banks to reduce their asset sensitivity through efforts such as: (1) extending the duration on the asset side of their balance sheets; (2) adding rate floors on new loans (to date, only banks with the strongest perceived pricing power have done so); and (3) increasing their use of derivatives and swaps (swap floating for fixed rate).

- Deposit pricing remains competitive; costs overall to rise with shift to interest-bearing: With the Fed having last raised rates in December and now on hold, consensus – irrespective of the market they operated in – was that deposit pricing was competitive but has stabilized. However, the overall cost of deposits (a decrement to bank’s net interest margin, “NIM”) is expected to continue rise (but at a slower rate) as more clients move from non-interest bearing to interest bearing deposits.

- Credit remains fine, notwithstanding idiosyncratic issues. Like our recent meetings in Atlanta and Nashville, the lenders we spoke to in NYC were unconcerned about credit issues today. Most saw no issues in their own portfolios, and those that did felt they were idiosyncratic (e.g., a one-off in healthcare) and not indications of broader trends. That said, more than one team mentioned making changes internally to prepare themselves for a slowdown. These actions included capping exposures on certain industries (e.g. hospitality, a likely early candidate for deteriorating credit quality in an economic downturn), increasing the granularity (i.e., reducing the size of individual loans) of the new credits they are putting on and management changes (moving a chief risk officer to chief credit officer).

- M&A expected to continue…: Consensus was that M&A conversations continue to be plentiful. Most banks indicated a strong preference for in-footprint deals, to help build additional share in their core markets and offer substantial expense synergies. Others noted an openness to new markets, even states away from their current platform, if the target “ticked the right boxes”, most notably a strong deposit base and attractive accretions. Interestingly, one bank executive noted a preference for targets with private equity involvement, as they usually have more realistic price expectations.

- Varying reasons for seller interest: The reasons for the increased interest from sellers varied by the size/nature of the target. However, there were several common motivators: the shift in the rate outlook, the expected higher technology-spend, the prospect of re-regulation following next year’s election and the new provision accounting (discussed more below).

- Few expectations for an MOE transaction. One only CEO addressed the possibility of an MOE. While he said “never say never”, he agreed with Rodgin Cohen’s comment (see, “U.S. Bank M&A: 8 Drivers as Described by Industry Giant, Rodgin Cohen”) that the social issues can be very difficult to manage.

- Capital continues to accrete. More than one bank noted they are above their targeted capital levels, and that their banks continue to accrete capital. Assuming the macro environment remained strong, they appeared to have a preference to return capital via buybacks versus dividends, to take advantage of the rout in valuations, or as a mechanism to offset the impact of sellers after the end of a lock-up period (following a recent transaction).

- The potential implications of new provision accounting to be discussed in the latter half of 2019: Publicly traded U.S. banks must adhere to the new provision accounting methodology for credit costs termed Current Expected Credit Losses (“CECL”) beginning January 1, 20201. CECL requires a bank to estimate its future expected losses over the remaining lifetime of its portfolio. At this point, the exact impact on bank income statements in not yet known, and most banks are working with third parties to model the change. More insight is expected in H2 2019, however, increased volatility in earnings is expected to be a result.

_____________

A word on trading liquidity for ETFs …

HFMU.U and HBG are highly liquid ETFs that can be purchased and sold easily. ETFs are as liquid as their underlying holdings and the global banking and the U.S. mid-cap financial services sectors have combined market cap of ~US$7 trillion and ~US$4 trillion, respectively.

How does that work? When ETF investors are buying (or selling) in the market, they may transact with another ETF investor or a market maker for the ETF. At all times, even if daily volume appears low, there is a market maker – typically a large investment bank – willing to fill the other side of the ETF order (at net asset value plus a spread). The market maker then subscribes to create or redeem units in the ETF from the ETF manager (e.g., Hamilton Capital), who purchases or sells the underlying holdings for the ETF.

Related Notes:

U.S. Bank M&A: 8 Drivers as Described by Industry Giant, Rodgin Cohen

Global Banks Still Thriving; HBG Posts Robust 12% EPS Growth Y/Y

HFMU.U Posts Robust 13% EPS Growth Y/Y; 500 bps Ahead of Large-Cap Financials

Insights from Atlanta: (Growth, M&A) Going Strong

U.S. Banks: Mid-Caps vs. JPM, C & WFC – Higher EPS Growth at Deeper Valuation Discounts