All values in U.S. dollars unless otherwise noted.

As the year draws to a close, the whipsaw nature of 2020 will not soon be forgotten.

When the pandemic struck earlier this year and businesses shuttered under direct orders by various governments, how long and how deep the resulting global economic downturn would be was next to impossible to forecast with any sense of accuracy. As businesses and economies began to reopen in late spring, confidence grew that the worst might be over for most parts of the global economy. But with a host of government support programs keeping many small businesses and people afloat, questions remained as to when and how much the banks would see in actual loan losses.

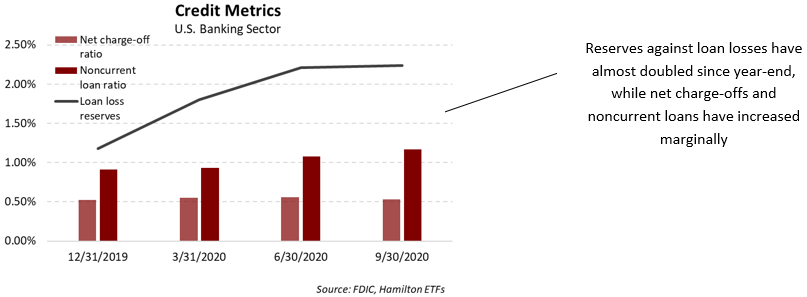

Adding to the banks’ challenges in the early days of the pandemic was CECL[1], the new accounting measure for loan loss provisions that came into effect on January 1, 2020. CECL requires banks to record expected “lifetime” losses versus previous accounting that required losses to be recorded when incurred. As a result, U.S banks reported their first quarter of results under the new regime in April 2020, while economic uncertainty was still very high. The banks booked significant provisions in Q1 – US$52.7 billion, or more than 3x the amount reported a year earlier[2]. Q2 saw further building of reserves, with additional provisions of $61.9 billion, more than 4x the level of Q2 2019[3]. By mid-year, the U.S. banking sector had doubled its reserves in just 6 months[4], to the highest level since September 2012.

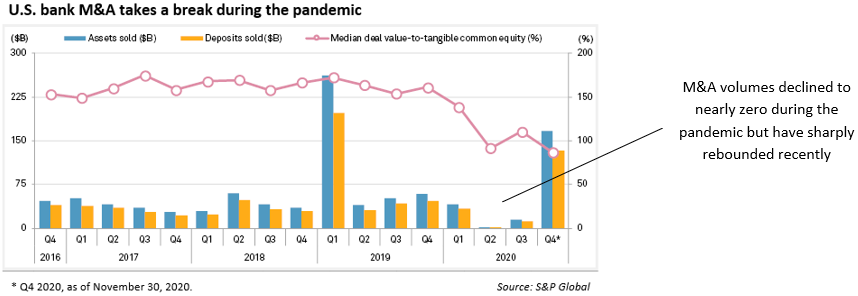

The economic uncertainty, combined with a limited ability to perform due diligence, not surprisingly put a halt to M&A, particularly between banks. It was difficult enough to predict the loss content in one’s own loan portfolio, let alone that of another bank with its own underwriting philosophy. While still rare, the market actually saw a couple of deals announced before the pandemic fall apart during this time, most notably Texas Capital Bancshares (TCBI)’s merger of equals with Independent Bank (IBTX)[5].

However, the latter part of 2020 has seen a decidedly different tone from banks (and markets).

First, Q3 bank earnings saw the end of reserve building, with most U.S. banks indicating that they were comfortable with their current level of reserves. Correspondingly, the reserve ratio remained stable, at a still lofty 2.24% and roughly twice the level of noncurrent loans[6]. We believe clarity on credit sets the banks up for a strong earnings recovery in 2021 and consequently higher stock prices, as both the “E” and the multiple applied to it (“P/E”) should rise.

Second, the improved credit and earnings outlook for banks was followed shortly by positive vaccine news and (some) regulatory/policy clarity following the U.S. presidential election in early November. This combination gave the market increased confidence in the economic recovery and as a result, provided a strong tailwind for value sectors such as the financials generally and the banks more specifically. For example, many of the banks in the Hamilton U.S. Mid/Small-Cap Financials ETF (HUM) and Hamilton Global Financials ETF (HFG) rose more than 15% in November and some as much as 39%.

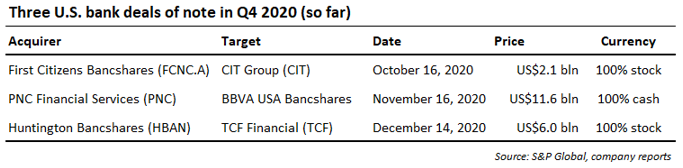

And third, supporting the conviction in the recovery, three U.S. bank deals of size have been announced (so far) in Q4, two mid-sized (CIT, TCF) and one regional (BBVA USA). While each deal is unique, in our view, this pick-up in M&A is a strong indicator of bank management teams’ constructive view on the U.S economy as we enter 2021, particularly as it relates to credit. And as noted above, this should provide value stocks, like banks and the financials, with additional tailwinds.

The return of M&A provides increased confidence in the outlook for bank earnings/stocks

We believe the conviction of management teams to engage in M&A at this point in the credit cycle is a clear sign of the banks’ confidence that the economic recovery is well underway. We expect Q4 earnings to provide yet another opportunity for bankers to demonstrate this conviction and provide another catalyst to support bank valuations/stocks in 2021.

Consolidation in the U.S. financial sector has been a secular theme since the 1980’s. However, it is also cyclical, with M&A volumes rising and falling depending on market sentiment and the economic environment. The pandemic saw activity drop substantially. But with the worst of the pandemic behind us and looming considerations such as the lower for longer interest rate environment and rising costs of technology investments, we believe U.S. bank M&A is likely to accelerate, particularly within the ~160 mid-cap banks[7] (versus the 15 large-cap banks, i.e., those with assets over $100 bln – 4 mega-cap, 11 regionals).

M&A remains one of several catalysts for the entire portfolio (not just banks) of the Hamilton U.S. Mid/Small-Cap Financials ETF (HUM). HUM currently holds ~50 positions (including 27 banks) almost all of which are candidates for some form of consolidation, either as a seller or a merger partner. As we wrote in our insight, “U.S. Bank M&A: Another Accretive MOE, Another Positive Market Reaction” (November 6, 2019), we believe the market will favour low premium, all stock transactions where the buyers and sellers share the benefits of the cost synergies.

Related Notes

Global Financials: The Most Attractive/Important Investment Themes in 2021 | November 16, 2020

Financials: Does COVID-19 Represent a Growth Scare, Credit Event or Crisis? | March 25, 2020

One Chart: U.S. Bank M&A Doubles in 2019 (and Why We Expect More) | January 24, 2020

U.S. Bank M&A: Another Accretive MOE, Another Positive Market Reaction | November 6, 2019

What U.S. Investment Bankers and Banks are Saying about M&A | September 23, 2019

U.S. Bank M&A: 8 Drivers as Described by Rodgin Cohen | May 29, 2019

Notes

[1] CECL – Current Expected Credit Losses was adopted by FASB and came into effect as of January 1, 2020 in the United States. The objective of CECL is to have banks estimate and establish reserves for a loan at issue based on their expected losses over the life of the loan. To do so, they must incorporate their assessment of the economic outlook, whether developed internally or based on a model such as Moody’s. Europe, Canada, and Australia, etc. adopted a similar accounting regime as part of IFRS 9 in 2018.

[2] Source: FDIC Quarterly Volume 14, Number 2.

[3] Source: FDIC Quarterly Volume 14, Number 3.

[4] The sector’s reserve ratio (loan loss allowance to loans and leases) in Q2 was 2.21%, compared to 1.18% as of December 31, 2019. Source: FDIC.

[5] The US$3 bln merger of equals (MOE) between IBTX/TCBI was announced on December 9, 2019 and terminated on May 26, 2020.

[6] Noncurrent loans refer to those 90 days or more past due plus those on nonaccrual status.

[7] Publicly traded mid-cap banks defined as those with a market capitalization of US$500 million to US$20 billion.

A word on trading liquidity for ETFs …

Hamilton ETFs are highly liquid ETFs that can be purchased and sold easily. ETFs are as liquid as their underlying holdings and the underlying holdings trade millions of shares each day.

How does that work? When ETF investors are buying (or selling) in the market, they may transact with another ETF investor or a market maker for the ETF. At all times, even if daily volume appears low, there is a market maker – typically a large bank-owned investment dealer – willing to fill the other side of the ETF order (at the bid/ask spread).