On Monday, this year’s third (sizable) U.S. bank merger-of-equals (“MOE”) was announced, continuing a trend we expected following similar transactions early in 2019. We have previously written that after a multi-year period of muted merger activity that U.S. bank consolidation – particularly among mid-cap banks – was poised to accelerate. We have cited this theme as impacting the U.S. mid-cap financials sector generally and the banking sector, specifically.

Note to Reader: This Insight includes references to certain Hamilton ETFs that were active at the time of writing. On June 29, 2020, the following mergers took place: (i) Hamilton Global Financials Yield ETF and Hamilton Global Bank ETF into the Hamilton Global Financials ETF (HFG), (ii) Hamilton Australian Financials Yield ETF into the Hamilton Australian Bank Equal-Weight Index ETF (HBA); (iii) Hamilton Canadian Bank Variable-Weight ETF into the Hamilton Canadian Bank Mean Reversion Index ETF (HCA), and (iv) Hamilton U.S. Mid-Cap Financials ETF (USD) into the Hamilton U.S. Mid/Small-Cap Financials ETF (HUM).

The topic of bank M&A has been prevalent all year in our trips to Dallas, DC, NYC, Nashville and Atlanta, including the advantages and disadvantages of MOEs, a deal structure favoured by markets (over traditional premium transactions).

Two Southeast Mid-Cap Banks Enter into a Highly Accretive Merger-of-Equals

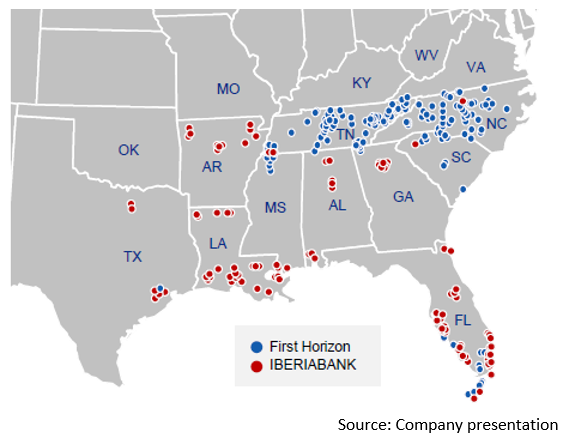

The latest deal, between Memphis-based, First Horizon National (“FHN”) and Lafayette-based, Iberiabank (“IBKC”) – both holdings of either the Hamilton U.S. Mid-Cap Financials ETF (USD) (ticker: HFMU.U) or the Hamilton Global Bank ETF (ticker: HBG) – brings together two complementary platforms in the Southeast with surprisingly little overlap in footprint (see below). The new entity, which will maintain the First Horizon name and headquarters, will rank as a top 25 bank in the U.S. by deposits, with $75 billion in assets across 11 states, and operate in 15 of the top 20 Southern MSAs by population.

The FHN/IBKC deal follows the blockbuster BB&T/SunTrust MOE announced in February (also the largest U.S. bank deal since the financial crisis), and the Midwest MOE of Michigan peers, TCF Financial and Chemical Financial that closed in August. Like earlier deals, the FHN/IBKC deal was met positively by the market, with both bank stocks rising and outperforming the broader bank indices on the day.

We believe the favourable market reaction is owing to the lower perceived integration risk of MOE transactions, as well as the attractive deal economics (in FHN/IBKC’s case, management forecasts double-digit earnings accretions for both entities on seemingly conservative expense synergies of 25%). This positive reaction is in stark contrast to recent premium bank deals that have typically seen the acquirer’s stock decline on the announcement in proportion to its resulting tangible book value dilution (for example, FITB/MBFI and PB/LXTB).

The latest deal fits with both our own expectations for more MOE transactions within the U.S. mid-cap bank space as well as comments made by bankers at a recent financial services conference (see What U.S. Investment Bankers and Banks are Saying about M&A). Combined with strong fundamentals, the secular trend of U.S. bank M&A that started in the 1980’s will, in our view, continue for another decade. This should provide support to the sector’s earnings growth profile, including banks held in HFMU.U (~65% weighting), HBG (~50% weighting), and to a lesser extent in the Hamilton Global Financials Yield ETF (ticker: HFY, which has ~10% weighting).

Related Notes

Notes from Dallas: Big Things Happen Here (October 2, 2019)

Notes from Washington D.C.: Investigating One of the Wealthiest MSAs in the Country (September 23, 2019)

Notes from Nashville: Titans of Growth (June 7, 2019)

U.S. Bank M&A: 8 Drivers as Described by Industry Giant Rodgin Cohen (May 29, 2019)

Notes from Atlanta: (Growth, M&A) Going Strong (April 1, 2019)

A word on trading liquidity for ETFs …

Hamilton ETFs are highly liquid ETFs that can be purchased and sold easily. ETFs are as liquid as their underlying holdings and the underlying holdings trade millions of shares each day.

How does that work? When ETF investors are buying (or selling) in the market, they may transact with another ETF investor or a market maker for the ETF. At all times, even if daily volume appears low, there is a market maker – typically a large bank-owned investment dealer – willing to fill the other side of the ETF order (at net asset value plus a spread). The market maker then subscribes to create or redeem units in the ETF from the ETF manager (e.g., Hamilton ETFs), who purchases or sells the underlying holdings for the ETF.