Reserve releases featured prominently in Q2 earnings results for the Canadian banks, another step forward for the sector in its ongoing credit recovery and just one of the positive catalysts we previously identified for Canadian bank stocks in 2021.

In our October webcast, “Canadian Banks: Credit Cycle is (Basically) Over”[1], we outlined our reasoning that a credit-driven recovery in Canadian bank earnings and stocks was beginning. To capitalize on the anticipated recovery, we launched our modestly levered Hamilton Enhanced Canadian Bank ETF (HCAL)[2], offering investors the potential for higher longer-term returns and higher yield (currently 5.13%[3], paid monthly), especially versus Canadian bank covered call strategies, which historically have experienced their largest underperformance in rising markets.

In February, we identified three catalysts for Canadian bank shares in 2021: (1) normalization of profitability and forward earnings estimates, (2) reserve releases, and (3) higher margins from steeper yield curve pricing in the potential outsized GDP growth quarters and higher long-term inflation expectations[4]. Catalyst #1 was realized in Q1 and supported a post-earnings rally[5].

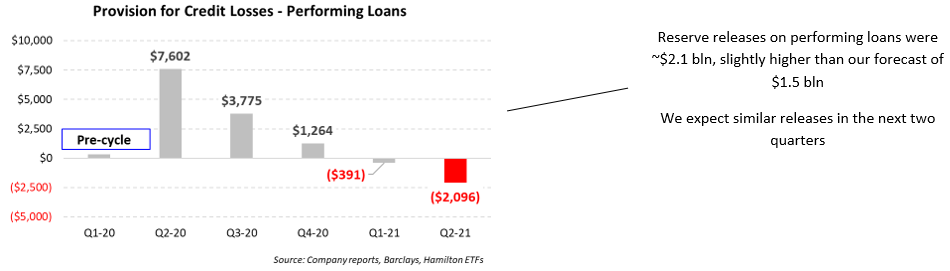

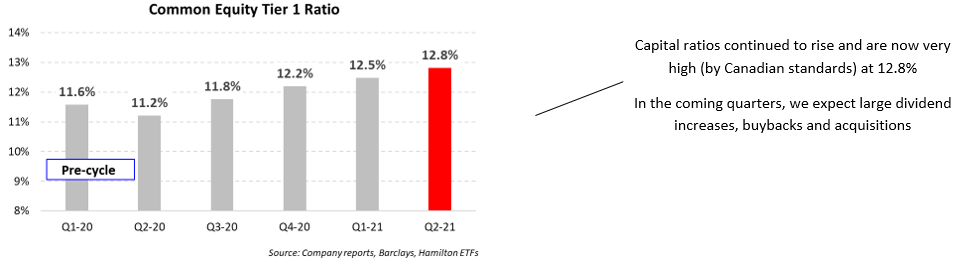

Heading into the Q2 earnings season, we wrote that investors should begin to focus on catalyst #2: reserve releases (with catalyst #3 coming later this year). We noted that reserve releases could benefit Canadian bank shares by: (1) supporting a period of unusually low loan losses, which would drive earnings estimates upward, (2) pushing capital ratios higher (CET1, in particular) which could support buybacks, dividends, and capital deployment, and (3) supporting higher P/E multiples from the improved outlook and financial strength of the sector[6]. Overall, we estimated total reserve releases of $6 to $8 bln between Q2 and Q4 2021, accelerating into the end of the year once the economy is on a clearer path to recovery.

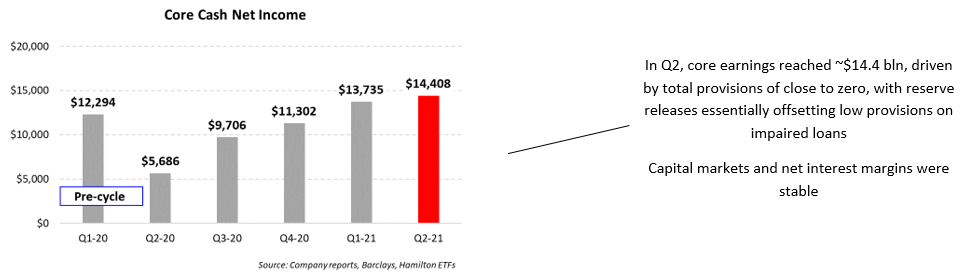

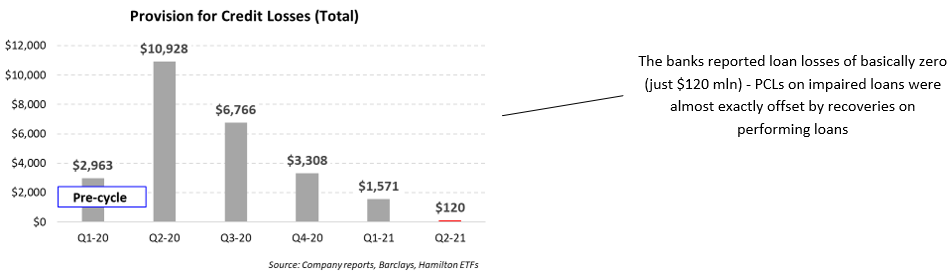

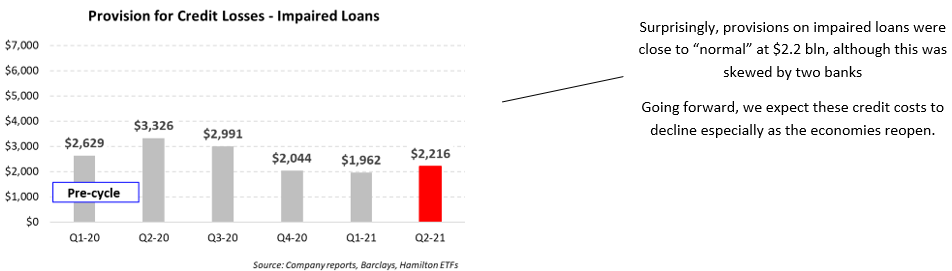

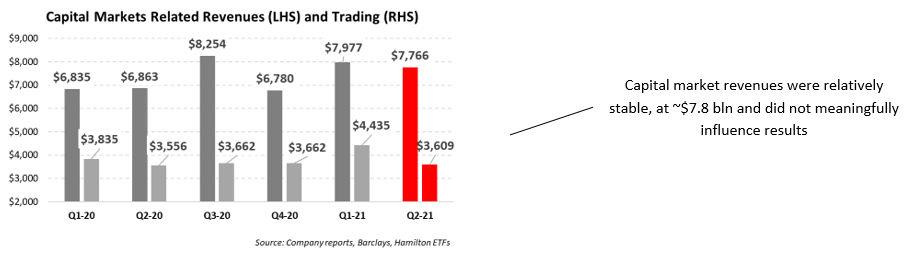

As expected, reserve releases dominated Q2 results, with the banks releasing reserves of ~$2.0 bln (slightly higher than our $1.5 bln forecast). This resulted in abnormally low provisions (close to zero; ~$100 mln) and pushed quarterly earnings to over $14 bln, or 15% higher than pre-cycle levels, and well above analyst estimates. These large earnings beats were not a surprise, as bank analysts routinely underestimate the velocity and magnitude of credit recoveries resulting in the banks materially exceeding consensus estimates (and meaning “real” P/E ratios are actually lower than they appear during credit recoveries[7]). Other key drivers of variability in bank earnings – capital markets, loan growth and net interest margins – were relatively stable.

Not surprisingly, the sheer magnitude of releases also drove large increases in CET1 capital ratios, which ended the quarter at a very high at 12.8%. In the coming quarters, these high capital levels and earnings should support (much) higher dividends (positive for sentiment), and buybacks (further supporting upward earnings revisions). It remains our view that the banks that emphasize buybacks will outperform those that emphasize (large) acquisitions.

Below is a summary of the key takeaways of the quarter, in charts.

Q2 2021 in Charts – Good Quarter with Reserve Releases Driving Large Beats

Capitalizing on the Recovery through Hamilton Enhanced Canadian Bank ETF (HCAL), Hamilton Canadian Bank Mean Reversion Index ETF (HCA)

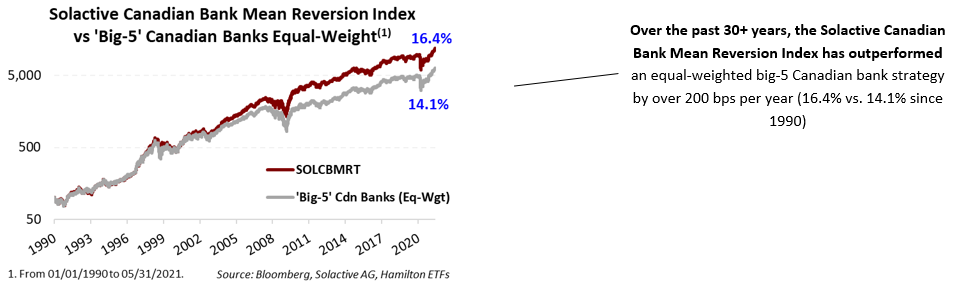

To capitalize on the ongoing recovery, investors can consider the Hamilton Canadian Bank Mean Reversion Index ETF (HCA), which seeks to replicate the returns (net of expenses) of the Solactive Canadian Bank Mean Reversion Index (SOLCBMRT). Alternatively, investors could consider the Hamilton Enhanced Canadian Bank ETF (HCAL), which seeks to replicate 1.25x the returns of the SOLCBMRT Index. The Solactive Canadian Bank Mean Reversion Index, which begins in 1990, has a history of outperformance versus an equal weight Canadian bank strategy. This outperformance was driven by the extremely high historical correlations – and mean reversion tendencies – of Canadian bank stock prices. The reasons are apparent, as the individual banks have very similar: (i) business mixes, (ii) geographic footprints, (iii) capital strength, (iv) dividend policy, and (v) a common regulator. The chart below highlights this strong performance history.

Recent Insights

Canadian Banks: Catalyst #2 (Reserve Releases) Approaching? (April 30, 2021)

HCAL/HCA: Volatility vs Individual Canadian Banks (April 26, 2021)

Canadian Banks: Are Analysts Underestimating the Recovery (Again)? (April 16, 2021)

Press Release: Hamilton ETFs Announces Name Change for HCAL (April 1, 2021)

Video: “Canadian Banks – Three Catalysts for 2021” (February 17, 2021)

Canadian Banks: Q4 Takeaways – Recovery Has Started; What’s Next? (December 8, 2021)

____

A word on trading liquidity for ETFs …

Hamilton ETFs are highly liquid ETFs that can be purchased and sold easily. ETFs are as liquid as their underlying holdings and the underlying holdings trade millions of shares each day.

How does that work? When ETF investors are buying (or selling) in the market, they may transact with another ETF investor or a market maker for the ETF. At all times, even if daily volume appears low, there is a market maker – typically a large bank-owned investment dealer – willing to fill the other side of the ETF order (at net asset value plus a spread). The market maker then subscribes to create or redeem units in the ETF from the ETF manager (e.g., Hamilton ETFs), who purchases or sells the underlying holdings for the ETF.

Notes

[1] In the webcast, we predicted that the Q4 earnings season would confirm that reserve builds had peaked and that investors should focus on implications of the economic recovery on stock fundamentals.

[2] Formerly known as the Hamilton Canadian Bank 1.25x Leverage ETF

[3] As on June 1, 2021

[4] See Video: Canadian Banks – Three Potential Catalysts for 2021 (February 17, 2021) for more detail

[5] See our insight, “Canadian Banks: Q1-21 Takeaways – One Catalyst Down, Two to Go” (March 2, 2021)

[6] See “Canadian Banks: Catalyst #2 (Reserve Releases) Approaching” (April 30, 2021)

[7] “Canadian Banks: Are Analysts Underestimating the Recovery (Again) (April 16, 2021)