In our October webcast, “Canadian Banks – Credit Cycle is (Basically) Over”, we correctly predicted that reserve builds for the Canadian banks would peak in Q4-20, and that the recovery would begin in Q1-21. In fact, we launched the Hamilton Enhanced Canadian Bank ETF (HCAL)[1] in October 2020 to give investors a vehicle to capitalize more fully on this recovery while at the same time benefiting from a higher dividend yield (currently 5.16%)[2].

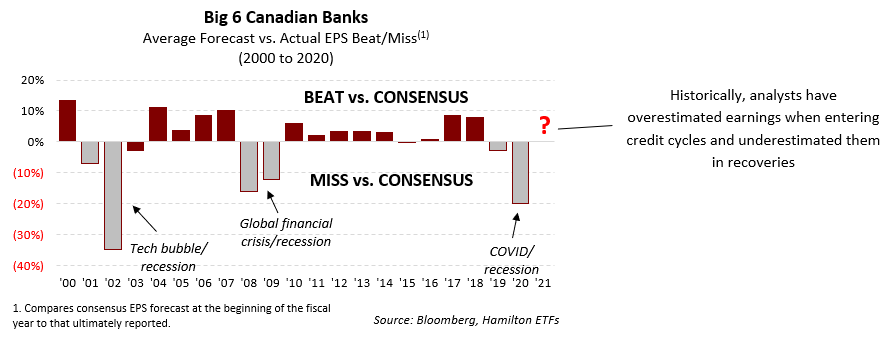

In this insight, we review the dynamic of credit cycles and analyst forecasts and the implications for valuations. In particular, we highlight the challenge analysts face in estimating earnings in credit cycles, and their tendency to underestimate both the severity of the cycle entering the cycle (causing banks to miss estimates), and the strength of the recovery as the credit cycle turns (causing banks to beat). This is relevant, because the Canadian banks have very clearly entered the recovery stage of the credit cycle and if history is a guide – which it very often is – analyst estimates are likely too low, and the “real” P/Es for the Canadian banks are lower than they appear.

Possibly by a lot.

As the chart below highlights, analysts have difficulty accurately forecasting earnings in credit cycles. As the recovery advances, history suggests analyst estimates for the next two years could be understated by between 5% and 10% per year, which means the banks are cheaper than they appear using current analyst estimates as a base. According to Bloomberg, the average P/E multiple for the Big-6 Canadian banks is currently 10.8x for f2022 and 10.3x for f2023. However, if historical patterns hold, these multiples could be overstated by between 0.5x and 1.0x, which if correct could mean that the “real” P/E multiples are between 9.7x and 10.3x for f2022 and 9.3x and 9.8x for f2023, well below historical averages. This is important, since if correct it would mean the market is currently underestimating the potential upside to Canadian bank shares.

As noted above, Q4 earnings confirmed the recovery had started, just as we predicted.[3] With respect to this recovery, in our February 17th video update, “Canadian Banks – Three Potential Catalysts for 2021”, we identified three catalysts for Canadian bank stocks in 2021, namely: (i) normalization of profitability and forward estimates; (ii) reserve releases (supporting dividends, buybacks and/or acquisitions); and (iii) improving macroeconomic data (higher growth expectations, improving sentiment, and a steepening yield curve). And in Q1-21 reporting, the first catalyst was realized, which we explained in our post-quarter update, “Canadian Banks: Q1-21 Takeaways – One Catalyst Down, Two to Go”.

In the next three to four quarters, we believe catalysts #2 (reserve releases) and #3 (outsized GDP quarters) will further support bank stocks. Further, if history repeats, upward earnings revisions could be as large as 10%, meaning the “real” price-to-earnings ratios could be between 0.5x and 1.0x lower than they appear.

To capitalize on the ongoing recovery, investors can consider the Hamilton Enhanced Canadian Bank ETF (HCAL), which uses modest cash leverage (25%). Over the long-term, HCAL offers potential for higher returns and a higher dividend yield (currently 5.16%[4], paid monthly). Alternatively, investors could consider the Hamilton Canadian Bank Mean Reversion Index ETF (HCA), which seeks to replicate the returns (net of expenses) of the Solactive Canadian Bank Mean Reversion Index and has a yield of 4.13%[5] (paid monthly).

Recent Insights:

Press Release: Hamilton ETFs Announces Name Change for HCAL (April 1, 2021)

Video: “Canadian Banks – Three Catalysts for 2021” (February 17, 2021)

Four Themes Driving Financial Innovation (January 25, 2021)

U.S. Banks: The Return of M&A – A Clear Sign of Banker’s Conviction in the Recovery (December 16, 2020)

Canadian Banks: Q4 2020 Takeaways – Recovery Has Started; What’s Next? (December 8, 2020)

Canadian Banks: Will Q4 be a ‘Clean-up’ Quarter? (October 26, 2020)

Canadian Banks: Outperformance from Mean Reversion (in 7 Charts) (June 11, 2020)

____

A word on trading liquidity for ETFs …

Hamilton ETFs are highly liquid ETFs that can be purchased and sold easily. ETFs are as liquid as their underlying holdings and the underlying holdings trade millions of shares each day.

How does that work? When ETF investors are buying (or selling) in the market, they may transact with another ETF investor or a market maker for the ETF. At all times, even if daily volume appears low, there is a market maker – typically a large bank-owned investment dealer – willing to fill the other side of the ETF order (at net asset value plus a spread). The market maker then subscribes to create or redeem units in the ETF from the ETF manager (e.g., Hamilton ETFs), who purchases or sells the underlying holdings for the ETF.

Notes

[1] Formerly known as the Hamilton Canadian Bank 1.25x Leverage ETF.

[2] As of April 15, 2021

[3] See our Insights “Canadian Banks: Will Q4 be a Clean-Up Quarter?” (October 26, 2020), and “Canadian Banks: Q4 2020 Takeaways – Recovery Has Started; What’s Next?” (December 8, 2020).

[4] As of April 15, 2021

[5] As of April 15, 2021