In October 2020, we launched the Hamilton Enhanced Canadian Bank ETF (ticker: HCAL), a modestly levered version of our Canadian bank mean reversion strategy ETF (ticker: HCA), in anticipation of a credit-driven recovery for Canadian bank earnings and stocks. In our view, with its 25% leverage, HCAL offers investors an opportunity to benefit as the recovery gains traction (in the near-to-medium term), as well as for higher long-term growth and attractive monthly dividends (the current yield is 5.31%[1]).

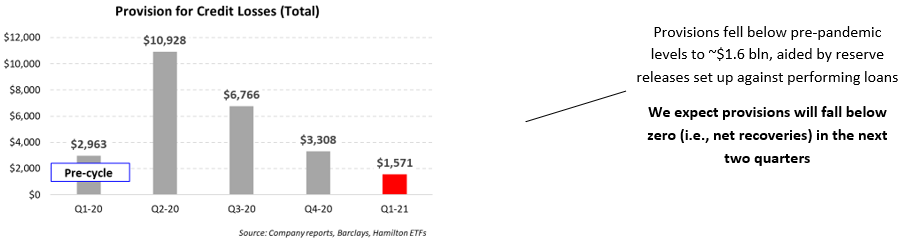

As the banks approached their fiscal year-end, we hosted a webcast entitled, “Canadian Banks: Cycle is (Basically) Over”, in which we predicted the worst of the credit cycle was behind the banks, and they were poised for a recovery. This forecast was supported by the fact the banks had built a very substantial $23.5 bln of allowances against performing loans to protect against possible defaults from the ongoing COVID-related economic downturn[2]. We forecast the earnings recovery would begin with a large decline (and normalization) of loan losses and that the recovery in stock prices would follow two distinct catalysts:

- Catalyst #1: the banks would achieve pre-cycle profitability in fQ1-21. This would be significant as it would lead to a normalization (i.e., increase) in forward earnings estimates (f2022) and set the stage for dividend increases in the coming quarters.

- Catalyst #2: the banks would begin to release between $6-$8 bln of reserves against performing loans (likely in f2022). This would push capital levels even higher and allow for either buybacks and/or possible expansion of P/E multiples.

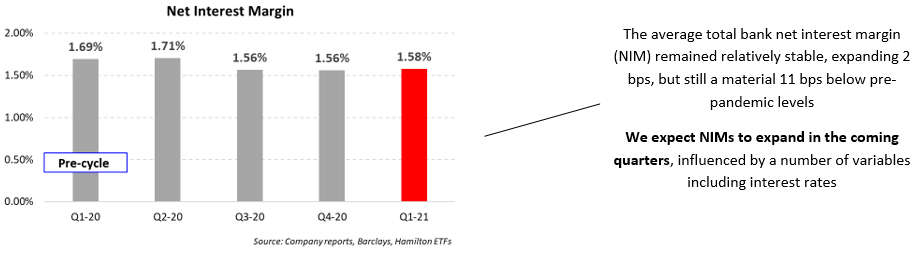

In our Q1 preview video (February 17, 2021), we identified a third catalyst for the sector – the potential for outsized GDP growth in the latter half of calendar 2021 stemming from pent-up demand as economies open up. If this acceleration of economic growth is accompanied by higher long-rates and/or a steepening yield curve, net interest margins should expand (after declining during the pandemic) which should result in higher revenues.

Taken together, these three catalysts could lead to further EPS estimate increases and possibly higher P/E multiples.

So far, our thesis is intact and all our major forecasts since the cycle began have been affirmed.

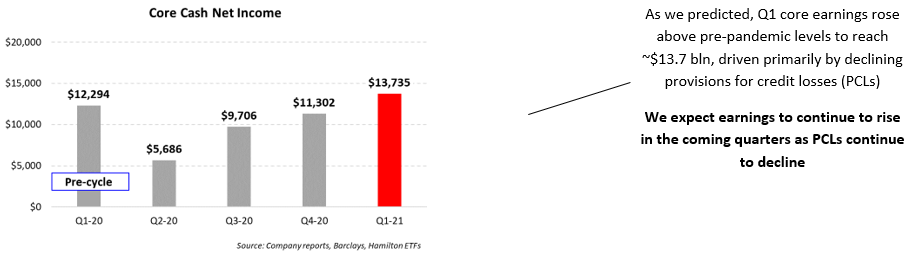

Key Q1-21 Takeaways: Catalyst #1 Earnings Normalization Achieved

As we forecasted several months ago, the banks reached normalized profitability in Q1-21. As a result, the first catalyst has been achieved, which helped stock prices to (finally) rise above pre-pandemic levels. Importantly, forecast EPS for f2022, which underpins stock prices and multiples, has also fully recovered. In fact, every single Big-6 Canadian bank now trades at a stock price higher than before the cycle began[3] and forward estimates for f2022 have similarly normalized.

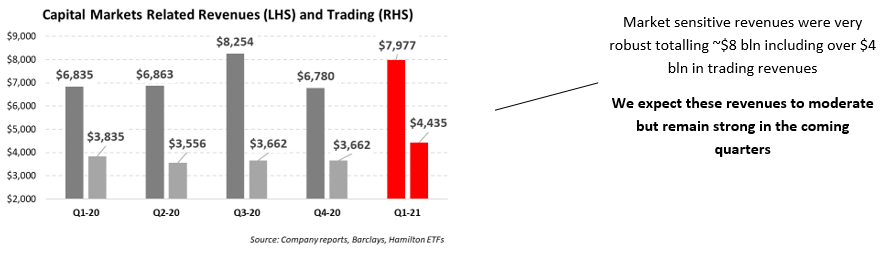

Below we provide – in charts – the sector’s earnings trends and key drivers of volatility since the cycle began, as well as our expectations for each going forward.

Two More Catalysts to Go; Capitalizing on the Ongoing Recovery with HCAL and HCA

As we explained in our preview video, we believe Canadian bank share price performance in 2021 will be supported by three catalysts: (i) normalization of earnings and forecast earnings, (ii) large reserve releases, and (iii) improving macro economic data. In this quarter, the first catalyst was achieved. We believe the remaining catalysts will support Canadian bank performance in 2021 and into 2022.

To gain exposure to the ongoing recovery, investors should consider our modestly levered Hamilton Enhanced Canadian Bank ETF (HCAL), which utilizes modest (cash) leverage[4] to allow investors higher potential long-term returns and a higher dividend yield – currently 5.31%[5], paid monthly (and unlike covered call strategies, not materially supported by return of capital). For investors who prefer unlevered exposure, they should consider the Hamilton Canadian Bank Mean Reversion Index ETF (HCA), which seeks to replicate the returns (net of expenses) of the Solactive Canadian Bank Mean Reversion Index (SOLCBMRT) and also pays monthly distributions.

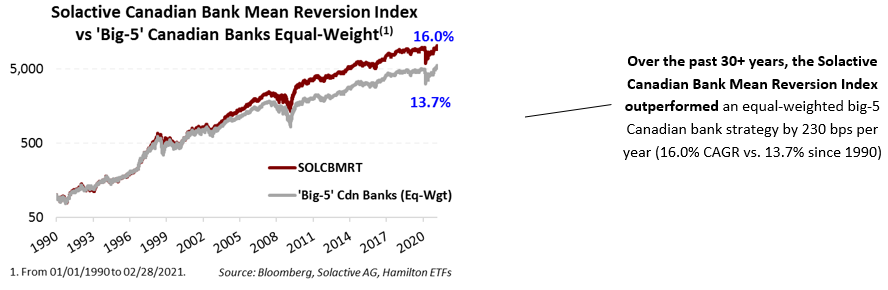

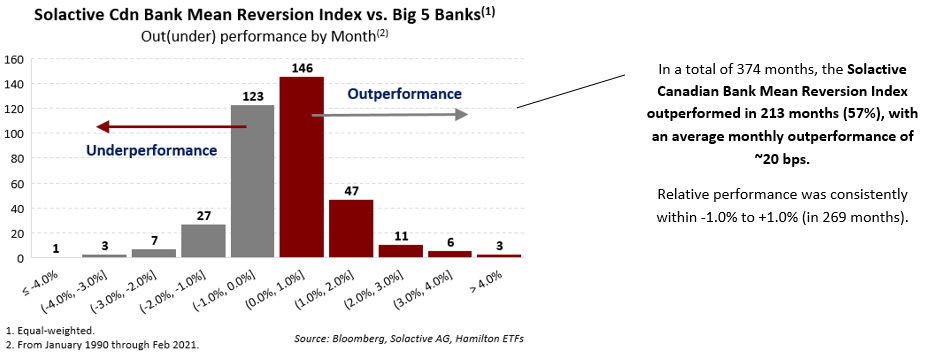

The Solactive Canadian Bank Mean Reversion Index, which begins in 1990, has a history of outperformance versus an equal weight Canadian bank strategy including over most relevant periods (5, 10, 20 and 25 years, for example) and credit cycles. This outperformance was driven by the extremely high historical correlations – and mean reversion tendencies – of Canadian bank stock prices.

Recent Notes:

Canadian Banks: Video: Key Takeaways from Q4 Earnings (December 8, 2020)

Canadian Banks: Q4 2020 Takeaways – Recovery Has Started; What’s Next? (December 8, 2020)

Canadian Banks: Will Q4 be a ‘Clean-up’ Quarter? (October 26, 2020)

Hamilton Enhanced Canadian Bank ETF (HCAL) – Get More from the Canadian Banks (October 14, 2020)

Canadian Banks: Outperformance from Mean Reversion (in 7 Charts) (June 11, 2020)

Canadian Banks: Three Vulnerable Loan Categories in Charts (May 15, 2020)

One Chart: Australia Appears to be Flattening the Curve Ahead of Other Countries (April 2, 2020)

Financials: Does COVID-19 Represent a Growth Scare, Credit Event or Crisis? (March 25, 2020)

____

A word on trading liquidity for ETFs …

Hamilton ETFs are highly liquid ETFs that can be purchased and sold easily. ETFs are as liquid as their underlying holdings and the underlying holdings trade millions of shares each day.

How does that work? When ETF investors are buying (or selling) in the market, they may transact with another ETF investor or a market maker for the ETF. At all times, even if daily volume appears low, there is a market maker – typically a large bank-owned investment dealer – willing to fill the other side of the ETF order (at net asset value plus a spread). The market maker then subscribes to create or redeem units in the ETF from the ETF manager (e.g., Hamilton ETFs), who purchases or sells the underlying holdings for the ETF.

Notes

[1] As of February 26, 2021.

[2] This does not include an additional $5 bln against impaired loans.

[3] Versus January 2, 2020.

[4] HCAL does not use derivatives but rather achieves its leverage through simple cash borrowing provided by a Big-6 Canadian bank.

[5] As of February 26, 2021.