Last week, Bank of Nova Scotia reported its Q3 results and its International Banking division generated solid double-digit earnings growth, supported by a strong economic backdrop and acquisitions. Within this segment is the Bank’s operations in the Pacific Alliance, the Latin American trade bloc that includes Peru, Chile, Columbia, and Mexico. This very large emerging markets platform has over $100 bln in loans, generates earnings of…

Commentary: HCA

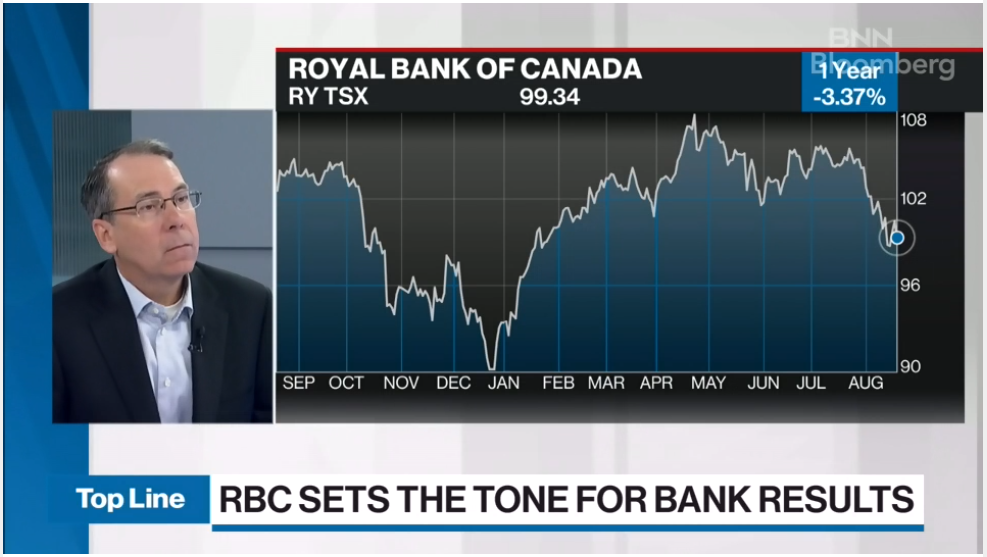

BNN Bloomberg: Royal Bank Q3 Earnings & Canadian Banks Outlook

Rob Wessel was on BNN Bloomberg this morning to discuss Q3 earnings results for RBC and our outlook for the Canadian banks and the Hamilton Canadian Bank Variable-Weight ETF (HCB). Click here to watch the interview. Note to Reader: This Insight includes references to certain Hamilton ETFs that were active at the time of writing. On June 29, 2020, the following mergers took place: (i) Hamilton Global…

Canadian Banks: Why Volatility Will Likely Rise (and a Comment on Mean Reversion)

In October 2018, we launched the Hamilton Capital Canadian Bank Variable-Weight ETF (ticker: HCB), which seeks to benefit from the historical mean reversion tendencies of the Big-6 banks, especially in times of greater market volatility. At the end of each month, the three most oversold banks are rebalanced to represent ~80% of HCB, while the three most overbought banks are rebalanced to 20%. HCB’s objective is…

Cdn/Aust’n Banks: Why the Big Housing Short is So Difficult (and the Risk of a “Direct Hit” Remains Low)

In Q4 2018, we expanded our ETF offering to include two ETFs with monthly distributions and exposure to two world-class – and very similar – financial sectors with excellent performance histories. In October, we launched the Hamilton Capital Canadian Bank Variable-Weight ETF (HCB), a rules-based strategy that seeks to capitalize on the historical mean reversion tendencies of the Canadian banking sector[1]. In December, we launched the…

Canadian Banks: Five Takeaways from BBT/STI, Accelerating U.S. Bank M&A

Last week, in our insight “U.S. Bank M&A: Implications of the Largest Deal in a Decade”, we explained why we expect U.S. bank consolidation will accelerate following the BB&T/SunTrust merger, and reasons why such activity will predominately be within the small and mid-cap banks. In this insight, we offer five takeaways for the Canadian banks – BMO, CM, RY, and TD – and their U.S. expansion…

Pref ETFs Falter (Again): Why HFA/HCB are Logical Switch Candidates for Monthly Income

Following our October launch of the Hamilton Capital Canadian Bank Variable-Weight ETF (HCB), today we launched the Hamilton Capital Australian Financials Yield ETF (HFA). Both of these ETFs pay monthly dividends. HFA seeks to generate a yield of 6.5% or higher from a portfolio of higher dividend-paying Australian financials operating in arguably the world’s strongest and safest financial sector (aided by covered calls). Of note, the…

HCB: A New Strategy for Bank Investors (Wealth Professional Article)

Wealth Professional interviewed Rob Wessel, Managing Partner at Hamilton Capital, following the launch of the Hamilton Capital Canadian Bank Variable-Weight ETF (HCB). The interview covers mean reversion trends and how they are incorporated into HCB, how the strategy might lower risk in period of market turbulence. Click here to read more.

Notes from Chicago: Opinions on the Canadian Banks (part 1)

We recently met with the top management of four Chicago-headquartered U.S. mid-cap banks (see related October 9, 2018 “Notes from Chicago – Three Takeaways from the Windy City (Part 2)”). Given their large presence in this giant MSA, it was not surprising that the Canadian banks and their speculated U.S. expansion plans were a frequent discussion topic. Chicago is the single most important market to Canadian…

Canadian Banks: Mean-Reversion Strategy for Higher Returns/Lower Risk

On October 2nd, 2018, Hamilton Capital will be launching the Hamilton Capital Canadian Bank Variable-Weight ETF (HCB). This ETF will consist of the Big-6 Canadian banks, rebalanced monthly to capitalize on the long-term mean reversion tendencies of the sector. Specifically, it will overweight the three most oversold banks from the prior month (to ~80%) and underweight the three most overbought banks (to ~20%). Please note: The…