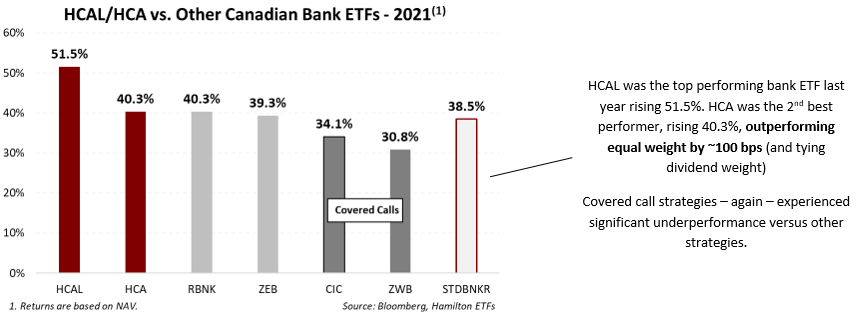

During 2021, the Hamilton Enhanced Canadian Bank ETF (HCAL) and the Hamilton Canadian Bank Mean Reversion Index ETF (HCA) outperformed all other Canadian bank ETFs, rising 51.5% and 40.3%, respectively. Entering last year, we forecast the Canadian banks would have a very strong year (see our insight “Q4-2020 Takeaways – Recovery Has Started” and our video “Three Potential Catalysts for 2021”[1]). HCAL outperformed all strategies by a wide margin, while HCA outperformed equal weight by ~100 bps (and tied dividend weight). The Canadian bank total return index (STDBNKR), which is market cap weighted, rose 38.5%.

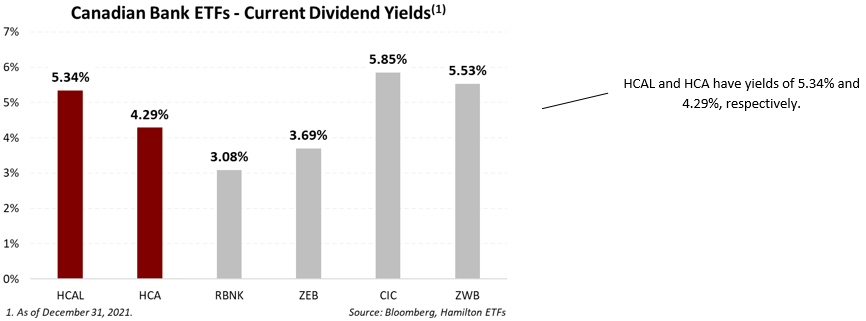

Not surprisingly, as they have done for the last decade, Canadian bank covered call strategies underperformed by a significant margin, with HCAL outperforming the largest covered call ETF by over 20%. As the chart below highlights, these strategies do offer higher yields, but investors sacrifice material upside performance. It is for this reason we launched the Hamilton Enhanced Canadian Bank ETF (HCAL), which offers higher upside potential and a comparable yield to covered call strategies through the use of modest 25% leverage. HCAL and HCA also offer attractive yields, at 5.34% and 4.29%, respectively, as of December 31, 2021.

As we explain in “Canadian Banks: Five Possible Drivers in 2022”, we believe the banks are poised to continue to have another good year. And importantly, valuations remain reasonable, if not low, by historical standards. This combined with strong – and likely rising – yields should provide support to share prices.

Recent Insights

Canadian Banks: Five Possible Drivers in 2022 (Q4 2021 in Charts) (December 17, 2021)

Canadian Banks: How High Can Dividends Go? (October 19, 2021)

HCAL Ends its First Year as Top Performing Canadian Bank ETF (October 19, 2021)

Canadian Banks: Record Earnings/Capital; Still in Catalyst #2 (Q3 2021 in Charts) (September 1, 2021)

Canadian Banks: Why OSFI Should Lift its Dividend Cap Now (August 20, 2021)

HCAL/HCA: Volatility vs Individual Canadian Banks (April 26, 2021)

Canadian Banks: Are Analysts Underestimating the Recovery (Again)? (April 16, 2021)

Video: “Canadian Banks – Three Catalysts for 2021” (February 17, 2021)

Canadian Banks: Q4 Takeaways – Recovery Has Started; What’s Next? (December 8, 2020)

____

A word on trading liquidity for ETFs …

Hamilton ETFs are highly liquid ETFs that can be purchased and sold easily. ETFs are as liquid as their underlying holdings and the underlying holdings trade millions of shares each day.

How does that work? When ETF investors are buying (or selling) in the market, they may transact with another ETF investor or a market maker for the ETF. At all times, even if daily volume appears low, there is a market maker – typically a large bank-owned investment dealer – willing to fill the other side of the ETF order (at the bid/ask spread).

[1] December 8, 2020 and February 17, 2021, respectively