Q3 earnings trends for the Canadian banks were again strong with record earnings and capital levels, while the ‘three catalyst’ investment thesis – normalization of profits, reserve releases and higher margins – we laid out for the sector in February continues to play out almost exactly as predicted[1]. We believe the banks are still supported by Catalyst #2.

Before we discuss Canadian bank results in more depth, we would like to highlight the recent launch of the Hamilton Enhanced Multi-Sector Covered Call ETF (ticker: HDIV), which has a yield of 8.39%[2], paid monthly. HDIV has a sector mix broadly consistent with that of the S&P/TSX 60 and utilizes modest 25% cash leverage to support higher yields and higher potential long-term returns, while seeking to mitigate the yield/return trade-off inherent in covered call strategies. For more information, please visit HDIV’s web page and refer to the Questions and Answers on HDIV.

Back to Q3 results: As mentioned, the Canadian banks reported another very strong quarter, however, there is one aspect – out of management’s control – that disappointed us: the continued moratorium on dividend increases, which we believe should have been lifted last quarter. As we explained in more detail in Canadian Banks: Why OSFI Should Lift its Dividend Cap Now (August 20, 2021), there is no substantive policy reason for the continued moratorium.

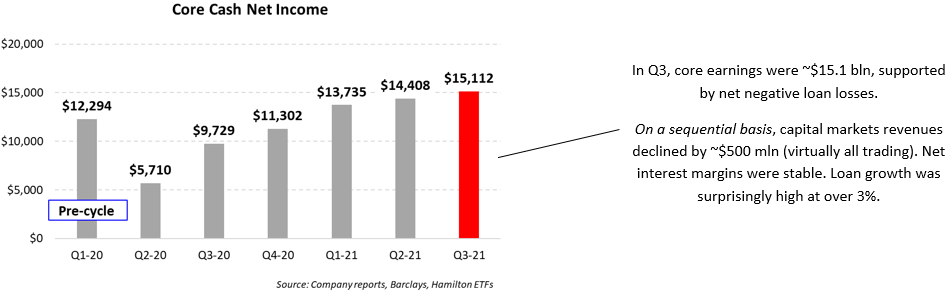

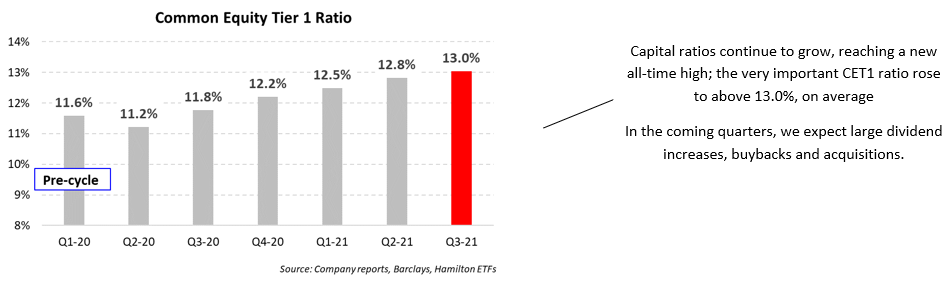

We believe this quarter’s results further support our view. Quarterly earnings (of $15 bln in aggregate, see chart A) and capital (CET1 of 13% on average) reached all-time highs – again. With payout ratios down nearly 800 bps from pre-pandemic levels[3] and earnings and capital facing additional upward pressure, the logic supporting this moratorium is tenuous at best. As for any political implications, it is difficult to believe the banks resuming normal dividend increases rises to the level of important public policy at a federal level. (On a related note, we believe it is too early to assess the likelihood for a special bank surtax, but Barclays estimated the impact to be between 1.1% and 2.4% of earnings.)

With respect to the quarter, the impact of pandemic-inflated reserves on earnings and capital continue to dominate results.

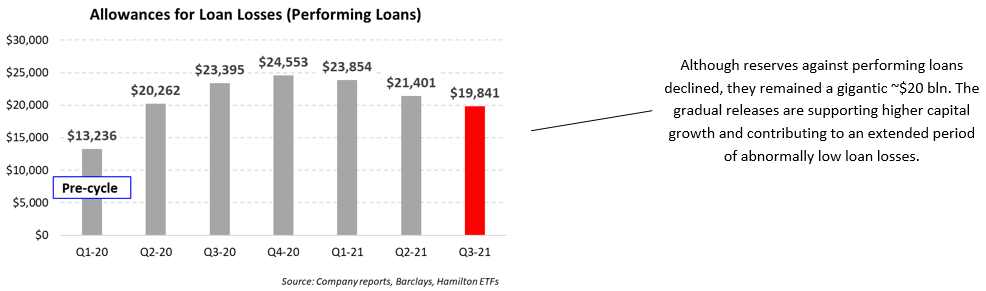

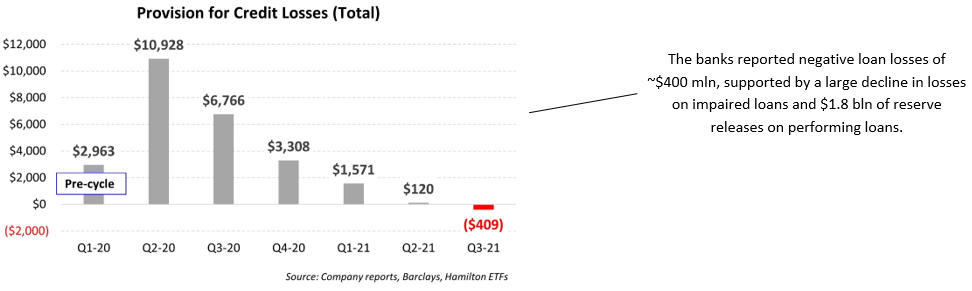

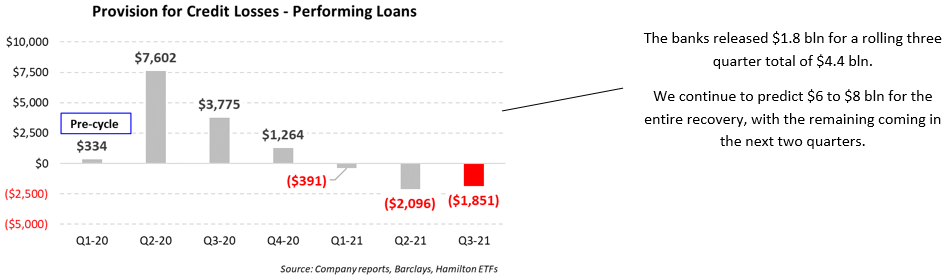

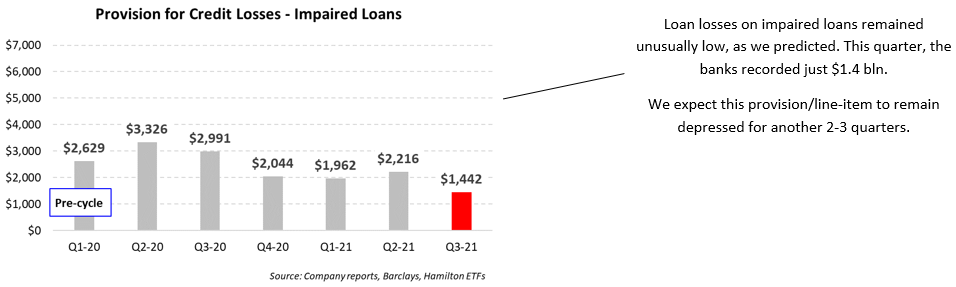

Reserves (also known as allowances) against performing loans are still a gigantic $20 bln [see chart B]. We forecasted total reserve releases of a substantial $6 to $8 bln. So far, the banks have released ~$4 bln, including $1.8 bln this quarter, and we anticipate up to an additional $4 bln to be released in the next one to two quarters. The sheer size of these reserves is supporting bank fundamentals via unusually low loan losses, while ongoing releases are supporting capital growth. Notably, this was the first quarter of the recovery where the banks recorded negative loan losses [see chart C].

In addition, the quantity and quality of bank capital has never been higher. As predicted, CET1 ratios rose above 13% in Q3 [see chart F], up from 11.6% before the pandemic, while the average ‘core’ dividend payout ratio has declined to ~37% from ~45% in Q1-20. The build up of billions of dollars of excess capital will allow the banks to raise dividends and institute buybacks once permitted. With core earnings nearly 20% higher than pre-pandemic levels, we believe the potential for similar percentage increases in the bank dividends next year is very high.

In our view, the recovery is still in the middle innings. This should support fundamentals for the next several quarters and potentially further upward earnings revisions. That said, valuations remain relatively low, with forward P/E multiples at just over 10x (below historical averages). Investors seeking exposure to the Canadian banks should consider our modestly levered Hamilton Enhanced Canadian Bank ETF (HCAL)[4], which offers investors the potential for higher longer-term returns and higher yield (currently 5.23%[5], paid monthly), especially versus Canadian bank covered call strategies, which historically have experienced their largest underperformance in rising markets.

Q3 2021 in Charts – Another Good Quarter; Balance Sheets Remain Extremely Strong

A.

B.

C.

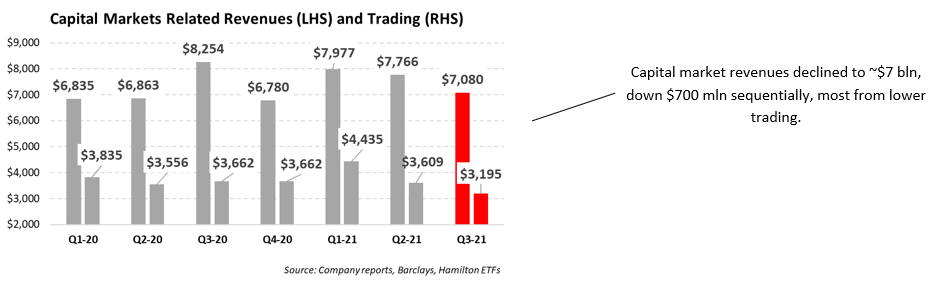

D.

E.

F.

G.

Recent Insights

Canadian Banks: Why OSFI Should Lift its Dividend Cap Now (August 20, 2021)

Canadian Banks: Reserve Releases Dominate Results; Q2-21 Takeaways (in Charts) (June 2, 2021)

Australian Banks: Earnings Recovery in Progress; Massive Capital Return Ahead (May 25, 2021)

Canadian Banks: Catalyst #2 (Reserve Releases) Approaching? (April 30, 2021)

HCAL/HCA: Volatility vs Individual Canadian Banks (April 26, 2021)

Canadian Banks: Are Analysts Underestimating the Recovery (Again)? (April 16, 2021)

Canadian Banks: Q1-21 Takeaways – One Catalyst Down, Two to Go (March 2, 2021)

Video: “Canadian Banks – Three Catalysts for 2021” (February 17, 2021)

____

A word on trading liquidity for ETFs …

Hamilton ETFs are highly liquid ETFs that can be purchased and sold easily. ETFs are as liquid as their underlying holdings and the underlying holdings trade millions of shares each day.

How does that work? When ETF investors are buying (or selling) in the market, they may transact with another ETF investor or a market maker for the ETF. At all times, even if daily volume appears low, there is a market maker – typically a large bank-owned investment dealer – willing to fill the other side of the ETF order (at net asset value plus a spread). The market maker then subscribes to create or redeem units in the ETF from the ETF manager (e.g., Hamilton ETFs), who purchases or sells the underlying holdings for the ETF.

[1] See our Video: Canadian Banks – Three Potential Catalysts for 2021 for more detail.

[2] As of August 31, 2021.

[3] Source: Barclays, Hamilton ETFs

[4] Formerly known as the Hamilton Canadian Bank 1.25x Leverage ETF

[5] As on August 31, 2021