HCAL Ends Year #1 as the Top Performing Canadian Bank ETF; Hamilton ETF AUM Exceeds $1 bln

Before we discuss our outlook for 2022, we wanted to highlight that the Hamilton Enhanced Canadian Bank ETF (HCAL), the top performing bank ETF since its launch in October 2020. Year-to-date (2021), HCAL is outperforming equal weight/yield weighted strategies by 9% and covered call strategies by 14-17%. As of November 30, HCAL had an annualized return of 48.5%, and has a yield among the highest at ~5.4%. In addition, in November, Hamilton ETFs’ assets under management (AUM) rose above $1 bln and we are now the #2 provider of Canadian bank ETFs in Canada[1].

Over the last two years, we have provided our views on how this unprecedented event could impact the Canadian banks, first the downturn (2020), with our webcast “Credit Cycle Coming; What to Expect” where we correctly identified the unique character of the cycle including/especially the short length of the downturn[2]. Then, with our October 2020 webcast “Canadian Banks: Cycle is (Basically) Over” we then shifted our focus to the emergent recovery in 2021 where we correctly predicted that the recovery had begun, and bank stocks would begin to recover from their depressed levels supported by three key catalysts[3].

What do we expect for 2022?

Recovery is Not Over (Yet); Five Factors Impacting Canadian Bank Stocks in 2022

The COVID-driven credit cycle has dominated bank profitability for two years and we believe will remain an important – albeit diminishing – driver of results in 2022. Importantly, while the credit recovery is far advanced, it is not over. We think the banks will see the benefits of the recovery for at another two quarters (Q1 and Q2), before trending to normal in the latter part of the year. We expect the following factors to influence 2022 results:

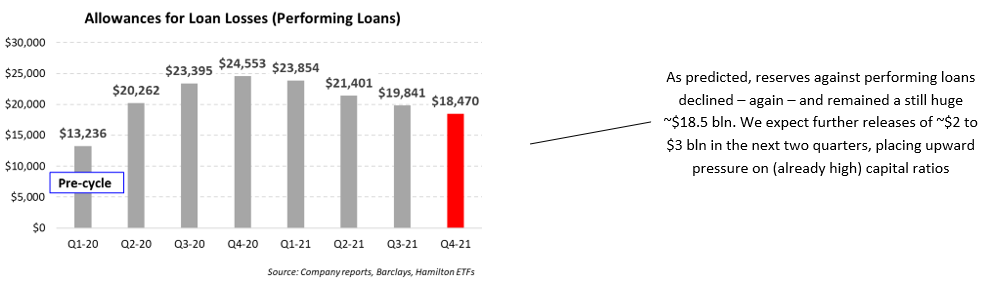

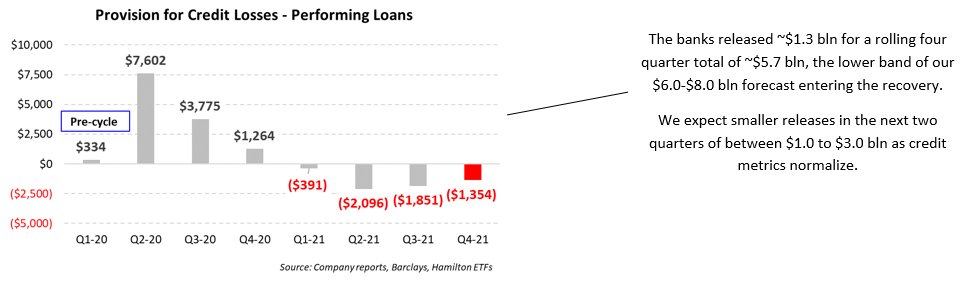

First, reserve releases are likely to continue for two more quarters. As mentioned, the banks released $6 bln in 2021 (Chart D), and we would expect another $2 bln, thus taking the full recovery in the current cycle to $8 bln, the upper range of our forecasts. These reversals continue to drive up capital ratios and support lower loan losses/higher earnings which are generally not being forecast by the analysts.

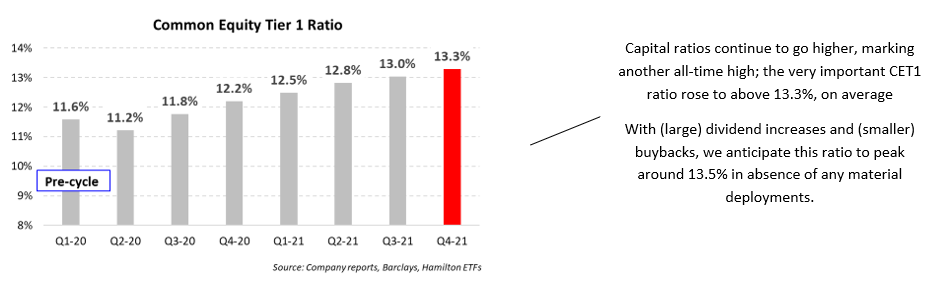

Second, capital return should be an important positive, especially dividends. The very important CET1 ratios are at all-time highs of 13.3% for the big-6 banks, having risen for six consecutive quarters (Chart F). In the absence of any large acquisitions, we would expect this ratio to approach 14%. With payout ratios ~400 bps below pre-pandemic levels we believe dividends will take another large step-up in Q2–22, possibly increasing 10% to 15%. Despite this substantial build-up in capital, buybacks announced in Q4 were surprisingly small, and it is not clear they will be increased.

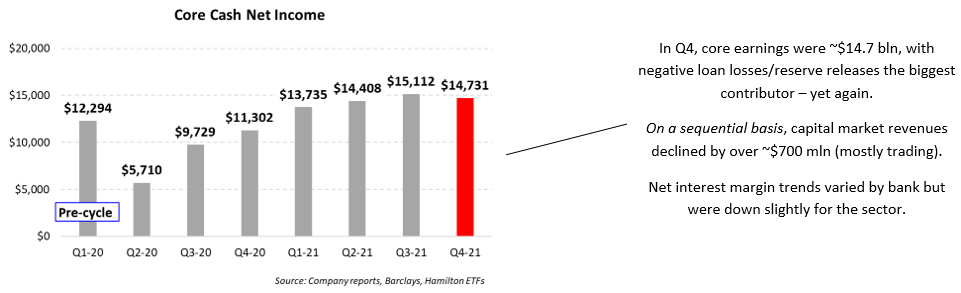

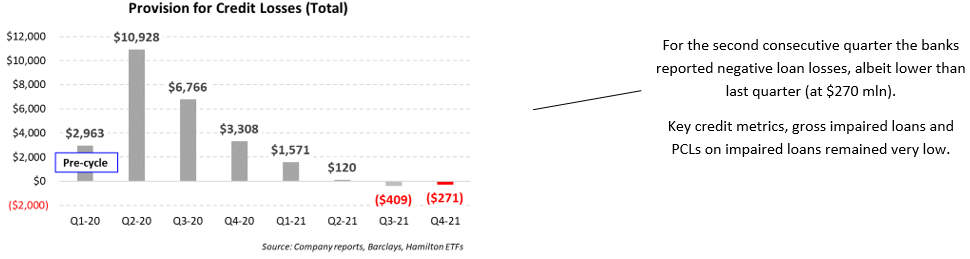

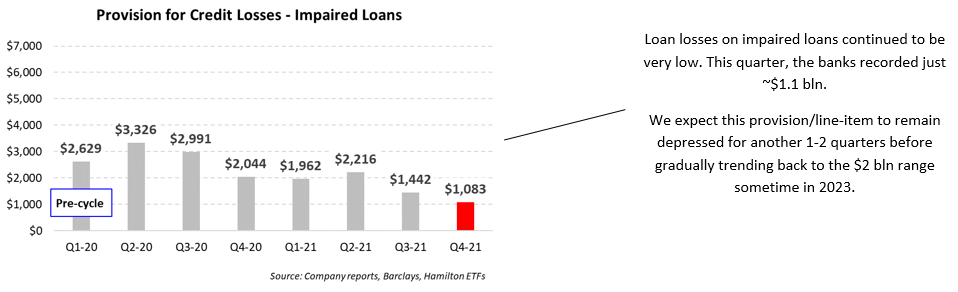

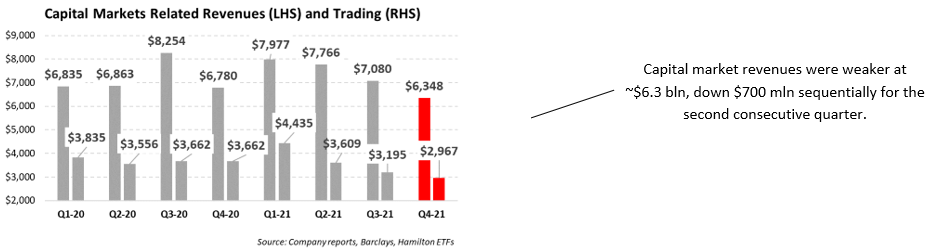

Third, earnings growth in 2022 is likely to be more modest following the huge 50% experienced in 2021 supported by very low, if not negative credit losses (Chart C). This would create a challenging growth comparable. That said, earnings quality is likely to improve as gradually rising loan losses are replaced by: (i) improving capital markets revenues which were surprisingly weak in 2H21 (Chart G), and (ii) higher net interest income from a combination of loan growth and higher net interest margins (NIMs).

Fourth unknown political and regulatory risk. During the election campaign, the government proposed a special 3% surtax and a mostly undefined “temporary Canada Dividend Recovery fund/tax”, which will negatively impact earnings, but be for the most part manageable. However, what concerns us is if these proposals reflect the beginning of a broader trend towards re-regulation of the financial sector with additional unexpected taxation/regulatory measures to follow. We believe this caution by the banks was why the dividend increases were lower than the market expected.

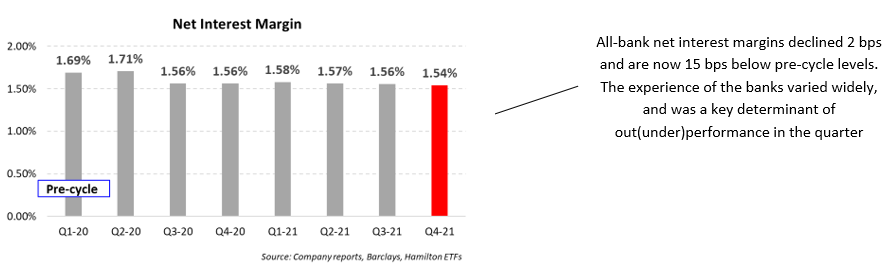

Fifth, the impact of monetary policy, interest rates and the yield curve could have a material impact on both earnings and valuations. In our video “Three Catalysts for 2021”, the third catalyst was “the reopening trade”, characterized by several quarters of outsized GDP growth (driving higher loan balances) and a steepening yield curve (expanding net interest margins) which together drive higher net interest income. Since the pandemic began in Q1 2020, lower rates contributed to a highly material 15 bps decline in net interest margins (Chart H). Should the yield curve steepen in an orderly fashion it would be positive. If the rise in rates is abrupt and/or disorderly, it could weigh on the markets and valuations.

So, what does this mean, overall?

In our view, while the recovery is in its late stages – it is not over. In 2022, we anticipate two more quarters of credit supported earnings before it begins to trend towards normal. We would also anticipate strong net interest income. We expect high capital returns including another quarter of large dividend increases. Together, these factors would support earnings and valuations. Moreover, Canadian bank valuations remain relatively low, with forward P/E multiples at just over 10x (well below historical averages).

Investors seeking exposure to the Canadian banks should consider our Hamilton Enhanced Canadian Bank ETF (HCAL)[4] – the top performing Canadian bank ETF since its inception. HCAL employs modest leverage of 25% and offers investors the potential for higher longer-term returns and a higher yield (currently 5.23%[5], paid monthly)

Q3 2021 in Charts – Another Good Quarter; Balance Sheets Remain Extremely Strong

A.

B.

C.

D.

E.

F.

G.

H.

Recent Insights

Canadian Banks: How High Can Dividends Go? (October 19, 2021)

HCAL Ends its First Year as Top Performing Canadian Bank ETF (October 19, 2021)

Canadian Banks: Record Earnings/Capital; Still in Catalyst #2 (Q3 2021 in Charts) (September 1, 2021)

Canadian Banks: Why OSFI Should Lift its Dividend Cap Now (August 20, 2021)

HCAL/HCA: Volatility vs Individual Canadian Banks (April 26, 2021)

Canadian Banks: Are Analysts Underestimating the Recovery (Again)? (April 16, 2021)

Video: “Canadian Banks – Three Catalysts for 2021” (February 17, 2021)

Canadian Banks: Q4 Takeaways – Recovery Has Started; What’s Next? (December 8, 2020)

____

A word on trading liquidity for ETFs …

Hamilton ETFs are highly liquid ETFs that can be purchased and sold easily. ETFs are as liquid as their underlying holdings and the underlying holdings trade millions of shares each day.

How does that work? When ETF investors are buying (or selling) in the market, they may transact with another ETF investor or a market maker for the ETF. At all times, even if daily volume appears low, there is a market maker – typically a large bank-owned investment dealer – willing to fill the other side of the ETF order (at net asset value plus a spread). The market maker then subscribes to create or redeem units in the ETF from the ETF manager (e.g., Hamilton ETFs), who purchases or sells the underlying holdings for the ETF.

[1] Combined AUM of over $730 million

[2] During 2020, we also explained our views on the cycle, including the following: “Does COVID-19 Represent a Growth Scare, Credit Event, or Crisis” (Webcast/Insight March); “Canadian Banks: Cycle Entering the Middle Innings” (Webcast, June); “Q4 Takeaways – Recovery Has Started; What’s Next” (Insight, December)

[3] During 2021, we addressed the recovery including the following: “Three Key Catalysts for 2021” (Video, February); “Q1-21 Takeaways – One Catalyst Down, Two to Go” (Insight, March); “Are Analysts Underestimating the Recovery (Again)?” (Insight, April); “Catalyst #2 (Reserve Releases) Approaching” (Insight, April); and “Reserve Releases Dominate Results; Q2-21 Takeaways (in Charts)” (Insight, June)

[4] Formerly known as the Hamilton Canadian Bank 1.25x Leverage ETF

[5] As on August 31, 2021