We believe Canadian investors should have at least a 5% weighting to ‘blue-chip’ financial innovation. The category has attractive growth prospects (secular EPS growth over 25%), high ROEs, and provides valuable diversification to core Canadian financial holdings (especially banks). In June 2020, we launched the Hamilton Financials Innovation ETF (HFT) for investors seeking exposure to higher growth secular themes but are concerned about downside volatility – hence our emphasis on “blue chip” or “established” fintech.

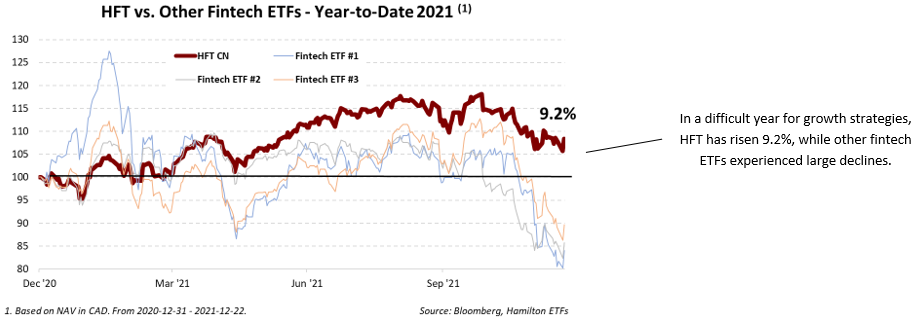

These past 12 months highlighted the benefit of this portfolio structure. Year-to-date, HFT is up 9.2%, while all other fintech ETFs have experienced large declines. Since its launch in June 2020, HFT has provided superior performance but with better downside protection, allowing it to generate higher risk-adjusted returns. The reason for this lower volatility is that relative to HFT, other fintech strategies/ETFs have much greater exposure to: (i) tech stocks including FAANG, (ii) unprofitable and/or smaller firms, and (iii) emerging markets, especially China. Also, of great significance, these other ETF strategies trade at valuations roughly three times higher than HFT with portfolio weighted price-to-earnings ratios of over 100x[1].

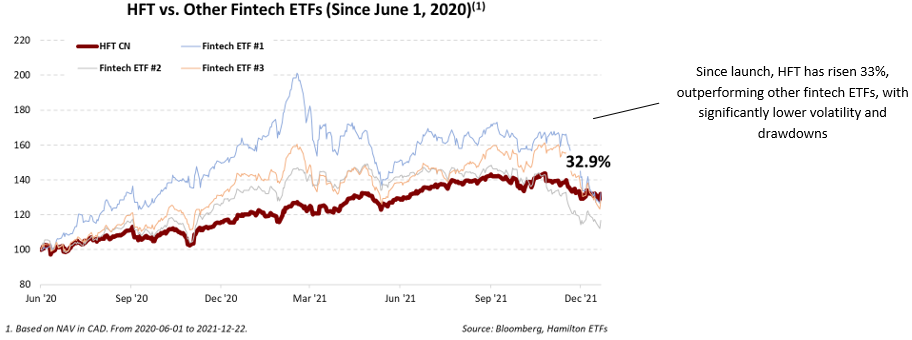

As the charts below highlight, HFT offers a more conservative vehicle to other fintech strategies with more consistent returns and lower volatility.

Since its June 2020 inception, HFT has outperformed four major fintech ETFs rising 33% as the chart below highlights, with more consistent and stable returns in contrast to the other fintech strategies, which were significantly more volatile.

The Hamilton Financials Innovation ETF (HFT) is a diversified portfolio of over 30 positions with primary exposure to the following three key categories: (i) digital payments (35% of NAV), (ii) market data and technology (~35%), and (iii) other fintech innovators, including wealth managers (~30%). The portfolio is skewed to large-cap global financials, with an emphasis on U.S. equities. In our view, HFT offers an attractive balance between growth, volatility, and valuation with limited exposure to the most important risks dominating most financial services investors’ portfolios – namely credit risk, interest rate risk, trading and insurance underwriting – which can be particularly volatile during periods of heightened macro uncertainty.

Related Insights

Is the Future of Banking “Open”? (March 26, 2021)

Market Data M&A Accelerates Pivot to a Digital Future (February 10, 2021)

Four Themes Driving Innovation in Global Financials (January 25, 2021)

Hamilton Financials Innovation ETF: Invest in Digital Leaders Reshaping the Financial Sector (November 19, 2021)

Fintech/Cdn Banks: Can Standalone Digital Banks Disrupt the Incumbents? (January 14, 2021)

Global Financials: The Most Attractive/Important Investment Themes in 2021 (November 16, 2020)

Hamilton ETFs Launches Hamilton Financials Innovation ETF (June 1, 2020)

Global Exchanges, E-Brokers and Fintech: Secular and Structural Growth Drivers Abound (June 15, 2019)

A word on trading liquidity for ETFs …

Hamilton ETFs are highly liquid ETFs that can be purchased and sold easily. ETFs are as liquid as their underlying holdings and the underlying holdings trade millions of shares each day.

How does that work? When ETF investors are buying (or selling) in the market, they may transact with another ETF investor or a market maker for the ETF. At all times, even if daily volume appears low, there is a market maker – typically a large bank-owned investment dealer – willing to fill the other side of the ETF order (at the bid/ask spread).

Notes

[1] At the beginning of 2021, HFT’s holdings traded at a portfolio weighted P/E of 35x forward compared to the other “fintech” ETFs which traded at a over 100x.