2022 is off to a noteworthy start for the Canadian banks, with long-awaited M&A announcements and another strong earnings season. In December, we posted our outlook for the year, “Canadian Banks: Five Possible Drivers in 2022”, in which we stated that the cyclical recovery was not yet over. We identified five factors that we expected would influence bank share prices during 2022: (i) reserve releases, (ii) capital return/deployment, (iii) (moderating) earnings growth, (iv) unknown political/regulatory risk, and (v) a major shift in monetary policy by central banks globally. While it was clear the drivers of the recovery that supported outsized performance in 2021 were greatly diminished, we forecast they would remain factors for the first two quarters of 2022.

Trends year-to date and Q1 results support our thesis.

Before we discuss Canadian bank results, we would like to highlight the recent launch of the Hamilton Enhanced Canadian Financials ETF (ticker: HFIN). Structured similarly to the Hamilton Enhanced Canadian Bank ETF (ticker: HCAL) (i.e., with modest leverage of 25%), our popular enhanced Canadian bank ETF, HFIN invests in the top 12 largest Canadian financials by market capitalization. With large allocations to both banks and insurers, HFIN is more diversified and provides investors with exposure to the same tailwinds driving the banks, plus greater exposure to: (i) rising long-end of the yield curve, (ii) varied international platforms, and (iii) lower valuations of the insurers. The current yield of HFIN is 5.49%[1], paid monthly.

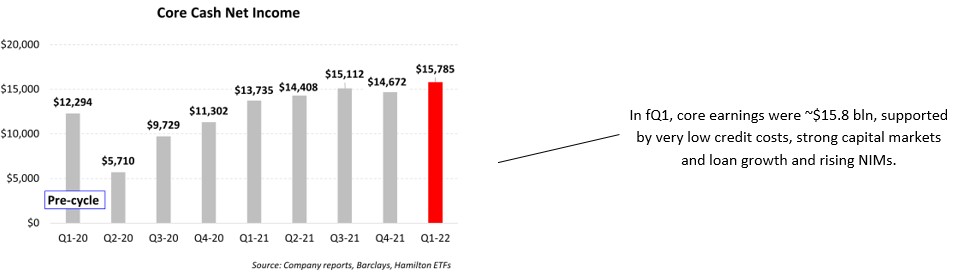

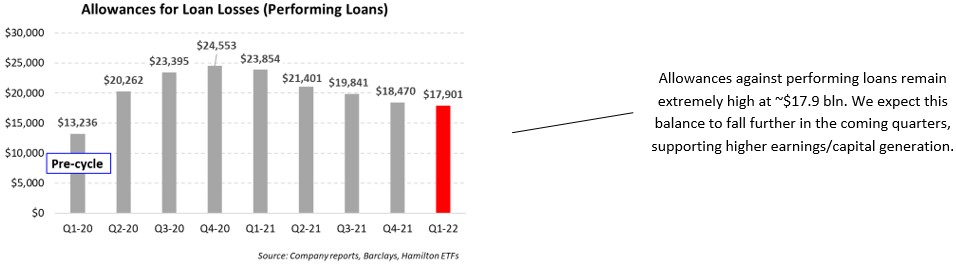

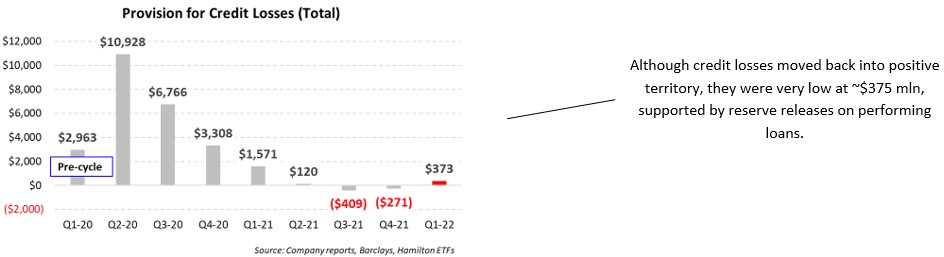

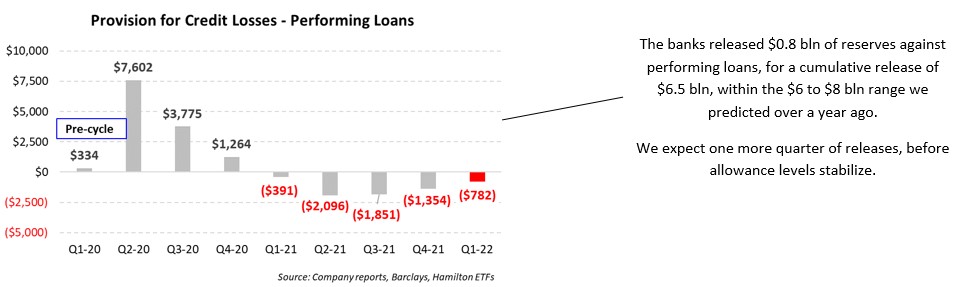

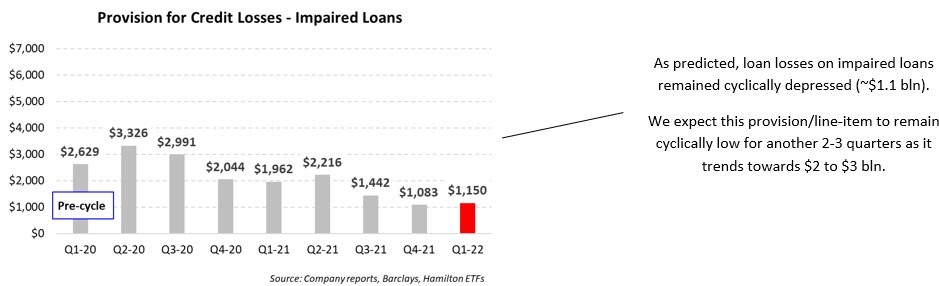

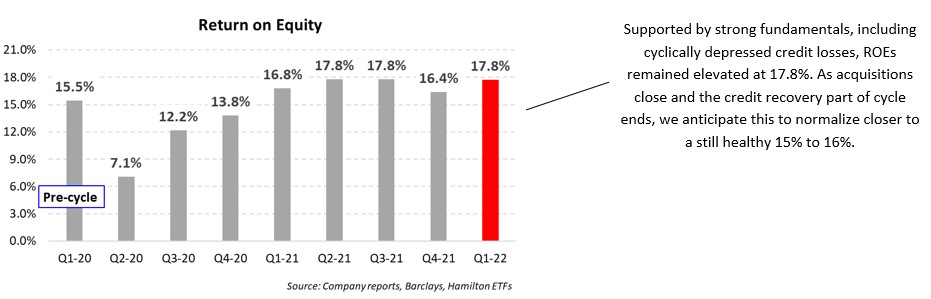

Back to fQ1 results and other trends year-to-date. First, earnings were elevated at ~$15.8 bln [see chart A] as credit losses were – again – very low at less than $400 mln supported by highly material reserve releases on performing loans of ~$800 mln [see charts C and D]. While strictly speaking the market does not “pay” for the earnings from releases, they support other drivers that directly support bank operating results and share prices, including favourable credit, higher earnings/ROEs, and strong capital generation. With reserves against performing loans still extremely high at $18 bln [see chart B], we would expect Q2 to include additional releases from this bucket.

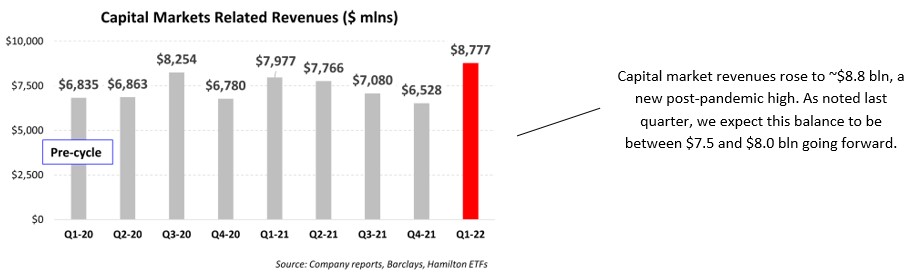

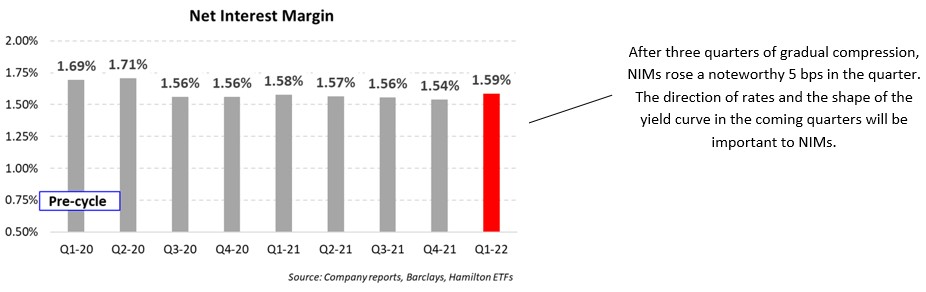

Second, non-credit related drivers also supported the strong quarter. After four consecutive quarters of compression, overall net interest margins expanded by a noteworthy 5 bps to 1.59% [see chart H], while loan growth was also strong (over ~3% Q/Q). Capital markets revenues, which tend to be seasonally higher in fQ1, rebounded to the highest level since the pandemic, coming in at a robust $8.7 bln, up from $6.5 bln last quarter [see chart G].

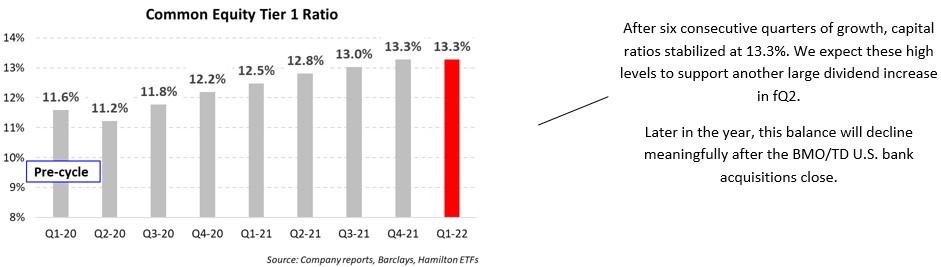

Third, capital return/allocation has already been a big theme year-to-date. BMO and TD announced the two largest acquisitions in Canadian bank history as BMO acquired BNP’s California-based Bank of the West (BoW) for ~$20 bln, and TD acquired First Horizon (ticker, FHN), a prominent U.S. Southeast regional bank, for ~$17 bln. The structure of these transformational deals is unprecedented in almost every major way[2]. Not to be overlooked, BNS also increased its stake in its Chilean subsidiary for $1.3 bln. In the next quarter, we anticipate another material increase in dividends supported by continued earnings growth and an increase (normalization) of payout ratios to pre-pandemic levels. Of great importance, after six consecutive quarters of strong increases in CET1 ratios, this critical ratio remained stable, at ~13% [see chart F]. There were no developments with respect to regulatory risk, but we anticipate some negative news before the summer[3].

In our view, the recovery from the pandemic likely has one more quarter before normalization. However, a crucial test awaits in the form of the significant shift in monetary policy. If in the coming quarters, the yield curve steepens and/or shifts higher in an orderly manner, there could be a highly material upside to net interest margins. On the other hand, if central banks have underestimated the strength and rate of inflation and need to increase rates faster/higher and disrupt GDP growth, all equities will decline – including the financials.

In the meantime, the fundamentals of the sector remain positive and valuations are reasonable. The Big-6 banks currently trade at 10.6x f2023 earnings and insurers at less than 10.0x f2023, below historical averages. Investors seeking exposure to Canadian banks and insurers should consider the Hamilton Enhanced Canadian Financials ETF (HFIN), which offers investors the potential for higher long-term returns and a higher yield (5.49%[4], paid monthly). Investors seeking exposure to purely the Canadian banks should consider our top performing Canadian bank ETF, the Hamilton Enhanced Canadian Bank ETF (HCAL) or the Hamilton Canadian Bank Mean Reversion Index ETF (HCA), which offer attractive yields of 5.48% and 4.28%, respectively (paid monthly)[4].

fQ1 2022 in Charts – Another Strong Quarter; Recovery (Still) Not Over

A.

B.

B.

C.

D.

E.

F.

G.

H.

H.

I.

Recent Insights

Canadian Banks: BMO’s High Risk, High(er) Reward Acquisition of BoW | January 27, 2022

HCA/HCAL Lead All Canadian Bank ETFs in 2021 | January 26, 2022

HFT – “Blue Chip” fintech ETF with Peer Leading Absolute and Risk-Adjusted Returns | December 22, 2021

Canadian Banks: Five Possible Drivers in 2022 (Q4 2021 in Charts) | December 17, 2021

Canadian Banks: How High Can Dividends Go? (and HCAL Outperforms) | October 19, 2021

____

A word on trading liquidity for ETFs …

Hamilton ETFs are highly liquid ETFs that can be purchased and sold easily. ETFs are as liquid as their underlying holdings and the underlying holdings trade millions of shares each day.

How does that work? When ETF investors are buying (or selling) in the market, they may transact with another ETF investor or a market maker for the ETF. At all times, even if daily volume appears low, there is a market maker – typically a large bank-owned investment dealer – willing to fill the other side of the ETF order (at net asset value plus a spread). The market maker then subscribes to create or redeem units in the ETF from the ETF manager (e.g., Hamilton ETFs), who purchases or sells the underlying holdings for the ETF.

[1] As of March 9, 2022.

[2] For a review of the BMO transaction, see our insight “BMO High Risk, High(er) Reward Acquisition of BoW” (January 27, 2022).

[3] Possibly including details on the Canada Dividend Recovery fund/tax and/or special bank tax

[4] As of March 9, 2022