[All values in U.S. dollars unless otherwise noted]

One year on from the market depths of the pandemic, it is worth a quick review of how far the U.S. financials have come. Notwithstanding the fact Ontario recently entered another province-wide lockdown, things south of the border look far brighter, especially for the holdings in the Hamilton U.S. Mid/Small-Cap Financials ETF (tickers: HUM, HUM-U) and much of the Hamilton Global Financials ETF (ticker: HFG; which is ~48% invested in U.S. financials[1]). In this insight, we review why U.S. financial stocks remain attractive (especially the mid-caps):

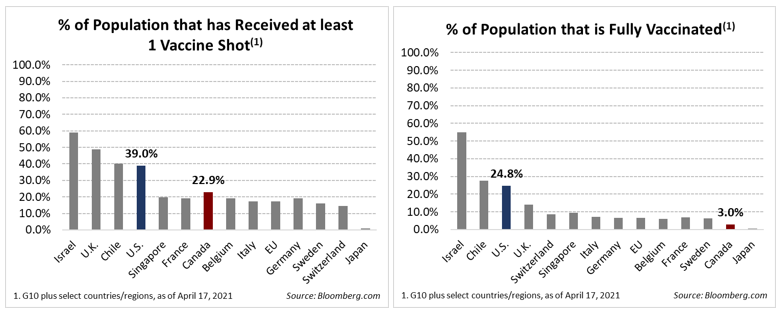

1. Vaccination rates – U.S. outpacing most countries

It’s no secret that the U.S.’s vaccination rate is well ahead of Canada’s and most of the world for that matter (left-hand chart). The differential, however, is particularly wide when we consider the percentage of the population that is fully vaccinated (right-hand chart). Albeit with a way to go to establishing herd immunity, the vaccination rates are an obvious positive factor in the U.S.’s ability to fully reopen its economy and repower toward pre-pandemic levels.

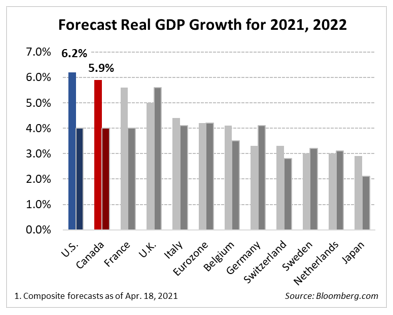

2. Economic growth outlook – again, U.S. outpacing peers

Not surprising, given the vaccination trends, as well as the powerful fiscal stimulus passed, growth for the U.S. is forecast to outpace the other major economies in 2021 and remain in the top tier for 2022:

Within the U.S., variance in GDP growth by region/state/MSA is also an important dynamic, with some regions (including the Southeast, Southwest) historically experiencing 50% to 100% higher GDP growth than other regions (e.g., Mid-Atlantic, Midwest). Given the U.S. has the most fragmented financial sector globally, there are significant opportunities for HUM (and HFG in its U.S. holdings) to emphasize these higher growth geographies.

3. M&A within the entire mid-cap sector – activity rising and potentially accelerating

As we wrote late last year – see, U.S. Banks: The Return of M&A – A Clear Sign of Bankers’ Conviction in the Recovery (December 16, 2020) – the pick-up in U.S. bank M&A in Q4 was a sign of management’s conviction that the economic recovery was well underway and that the worst expectations for credit were unlikely to come to bear. The activity continued into 2021, with other subsectors also proposing significant deals. For instance, some of the larger deals involving HUM and HFG portfolio companies included:

- Arizona-based, Western Alliance Bancorp announced it was acquiring mortgage acquirer and servicer, Amerihome

- Private equity firm, Apollo Global Management announced the purchase of index annuity provider, Athene Holding[2]

- Delaware’s WSFS Financial agreed to acquire Pennsylvania neighbour, Bryn Mawr Bank

- P&C insurer heavyweight, Chubb Ltd confirmed it made an offer to peer Hartford Financial Services[3]

- Private equity firm, Ares Management announced its intention to buy Landmark Partners

- Southern banking peers, BancorpSouth and Cadence, announced a merger-of-equal

Consolidation – a secular theme in the U.S. financial sector since the 1980’s – is cyclical, with activity depending on market sentiment and the economic environment. With the lower for longer interest rate environment and rising costs of technology investments, we believe already rising U.S. financials M&A activity, particularly within the small/mid-cap space, is likely to continue to accelerate.

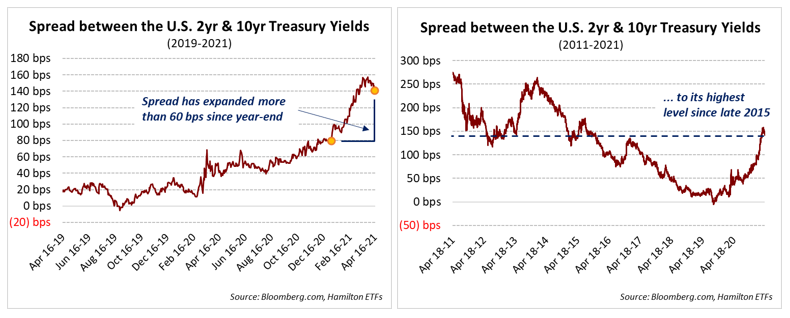

4. Yield curve – recent steepening aids sentiment with possibility of higher net interest income/margins

The spread between the yields on the U.S. 2- and 10-year treasuries (a widely used if not crude proxy for interest rate sensitivity for the U.S. financials) has widened over 100 bps since the depths of the pandemic and 60 bps year-to-date alone. Market expectations for higher core inflation – aided in no small part by the fiscal stimulus this year and last – could see this key measure widen even further[4]. Provided this happens in an orderly fashion, this could support higher net interest margins, and as a result, earnings growth, particularly for the banks, certain wealth managers (with high margin balances), and insurers.

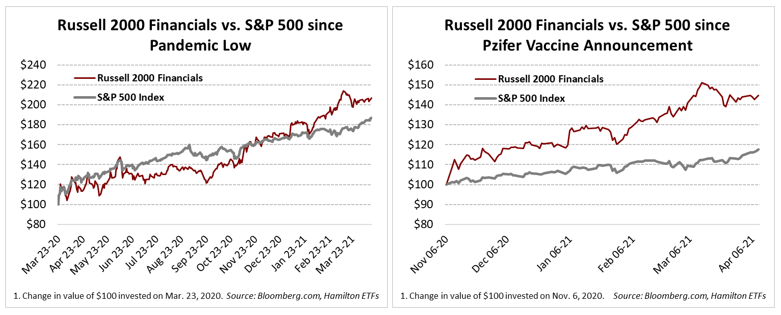

5. Stock performance – financials are riding the reopening wave

Since Q4 2020, value stocks have staged a significant comeback (particularly versus growth stocks), fueled by economic optimism stemming from positive vaccine news (first the efficacy rates, now growing vaccination rates), the U.S. election and related fiscal stimulus. Financials, as a group, have been part of that value trade, outperforming growth sectors and the markets generally since late fall (after having lagged in the months immediately following the pandemic bottom on March 23, 2020).

Can this outperformance continue?

We believe yes. Why?

6. Earnings forecasts – still moving higher

Most market observers will agree that the worst for credit is behind the financials, in particular the banks (although we expect much of last year’s reserve build for the banks to reverse itself faster than is in consensus estimates, as analysts are historically slow in recognizing the magnitude and velocity of the recovery)[5]. Importantly though, we expect the financials’ earnings to move higher over the course of the year aided by higher GDP growth, increased demand and rising net interest margins, which in turn should support stocks.

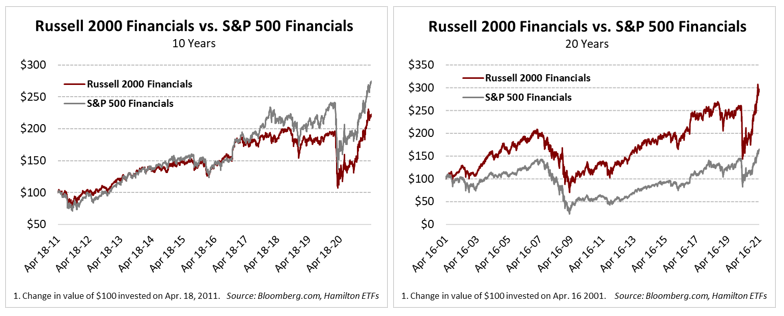

As proxies for the economy, we believe bank and financial stocks, particularly those in states further along in the recovery – including many in the Southeast and Southwest – will continue to outperform the market. We also think it is possible that the U.S. mid-caps will see their valuation multiples expand relative to their large-cap peers, particularly as they stand to benefit more from an acceleration in M&A and rising rates. Since the global financial crisis, the U.S. large-cap financials have materially outperformed their mid-cap peers (left-hand chart), in part because M&A activity declined considerably, and the yield curve flattened. With an expectation that these trends are reversing, the U.S. mid-caps could be set to resume their longer history of material outperformance (right-hand chart). We believe, taken together, this sets the Hamilton U.S. Mid/Small-Cap Financials ETF (tickers: HUM, HUM-U) up for continued strong performance. With its 48% exposure in U.S. financials, we also expect the Hamilton Global Financials ETF (ticker: HFG) to benefit from the above trends.

Recent Insights:

Market Data M&A Accelerates Pivot to a Digital Future | February 10, 2021

U.S. Banks: The Return of M&A – A Clear Sign of Bankers’ Conviction in the Recovery | December 16, 2020

Global Financials: The Most Attractive/Important Investment Themes in 2021 | November 16, 2020

Financials: Does COVID-19 Represent a Growth Scare, Credit Event or Crisis? | March 25, 2020

One Chart: U.S. Bank M&A Doubles in 2019 (and Why We Expect More) | January 24, 2020

U.S. Bank M&A: Another Accretive MOE, Another Positive Market Reaction | November 6, 2019

What U.S. Investment Bankers and Banks are Saying about M&A | September 23, 2019

U.S. Bank M&A: 8 Drivers as Described by Rodgin Cohen | May 29, 2019

____

A word on trading liquidity for ETFs …

Hamilton ETFs are highly liquid ETFs that can be purchased and sold easily. ETFs are as liquid as their underlying holdings and the underlying holdings trade millions of shares each day.

How does that work? When ETF investors are buying (or selling) in the market, they may transact with another ETF investor or a market maker for the ETF. At all times, even if daily volume appears low, there is a market maker – typically a large bank-owned investment dealer – willing to fill the other side of the ETF order (at net asset value plus a spread). The market maker then subscribes to create or redeem units in the ETF from the ETF manager (e.g., Hamilton ETFs), who purchases or sells the underlying holdings for the ETF.

Notes

[1] As of April 16, 2021.

[2] Apollo is buying the 65% of Athene it did not already own.

[3] At the time of writing, a deal remains unconsummated and other bidders could emerge.

[4] Particularly as the Fed remains committed to keeping short-term rates low, without any intention to intervene in the longer-end.

[5] Three days into Q1 earnings season, and we have already seen large beats from more than a dozen banks, supported in no small part by reserve releases.