[All values in U.S. dollars unless otherwise noted]

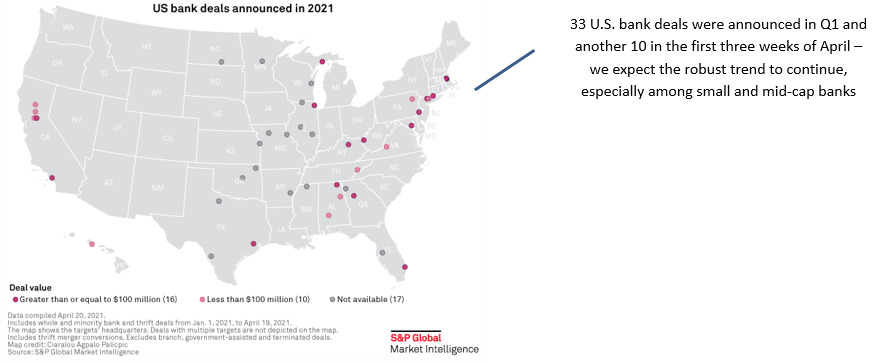

As we noted in last week’s Insight, U.S. Financials: Why They Remain Attractive (Especially the Mid-Caps), the Q4 2020 pick-up in U.S. bank M&A – a clear sign of management’s conviction that the economic recovery was well underway – has gained momentum in 2021, including several transactions involving Hamilton U.S. Mid/Small-Cap Financials ETF (tickers: HUM, HUM-U) and Hamilton Global Financials ETF (ticker: HFG) portfolio companies. According to S&P Global, 33 U.S. bank deals were announced in Q1 and another 10 in the first three weeks of April[1]!

Consolidation has been a secular theme in the U.S. financial sector since the 1980’s. It is a cyclical trend, highly dependent on market sentiment and the economic environment. The pandemic saw activity slow, as the banks assessed their own loan books in light of the economic uncertainty. With the economy having turned the corner and the lower for longer interest rate environment and rising costs of technology investments, we believe U.S. bank M&A, particularly within the small/mid-cap space, is likely to continue to accelerate.

Further, we believe management comments from the Q1 2021 earnings calls over the last two weeks support our expectations for accelerating M&A, especially in the higher growth regions of the Southeast and Southwest. (Given its significant exposure to mid/small-cap banks in the sun belt, the Hamilton U.S. Mid/Small-Cap Financials ETF, tickers: HUM, HUM-U, should be set to benefit from this trend).

Below is just a selection of excerpts from the Q1 calls, organized by region:

Southeast:

- “We have spent more time, probably in the last couple of months than we have in the last couple of years, analyzing and looking at that market and spending time on M&A. We would be open to do in a cash deal or some combination of cash to and stock.” ($20-50 bln asset bank)

- “Our primary focus for capital is organic growth and M&A. I think the M&A market conversations have been robust and increasing over the last six months, and so, I think ideally we put that into M&A”. ($5-10 bln asset bank)

- “We’ve kind of said our sweet spot is really between $3 bln and $10 bln. We are very strategic in the way we look at M&A. … There are probably some other non-bank opportunities that may be out there as well.” ($20-50 bln asset bank)

- “So, there are a lot of conversations, a lot of really exciting ones going on. We continue to be focused really on the smaller banks, now that’s … $3.5 bln or less.” ($10-20 bln in assets)

- “there’s lots of dialogue going on. And so, we continue to evaluate M&A opportunities really across the front. …” ($20-50 bln asset bank)

- “from an M&A perspective, I would say our dance card is filling up. We’re very active in discussions today. … So, we think that that is a great opportunity for us, especially with the value of our currency today.” ($20-50 bln asset bank)

- “… we’re primarily sticking with the smaller $2 bln … to $4 bln at this point. We’re not afraid to do a $10 bln deal … I’ll just tell you that we’ve always liked North and South Carolina. … we’ve always liked Texas.” ($10-20 bln asset bank)

Southwest:

- “And then on the M&A front, … we do have the excess capital that we want deploy towards M&A. We feel like … it’s a relatively healthy environment.” ($10-20 bln asset bank)

- “I think to me there’s two major drivers [of consolidation] … desire to spread the expense base more broadly and … investment in technology … we would expect to have an opportunity to participate in acquisition going forward.” ($20-50 bln asset bank)

Northwest/West:

- “… just measured by the amount of phone calls that we’ve received and people who want to talk about transactions, it’s very busy.” ($10-20 bln asset bank)

- “… there are a lot of conversations that are happening. I do believe that we will have opportunities to take a look at potential targets.” ($10-20 bln asset bank)

Midwest:

- “… we’re very interested in M&A at this point now that the credit fog is kind of lifted here. … I will say that conversations are active, and I would agree with you that certainly appears that M&A is before us in Chicago. So, we are ready and very interested in finding a strategic partner.” (<$5 bln asset bank)

- “… the market is heating up nationally on the M&A front, and we’re starting to feel a little bit more here in the upper Midwest, and we’ll be in those discussions as we go.” ($5-10 bln asset bank)

- “We are in some really good deep conversations … it’s really picked up the last three or four months and I am very positive and hopeful that those things will happen this year” (<$5 bln asset bank)

Northeast:

- “A lot of the bigger deals at the higher levels that we’ve seen in recent quarters, feel like they’ve been sort of MOE type deals and more partnership deals. … we’re open to that. ” ($5-10 bln asset bank)

____

Related Notes

U.S. Financials: Why They Remain Attractive (Particularly the Mid-Caps) | April 19, 2021

Market Data M&A Accelerates Pivot to a Digital Future | February 10, 2021

U.S. Banks: The Return of M&A – A Clear Sign of Bankers’ Conviction in the Recovery | December 16, 2020

Global Financials: The Most Attractive/Important Investment Themes in 2021 | November 16, 2020

Financials: Does COVID-19 Represent a Growth Scare, Credit Event or Crisis? | March 25, 2020

One Chart: U.S. Bank M&A Doubles in 2019 (and Why We Expect More) | January 24, 2020

U.S. Bank M&A: Another Accretive MOE, Another Positive Market Reaction | November 6, 2019

What U.S. Investment Bankers and Banks are Saying about M&A | September 23, 2019

U.S. Bank M&A: 8 Drivers as Described by Rodgin Cohen | May 29, 2019

____

A word on trading liquidity for ETFs …

Hamilton ETFs are highly liquid ETFs that can be purchased and sold easily. ETFs are as liquid as their underlying holdings and the underlying holdings trade millions of shares each day.

How does that work? When ETF investors are buying (or selling) in the market, they may transact with another ETF investor or a market maker for the ETF. At all times, even if daily volume appears low, there is a market maker – typically a large bank-owned investment dealer – willing to fill the other side of the ETF order (at net asset value plus a spread). The market maker then subscribes to create or redeem units in the ETF from the ETF manager (e.g., Hamilton ETFs), who purchases or sells the underlying holdings for the ETF.

Notes

[1] From April 1st to April 19, 2021.